2 Covered Call Ideas On Intel Stock

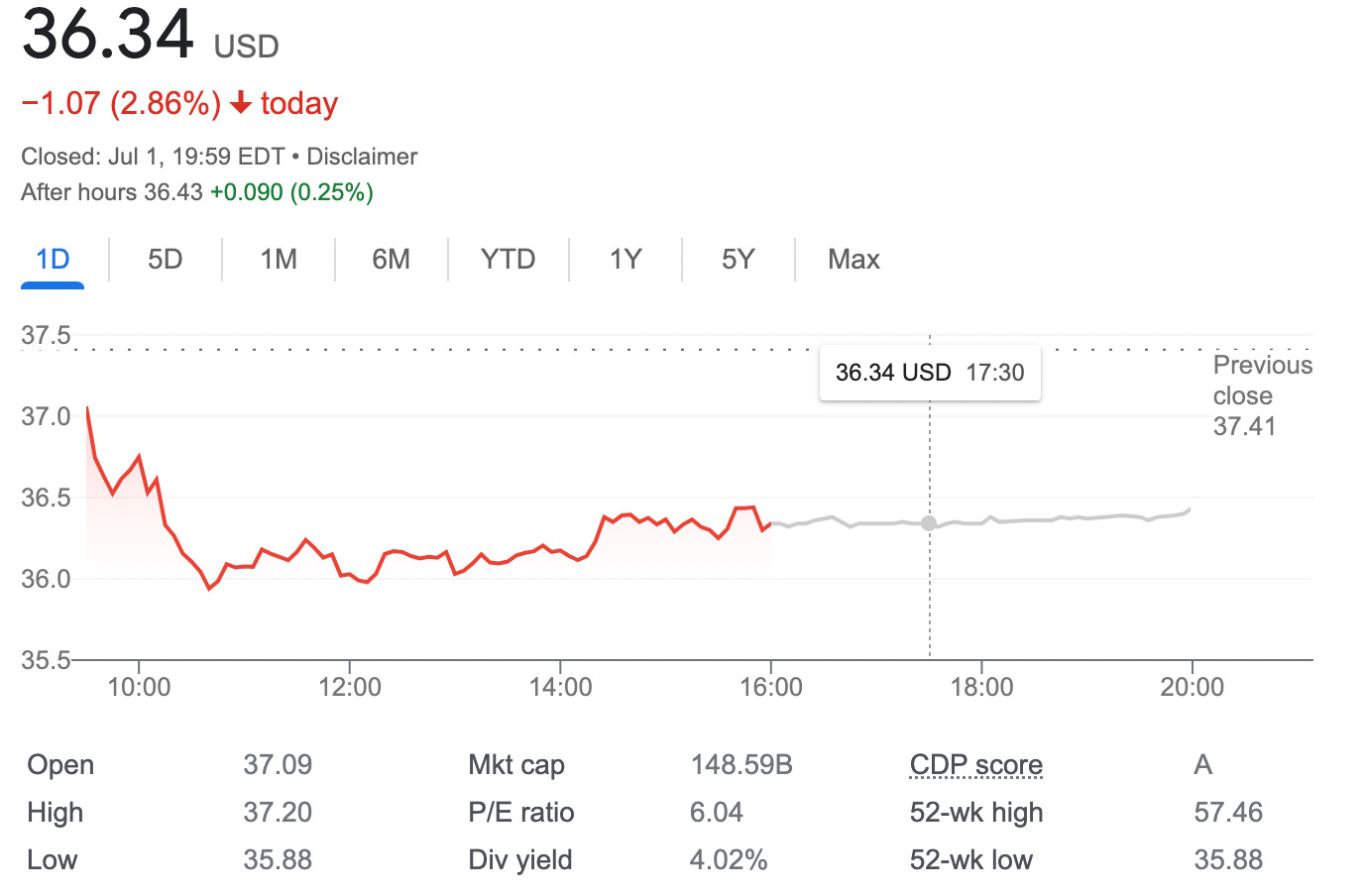

With tech stocks being hit the most during the market selloff in 2022, buying Intel stock at $37 might seem like a bargain deal, and some options traders might look at the current stock price as very tempting for buying the stock and selling covered calls to generate income.

It might be a good entry price and also it might be not. We are just not sure if we are at the bottom yet. The stock market might keep bleeding, fighting with inflation and losing some other 10-20% next month or in the next 12 months. We are not sure (Yet)

The current consensus among 39 polled investment analysts is to hold stock in Intel Corp. This rating has held steady since June, when it was unchanged from a hold rating.

I like Intel stock because it is a tech stock, with a decent dividend and of course because of selling call and put options to squeeze some extra juice. For a long time I have been holding Intel Stock in my dividend stock portfolio, though currently, I don’t own any shares with INTC.

In this article, I have decided to take a look at two covered call ideas on Intel stock, suitable both for bullish and slightly bearish scenario (the stock keep falling another 20%)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Intel Covered Call Example

Let’s look at two different covered call examples on Intel stock. The first will use a monthly expiration near the money strike price and the second will also use monthly expiration but with the strike price set in the money.

Near the money, INTC covered call example. Buying 100 shares of INTC would cost around $3,634.

The August 5, 2022, 37 strike call option was trading around $1.5, generating $150 in premium per contract for covered call sellers.

Selling the call option generates an income of 4.12% in about 30 days. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 37?

If INTC closes above 37 on the expiration date, the shares will be called away at 37, leaving the trader with a total profit of $216 ($66 gain on the shares plus the $150 option premium received). That equates to a 5.9% return.

But what to do if a trader is concerned that INTC stock price might fall, let’s say under 30? That seems quite a dramatic fall, but anything can happen.

Instead of selling near the money 37 calls, traders could sell in the money 30 call option.

Selling the $30 call option for $7.6 generates an income of $126 or about 3.46% in 30 days. If INTC closes above 30 on the expiration date, the shares will be called away at 30, leaving the trader with a total profit of $126 ($634 loss on the shares and the $760 option premium received).

These figures don’t include any potential dividends received during the course of the trades.

As we can see, both examples give us a nice options premium, with very decent results, but just the second gives us larger downside protection.

Which option would you choose?