4 stocks to sell covered calls and generate $600/mo

Selling covered calls is one of my favorite income-generating techniques.

I prefer selling call options on relatively safe stocks, for example, dividend aristocrat stocks or stocks from the Dow Jones List

In today's article, I'm going to talk about selling covered calls on Intel, Walgreens Boots Alliance, Pfizer, and Dow inc.

Doing some backtesting I was able to “capture“ more than $600/mo in options premium by investing about $21,500.

I should note, that there is a lot of uncertainty in the stock market right now, Omicron variants, Ukraine crisis, earnings reports, etc, which ads some volatility and offers juicier premiums, which also means more risk. Take all the written below with a pinch of salt

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

In fact, these are the stocks I actually have and I keep selling both put and call options against them, so it is easier to talk about them.

Let’s dive in.

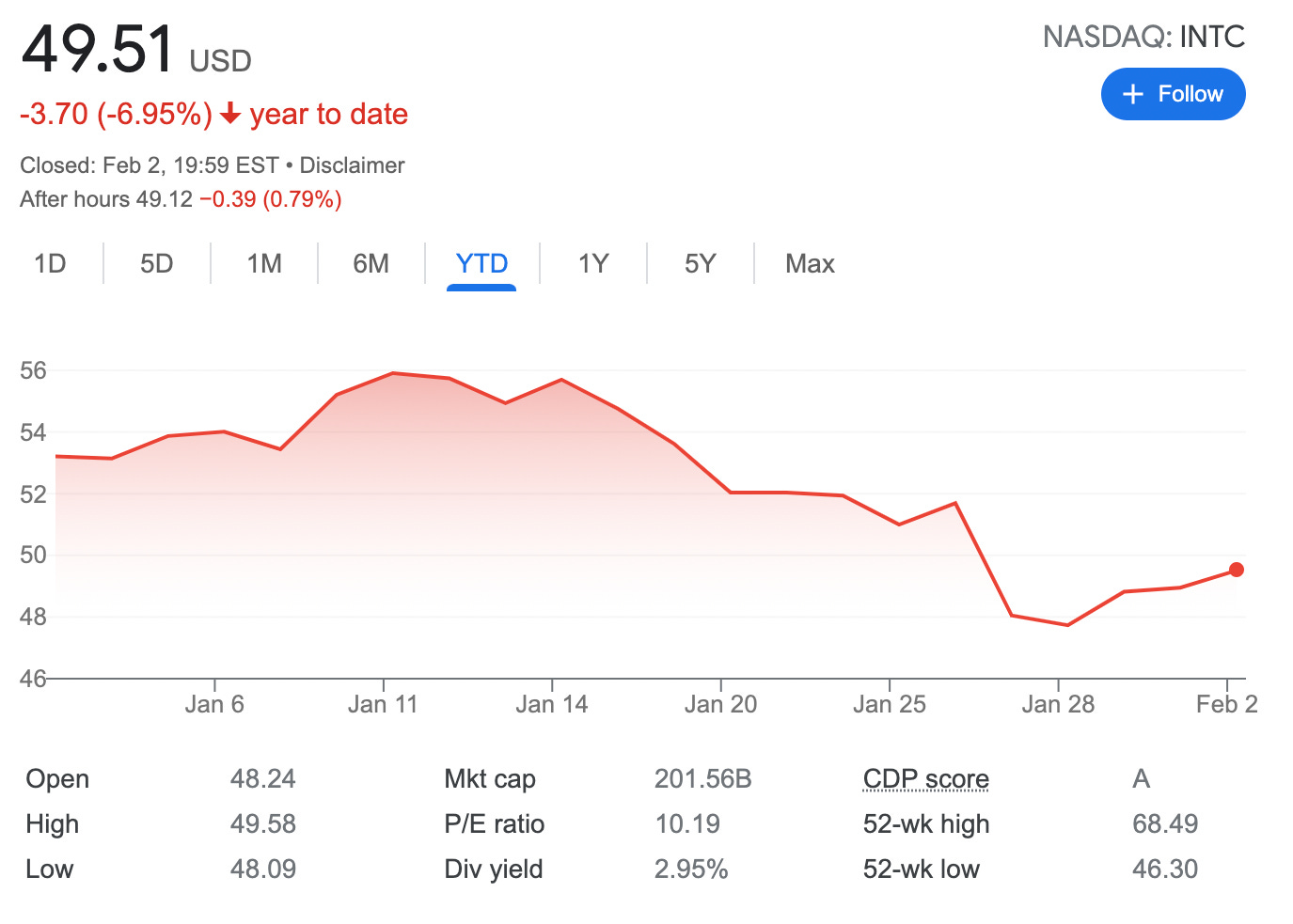

Generate monthly income selling covered calls on Intel (NASDAQ: INTC) stock

Intel stock price as of February 2, 2022

On February 2, 2022, you could buy 100 shares of INTC stock spending $4,951 and simultaneously sell out of the money March 4 expiry covered call with a strike price of $50 for about $1.35. That gets you $135 and makes about 2.72% return in about 29 days. Break-even: $48.16

If INTC stock closes below $50 on March 4, you keep the premium and start over. If the stock closes above $50, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $50, remember you have made a premium + value gain. -$4,951+$5,000+$135= $184. That would be about a 3.71% yield on your initial investment in about 29 days.

Remember, you are selling one contract, 100 shares of INTC stock, make sure you have 100 shares to sell if called away.

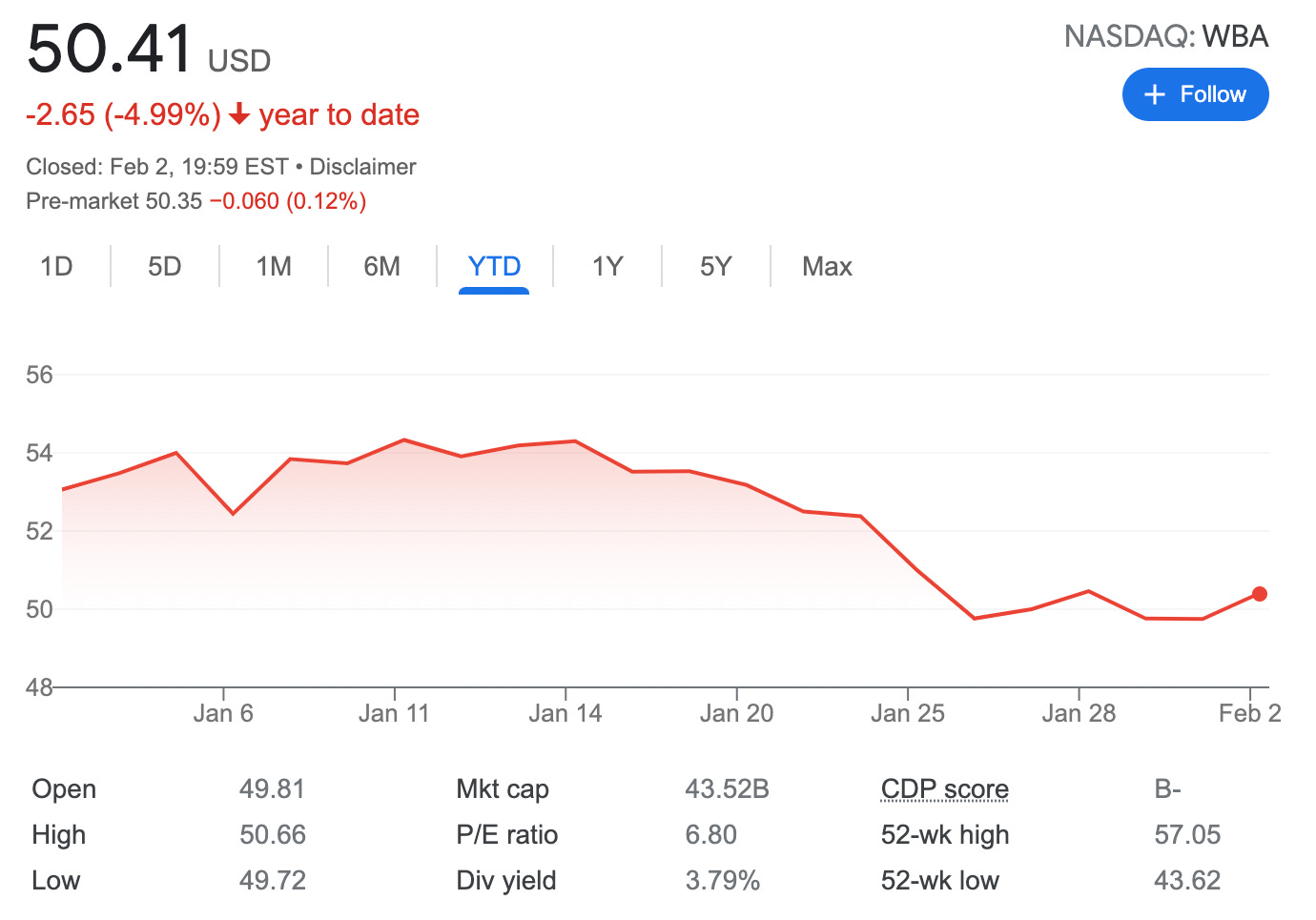

Generate monthly income selling covered calls on Walgreens Boots Alliance Inc (NASDAQ: WBA) stock

WBA stock price as of February 2, 2022

On February 2, 2022, you could buy 100 shares of WBA stock spending $5,041 and simultaneously sell out of the money March 4 expiry covered call with a strike price of $51 for about $1.17. That gets you $117 and makes about a 2.22% return in about 29 days. Break-even: $49.24

If WBA stock closes below $51 on March 4, you keep the premium and start over. If the stock closes above $50, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $51, remember you have made a premium + value gain. -$5,041+$5,100+$117= $176. That would be about a 3.49% yield on your initial investment in about 29 days.

Remember, you are selling one contract, 100 shares of WBA stock, make sure you have 100 shares to sell if called away.

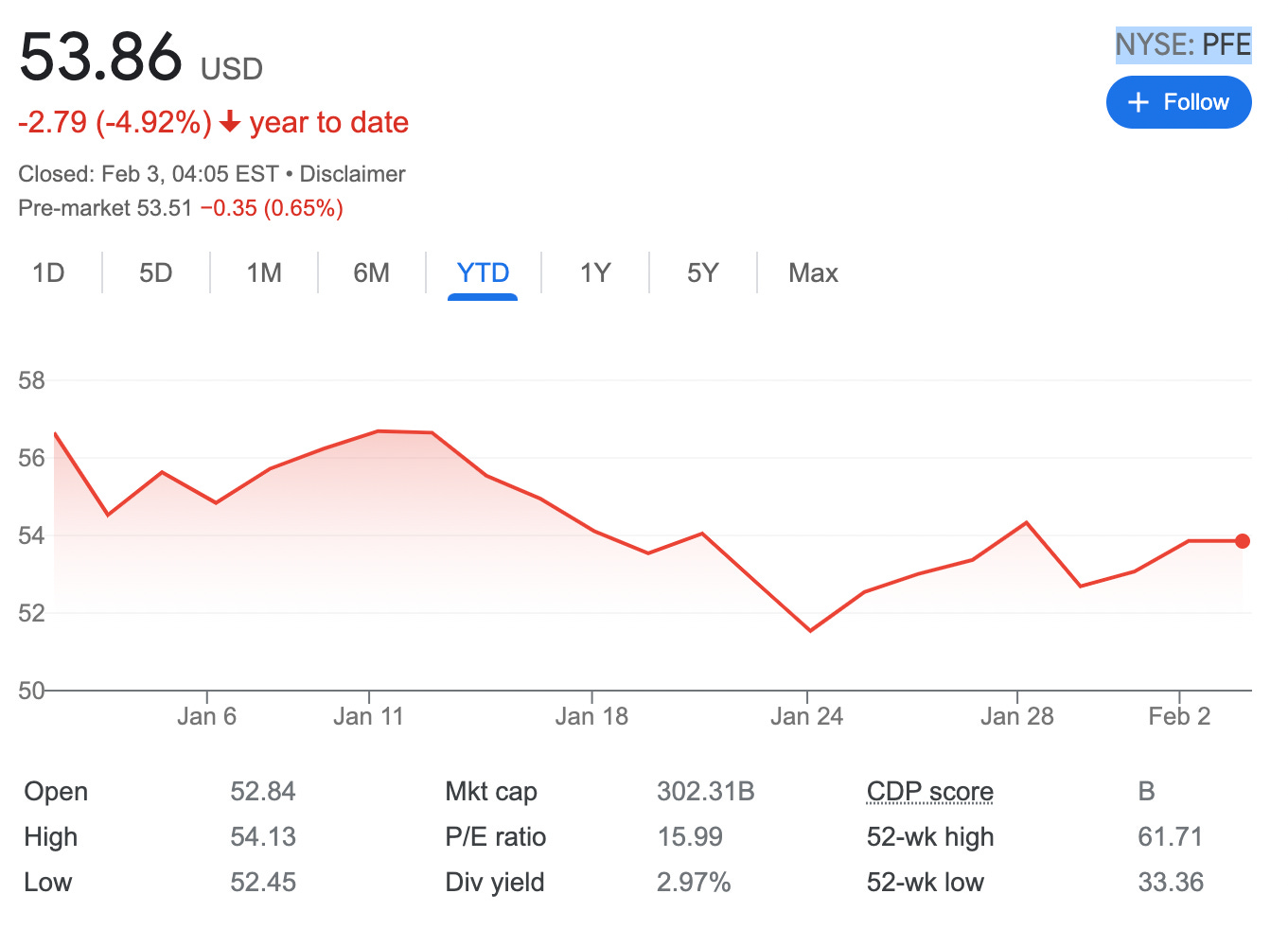

Generate monthly income selling covered calls on Pfizer (NYSE: PFE) stock

PFE stock price as of February 2, 2022

On February 2, 2022, you could buy 100 shares of WBA stock spending $5,386 and simultaneously sell out of the money March 4 expiry covered call with a strike price of $54 for about $2.21. That gets you $221 and makes about a 4.10% return in about 29 days. Break-even: $51.65

If PF stock closes below $54 on March 4, you keep the premium and start over. If the stock closes above $54, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $54, remember you have made a premium + value gain. -$5,386+$5,400+$221= $176. That would be about a 4.36% yield on your initial investment in about 29 days.

Remember, you are selling one contract, 100 shares of PFE stock, make sure you have 100 shares to sell if called away.

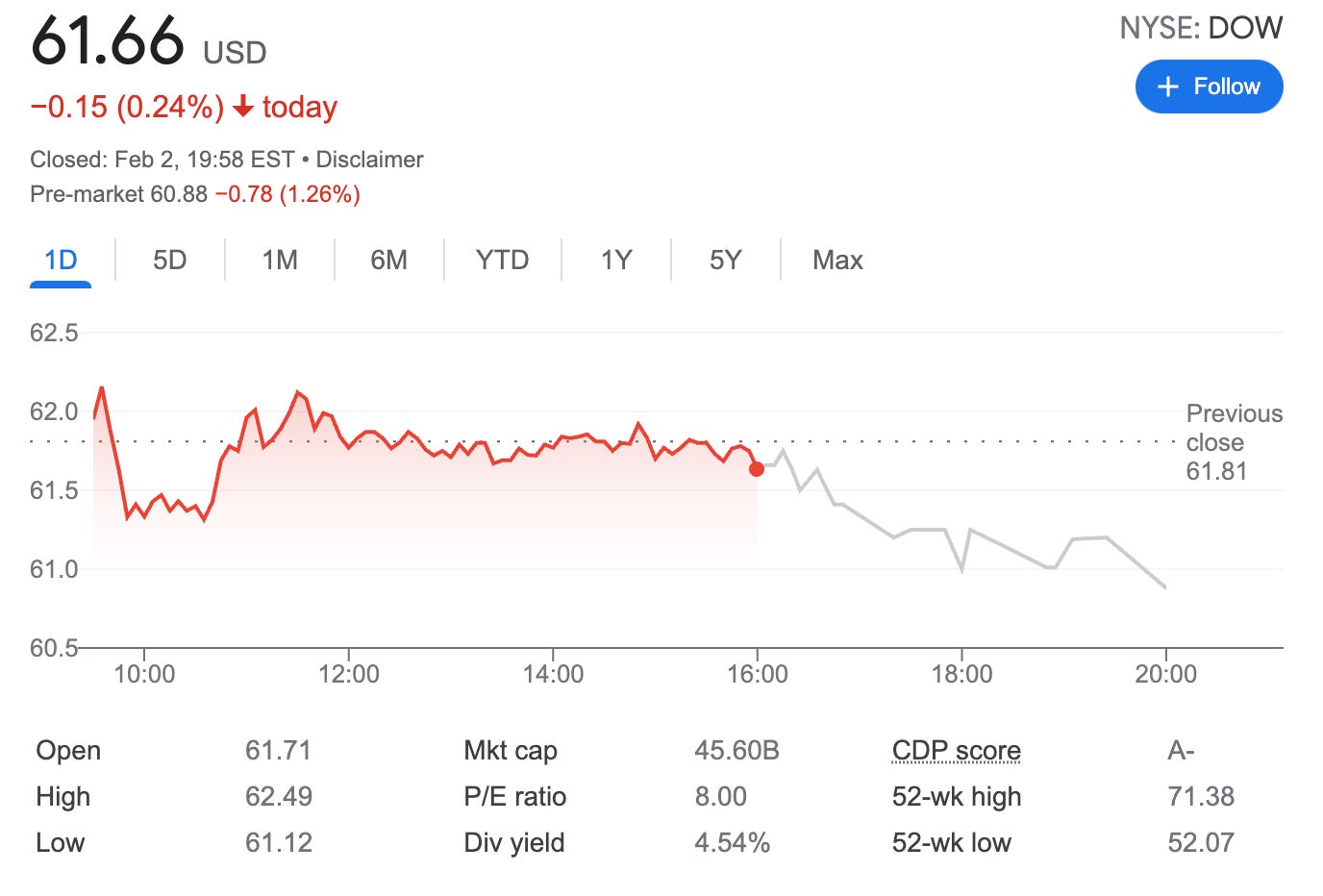

Generate monthly income selling covered calls on Dow inc (NYSE: DOW) stock

DOW stock price as of February 2, 2022

On February 2, 2022, you could buy 100 shares of DOW stock spending $6,166 and simultaneously sell out of the money March 4 expiry covered call with a strike price of $62 for about $1.71. That gets you $171 and makes about a 2.77% return in about 29 days. Break-even: $59.95

If Dow stock closes below $62 on March 4, you keep the premium and start over. If the stock closes above $62, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $62, remember you have made a premium + value gain. -$6,166+$6,200+$171= $176. That would be about a 3.32% yield on your initial investment in about 29 days.

Remember, you are selling one contract, 100 shares of Dow stock, make sure you have 100 shares to sell if called away.

The bottom line

Selling covered calls on these four dividend-paying stocks right after buying them ($21,544) would generate about $644/mo. That's a potential income return of 2.98% return in 29 days.

Additionally, in 2022 you would get about $139 dividend from INTC, $191 from WBA, $160 from PFE, and $280 from Dow inc. Total $770 (before tax) or about a 3.57% dividend yield per year.

Unfortunately, this is good just in theory, stock prices might drop significantly after sending out this newsletter, but in general, when looking for covered call ideas look for stable stocks with a set record of track. Dow Jones list is a good start to exploring stocks.

If you enjoyed this article and would love to read more like this, consider becoming a paid subscriber to the newsletter