Bull vertical spread idea with Amazon stock

I have been eying buying Amazon stock for covered call writing for the past few years. Unfortunately, before the recent 1:20 stock split buying 100 AMZN shares was out of my league.

Once it was announced that AMZN is performing a 1:20 stock split, it was a no-brainer to me - I started slowly acquiring AMZN stock.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

We are now holding 7 shares of AMZN in our Partnership Fund portfolio

Using dollar-cost averaging our average cost per AMZN share is $119.98

93 shares to go once we will be able to start selling covered calls and generate extra income from AMZN. We are looking to get there by April / May 2023

Well actually I'm planning to start selling part-covered calls once we will have some 20-25 AMZN shares, to boost the portfolio by reinvesting any premium received into more AMZN stocks

here is an example trade:

SLD 1 AMZN NOV 18'22 125 CALL 4.15 USD

BOT 1 AMZN NOV 18'22 130 CALL 2.55 USD

For such a trade, we would get a premium of 160 USD (before commissions) risking $500. In case we would have 100 shares with AMZN, we wouldn't risk at all on the call side (well there is always a downside risk).

Without actually holding underlying shares we would be required to adjust this position if challenged (or close with a loss). Max loss of $340

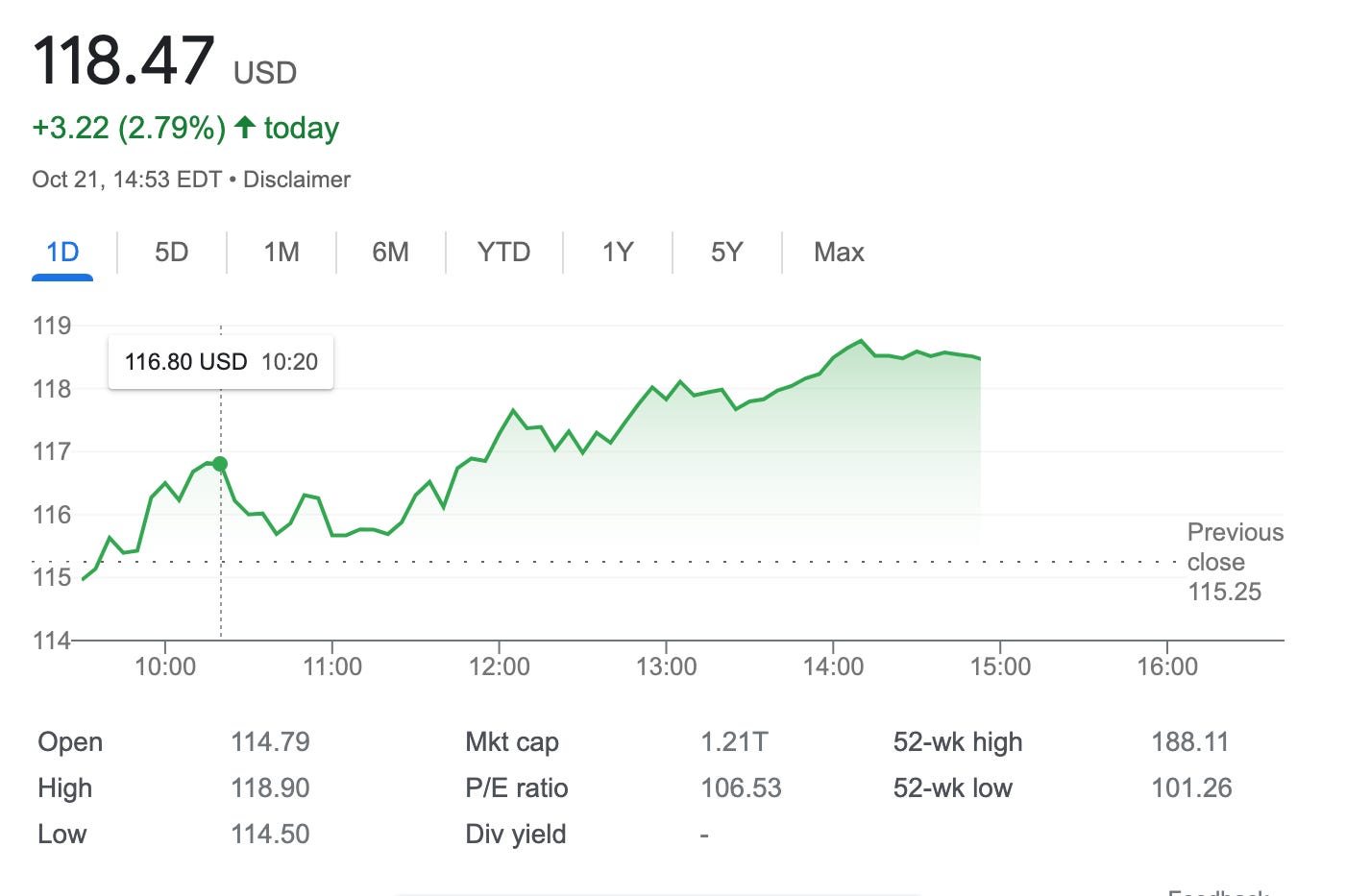

As I was holding just 7 AMZN shares on October 21, 2022, I would instantly buy one additional share from the premium received and wait for the expiry day.

Let’s model a few scenarios of what could happen next.

On the expiry date Amazon expires under $125, that’s great, I keep the premium, reinvest in more Amazon shares and proceed with more bull vertical spreads.

In case Amazon would expire between $125 and $130, I would be a bit troubled as I would be required to deliver shares (which I don't own fully). Before actual delivery, I would try to buy back this contract and roll it higher. Let’s assume AMZN trades at $127.5 on the expiry date. I would need to buy 93 shares at the market price and sell them at $125.

((7*119.98)+(93*127.5)-160)/100 =$125.37

My total loss would be $37

In case AMZN expires at $130

((7*119.98)+(93*130)-160)/100 = $127.69

that would be my max loss = $269, assuming I wouldn't roll up and forward this contract before.

In case Amzn would expire higher than $130, my max loss still would be capped at $130, as there I have bought my protection. Say Amazon trades $135 on the expiry

((7*119.98)+(93*135)-(100*5)-160)/100 - $127.34

My main goal would be to adjust this option in a timely manner to avoid potential loss

Interested to learn more? I'm offering paid - online live course Risk Reversal Options Trading Strategy