Selling covered calls is one of my favorite income-generating techniques.

I like to sell calls on relatively safe stocks, and dividend aristocrat stocks kind of give me such security.

In today's article, I'm going to talk about selling covered calls on AT&T, Walgreens Boots Alliance, Coca-Cola, and Johnson & Johnson stocks.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

But before that, let’s get some basic understanding

Covered Call

A covered call refers to a transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. To execute this an investor holding a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. If the investor simultaneously buys a stock and writes call options against that stock position, it is known as a "buy-write" transaction.

Dividend Aristocrat

Qualifications for a stock to be a Dividend Aristocrat are:

A stock must be a member of the S&P 500

A stock must have increased their dividend payment for at least the past 25 consecutive years.

Now, when we are all set up and ready, let’s dive in.

Generate monthly income selling covered calls on AT&T (T:NYSE) stock

AT&T stock price as of April 23, 2021

On April 23, 2021 you could buy 100 shares of AT&T stock spending $3,136, and simultaneously sell out of the money May 14 expiry covered call a strike price of $31.5 for about $0.44. That gets you $44 and makes about 1.4% return in about 21 days. Or about 23.08% annualized. Break-even: $30.92

If T stock closes below $31.5 on May 15, you keep the premium and start over. If the stock closes above $31.5, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $31.5, remember you have made a premium + value gain. -$3,136+$3,150+$44= +$58. That would be about 1.84% yield on your initial investment in about 21 days.

Remember, you are selling one contract, 100 shares of T stock, make sure you have 100 shares to sell if called away.

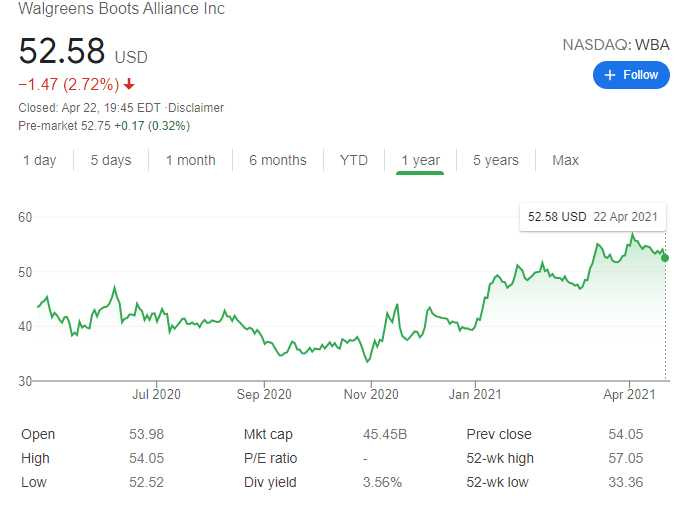

Generate monthly income selling covered calls on Walgreens Boots Alliance Inc (NASDAQ: WBA) stock

WBA stock price as of April 23, 2021

I must admit WBA stock looks a bit overbought to me, and despite I have a few shares with WBA I would think twice before buying at least 100 shares to sell call options on this stock. I would probably go with put options

On April 23, 2021 you could buy 100 shares of WBA stock spending $5,258, and simultaneously sell out of the money May 14 expiry covered call a strike price of $53 for about $1.45. That gets you $145 and makes about 2.75% return in about 21 days. Or about 46% annualized. Break-even: $51.13

If WBA stock closes below $53 on May 14, you keep the premium and start over. If the stock closes above $53, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $53, remember you have made a premium + value gain. -$5,258+$5,300+$145= +$187. That would be about 3.55% yield on your initial investment in about 21 days.

Remember, you are selling one contract, 100 shares of WBA stock, make sure you have 100 shares to sell if called away.

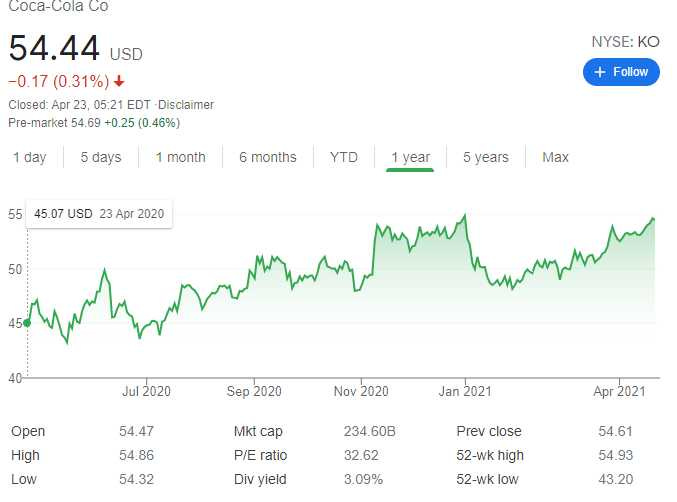

Generate monthly income selling covered calls on Coca Cola (NYSE:KO) stock

KO stock price as of April 23, 2021

On April 23, 2021 you could buy 100 shares of KO stock spending $5,444, and simultaneously sell out of the money May 14 expiry covered call a strike price of $54.5 for about $0.8. That gets you $80 and makes about 1.46% return in about 21 days. Or about 24.82% annualized. Break-even: $53.64

If KO stock closes below $54.5 on May 14, you keep the premium and start over. If the stock closes above $54.5, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $54.5, remember you have made a premium + value gain. -$5,444+$5,450+$80= +$86. That would be about 1.57% yield on your initial investment in about 21 days.

Remember, you are selling one contract, 100 shares of KO stock, make sure you have 100 shares to sell if called away.

Generate monthly income selling covered calls on Johnson & Johnson (NYSE:JNJ) stock

JNJ stock price as of April 23, 2021

On April 23, 2021 you could buy 100 shares of JNJ stock spending $16,518, and simultaneously sell out of the money May 14 expiry covered call a strike price of $167.5 for about $1.61. That gets you $161 and makes about 0.97% return in about 21 days. Or about 16.50% annualized. Break-even: $163.47

If JNJ stock closes below $167.5 on May 14, you keep the premium and start over. If the stock closes above $167.5, your stock gets called away, and you realize your gains.

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing cash-secured put.

In case your stock gets called away at $167., remember you have made a premium + value gain. -$16,518+$16,750+$161= +$393. That would be about 2.37% yield on your initial investment in about 21 days.

Remember, you are selling one contract, 100 shares of JNJ stock, make sure you have 100 shares to sell if called away.

Selling covered calls on these four dividend aristocrat stocks right after buying them ($30,356) would generate about $430/mo. That's a potential income return of 1.41% return in just 21 days or 23.97% per year.

Also, in 2021 you would get about $208 dividend from AT&T, $186 from WBA, $165 from KO, and $404 from JNJ. Combined $963 (before tax) or about a 3.2% dividend yield per year.

Unfortunately, I don't have a set track record on selling covered calls on these four dividend aristocrat stock, as I don't have yet 100 shares from each of the stocks, I'm still using naked puts to beef up income and acquire these stocks.

If you enjoyed this article and would love to read more like this, please subscribe to the newsletter

Great info. One question though, do you use any software that scans the market for the highest options premiums?