August 2021 Options Income Report $1,469

The last August, we did a total of 37 trades / from which most were credit spreads and a few covered calls. As last month we got assigned FCEL and NKLA stock, we opened covered call positions on them.

Also, we did a few roll forwards, as some of our options got into the money and we decided not to take full assignment (did a partial rolling)

In total, we managed to take $1,469 from options income during the month of August, which is a fantastic result.

Last August we were trading: RIDE, FCEL, SESN, XOM, CLOV, NKLA, GOLD, HPQ, PFE, INTC, SDC, SPCE (in bold - covered calls)

Dividend income

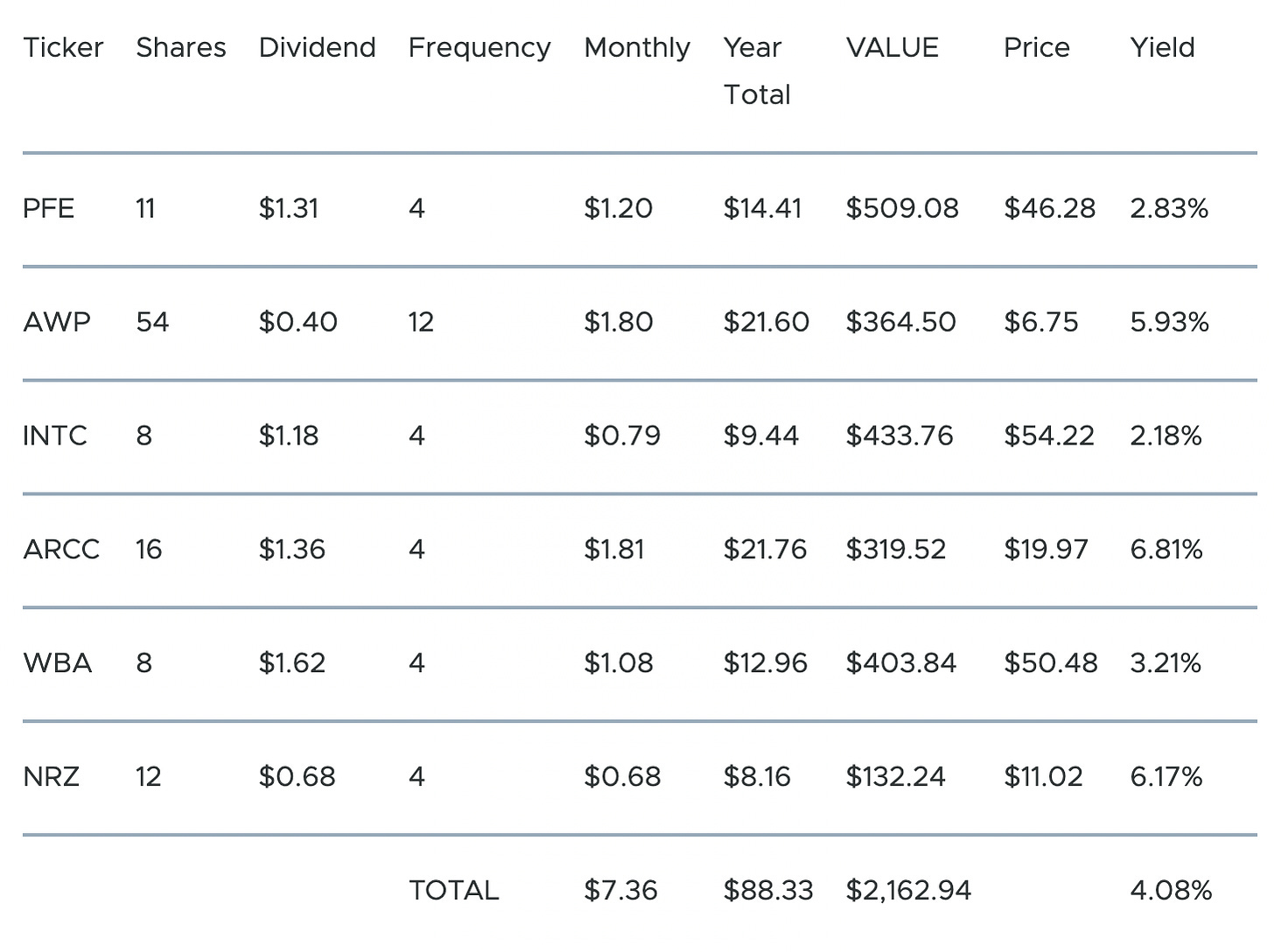

Our dividend income portfolio’s value now is $2,162 (+$996), and it generates about $7.36 in monthly dividend income. The current annual yield is about 4.08%

Here are all of our holdings (as of August 31, 2021)

Trading plan for September 2021 (Option trades & Stock Buys)

This month we are going to reinvest 50% from the options income in the 5 following stocks - PFE, AWP, INTC, ARCC, and WBA. We will keep investing in these stocks once will reach at least 100 shares for each of the tickers.

Once there will be at least 100 shares we will start selling covered calls to generate additional income.

For the month of September, we are looking to sell both credit spreads and covered calls. It looks we are going to sell covered calls on FCEL, NKLA, SDC, SESN, and maybe some other stock.

From covered calls/credit spreads - we are looking to take ~ $1,000 during the month of September.

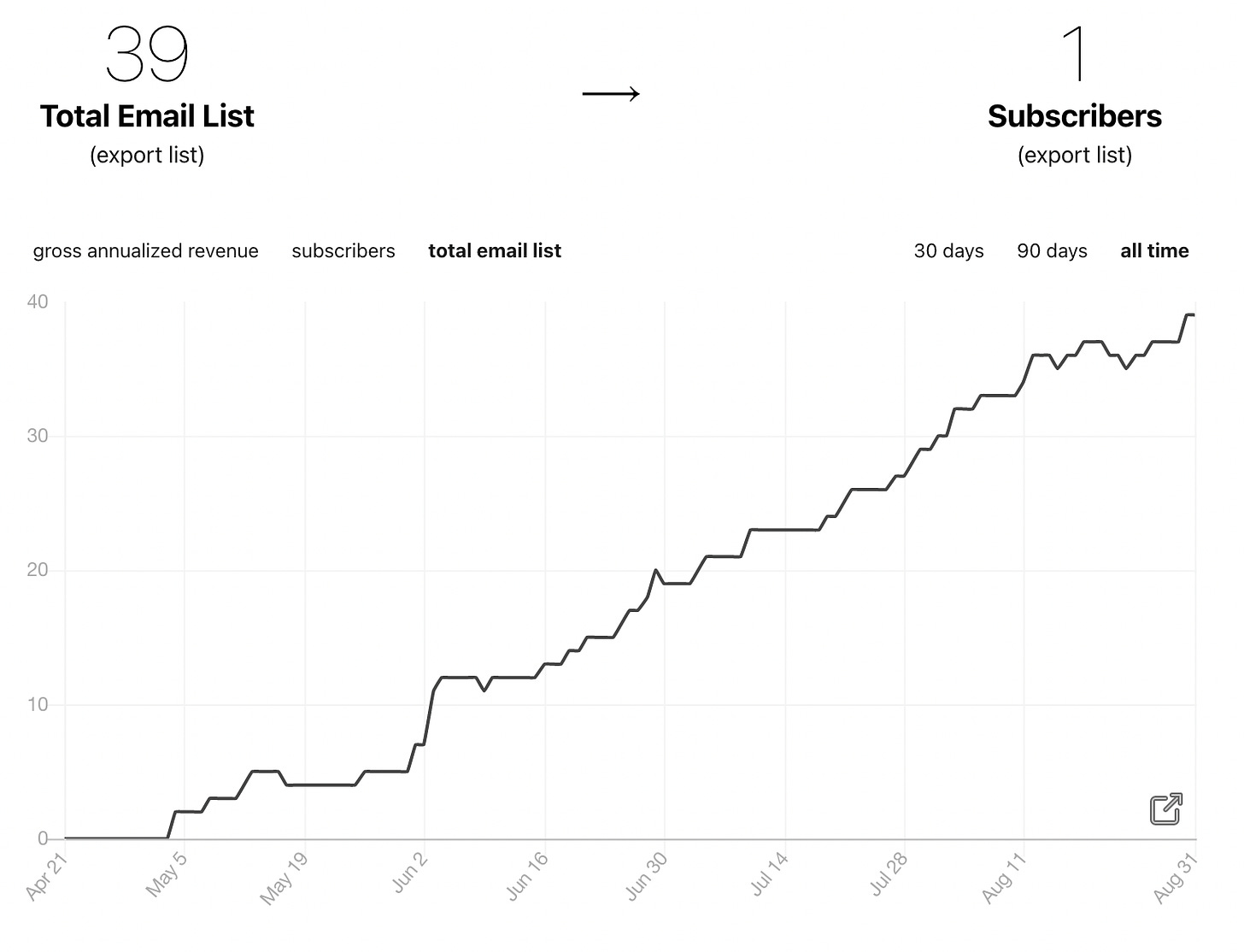

Subscriptions

At the end of August, we had

39 email subscribers (+10) for Covered Calls with Reinis Fischer newsletter

1 paying subscribers (for as low as $7/mo subscribers get access to extra content 1-2 per week)

37 subscribers (+6) for the YouTube channel