2 Covered Call Ideas On Apple Stock

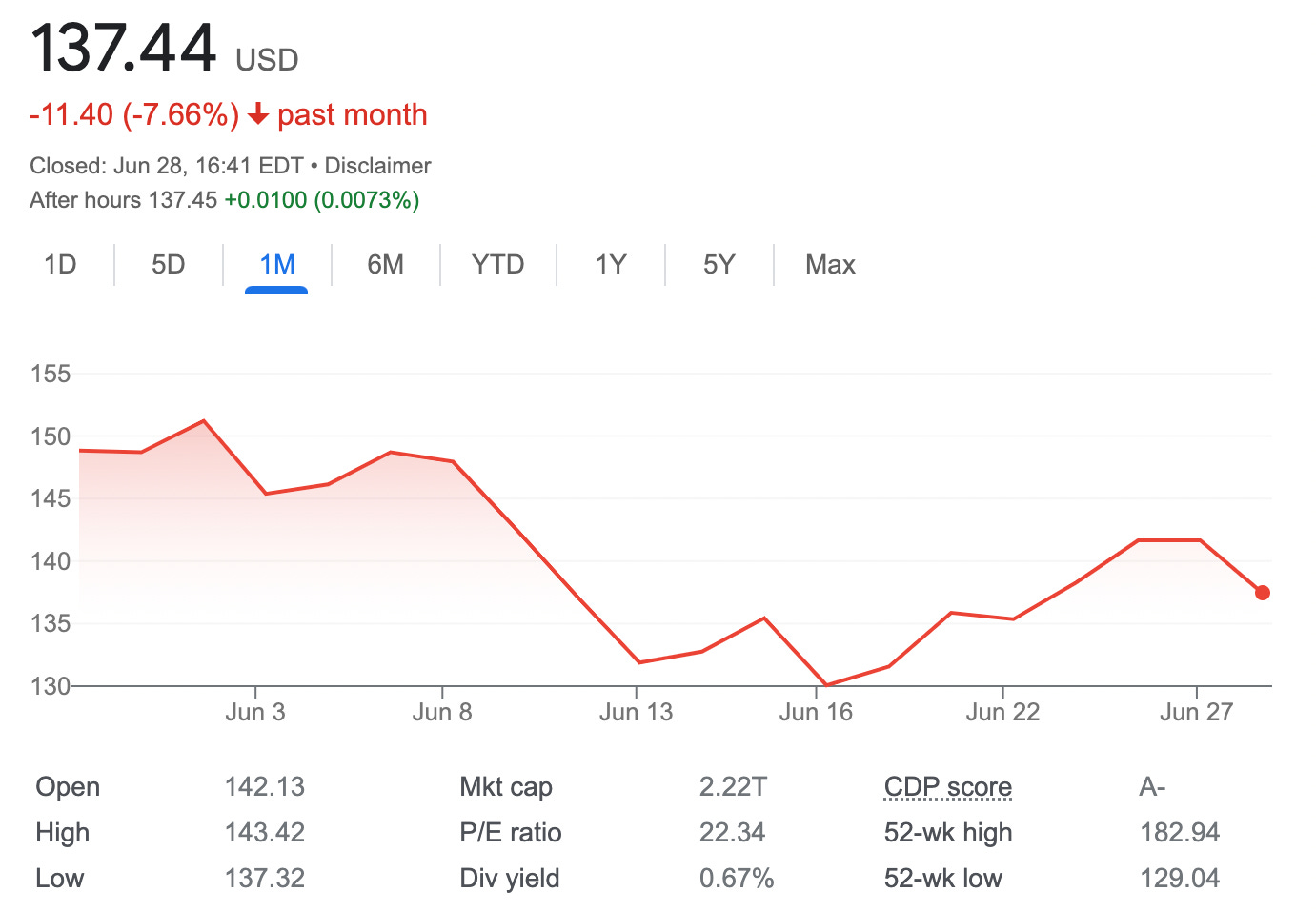

With Apple stock falling under $140 it might seem like a bargain deal, and some options traders might look at the current stock price as very tempting for buying the stock and selling covered calls to generate income.

It might be a good entry price and also it might be not. We are just not sure if we are at the bottom yet. The stock market might keep bleeding, fighting with inflation and losing some other 10-20% next month or in the next 12 months. We are not sure.

The current consensus among 43 polled investment analysts is to buy stock in Apple Inc. This rating has held steady since May when it was unchanged from a buy rating.

In this article, I decided to take a look at two covered call ideas on Apple stock, suitable both for bullish and slightly bearish scenario (the stock keep falling another 10%)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

AAPL Covered Call Example

Let’s look at two different covered call examples on AAPL stock. The first will use a monthly expiration and near the money strike price and the second will also use monthly expiration but with the strike price set in the money.

Keep reading with a 7-day free trial

Subscribe to OptionsBrew.com to keep reading this post and get 7 days of free access to the full post archives.