Assigned 100 shares SESN; Established Covered Call; Potential Income return 7.5% in 14 days

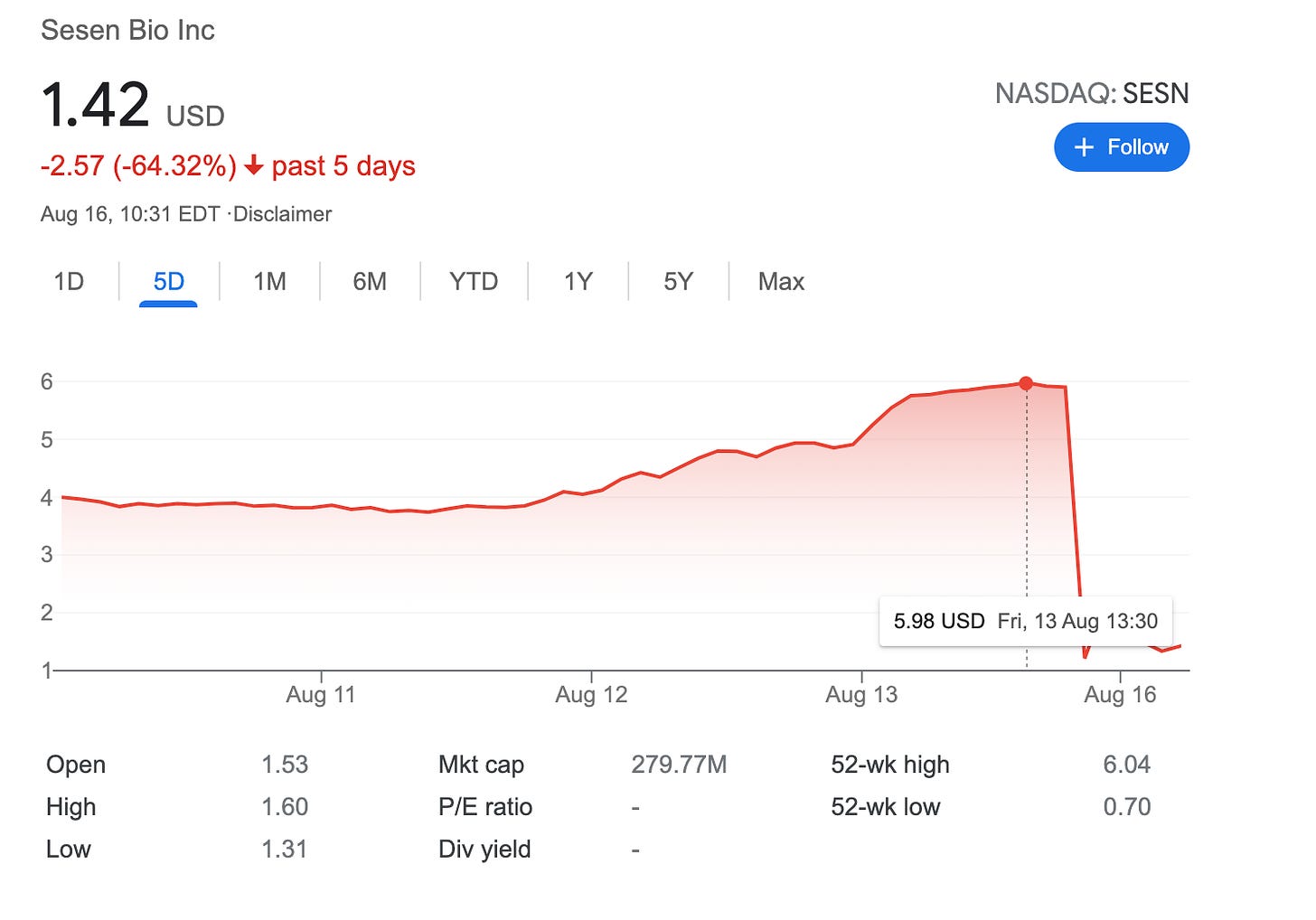

On August 13, 2021, I got assigned 100 shares with SESN stock at the price of $4 per share. Luckily this was a part of the credit spread, and I had my protection at $3.

When the stock market opened Monday, August 16, I sold my protection for $1.62

Long story short - SESN was hoping for FDA approval for some of their medicine, but in the end, FDA didn’t approve and the stock price plummeted.

Originally this trade was opened just a few days earlier on August 9, 2021, as a credit spread. 7 credit spreads with expiry still set in September, but apparently, some decided to use his rights and exercised 100 shares. Well, that's how it works.

Here is the trade setup:

BOT 100 SESN Stock 4.00 USD (assigned)

SLD 1 SESN SEP 17 '21 3 Put Option 1.62 USD

SLD 1 SESN AUG 20 '21 2 Call Option 0.10 USD

here I bought 100 shares for paying $400, as I had protective put, I sold it for $162, and additionally, I sold a covered call with this Friday’s expiry for $10.

What happens next?

On the expiry date, August 20, 2021, SESN is trading under $2 per share - options expire worthlessly and I keep premium - if SESN trades above $2 on the expiry date, my 100 shares will get called away and I will get $200

When originally setting up the credit spread I already got $0.47 per share, my new break-even price for this trade then is $4-$0.47-$1.60-$0.07 = $1.85