4 theoretical ways to profit with AMC stock

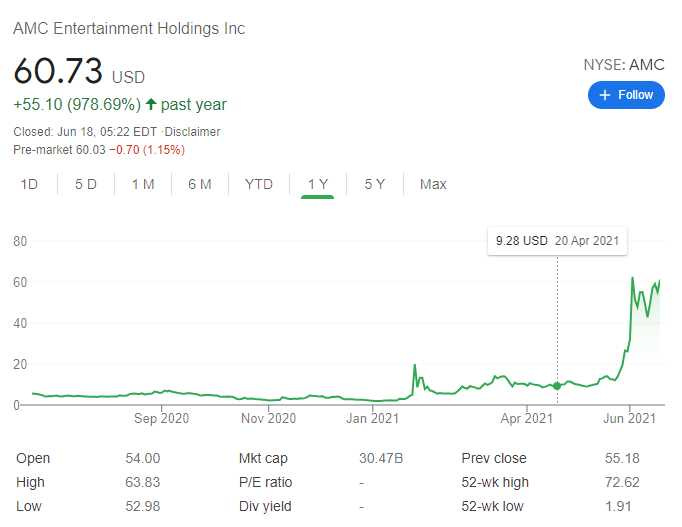

With the recent short squeeze with AMC stock I decided to take a look, is there still a chance to make some money with this stock by trading options?!

Before digging in all the details, here is my brief backstory with AMC stock:

I have been trading options with AMC stock since August 2020, I remember the stock price was around $5 and I was selling credit spreads with great success, even when I got assigned I switched to covered call selling, made quite a nice income until the stock dropped under $4 in December and for a couple of months I felt like being a bag holder.

I remember how happy I was, once the short squeeze started in January and I let my shares called away at some $5 or $6 per share.

Today seeing AMC stock trading at $60 I think - OMG, where does the World is going?!

I decided to take a closer look at how to trade AMC stock, here are the 4 scenarios I can look at:

Simple buy and hold.

Well, I wouldn’t buy the stock at the current prices. In case the stock drops significantly…

Put options.

We could write put options to collect juicy premium, but I would avoid put options as the stock price could drop significantly and we would become bagholders or would pay a high price to get out of this trade.

Credit spreads.

This is something I would consider. Probably weekly options. But again I would think 60 times before entering credit spread trade with this stock. It’s still a gamble.

Straddles

A possible alternative would be buying straddles (buying both put and call options with the same strike price). In case the price would keep going up, we would income from call options, if the price would drop significantly, we would make income from put options.

Here I made a video, take a look

Frankly speaking, I would stay away from AMC or any other short squeezed stocks, instead focus on quality growth stock, preferably dividend aristocrat stock.