April 8th, 2022 Options Expiration Results

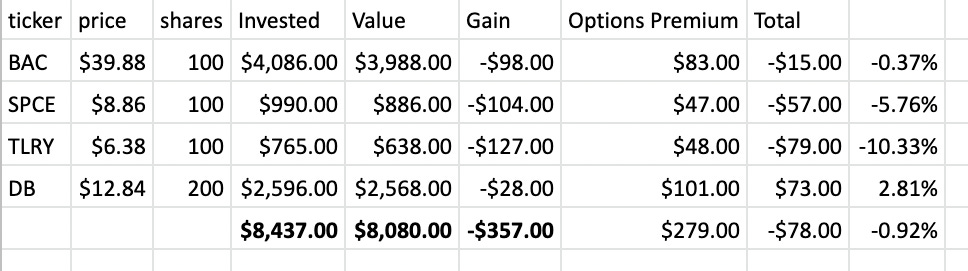

At the start of April, I invested $8,437.00 in 4 stock tickers and sold weekly covered calls with April 8th expiry on them, later on, I sold one additional I put option.

This week I was holding 4 covered calls and 1 cash-secured put position. All positions were opened at the start of April. I was holding Bank of America, Virgin Galactic, Tlry, and Deutsche bank calls and a put option on European ING bank

4 stocks to sell covered calls this April

All but TLRY calls were rolled to the next week’s expiry with the same strike prices as in the previous week. I skipped rolling TLRY stock as it was too deep out of the money, and instead, I decided to wait for the next week and see can I get a better premium.

Bank of America (NYSE: BAC)

SLD 1 BAC NYSE Apr14'22 41 CALL 0.26 USD

Virgin Galactic (NYSE: SPCE)

SLD 1 SPCE NYSE Apr14'22 10 CALL 0.12 USD

Deutsche Bank (NYSE:DB)

SLD 2 DB NYSE Apr14'22 13 CALL 0.26 USD

All, but DB, currently are under water, lets see will I be able to recover invested money in the next weeks.

Additionally 1 put option on AMS:INGA expired and I sold 2 new put options with next week’s expiry

SLD 2 INGA AEB (ING) Apr14'22 9.3 PUT 0.19 EUR

Options Premium so far

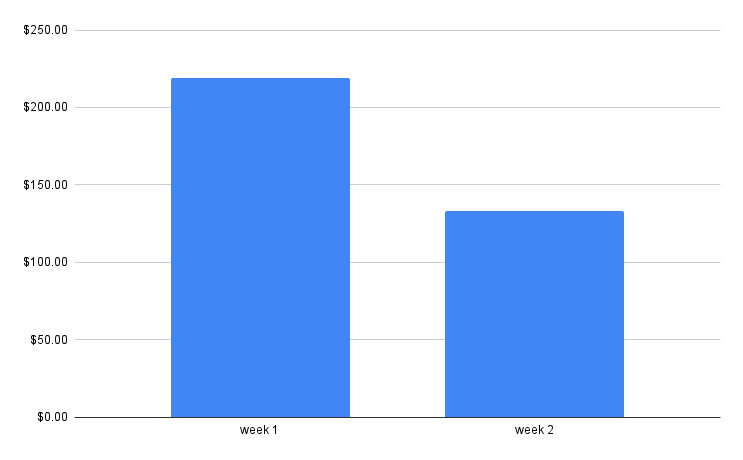

Options premium received this week: $133.07

As I’m trading on margin (borrowing funds from the broker) I haven’t reinvested these funds in an additional dividend stock, but instead, I’m planning to withdraw some 25% from the options premium at the end of the month.

So far in April, I’ve made $352.07 with $10,300 capital at risk. About 3.4% return.