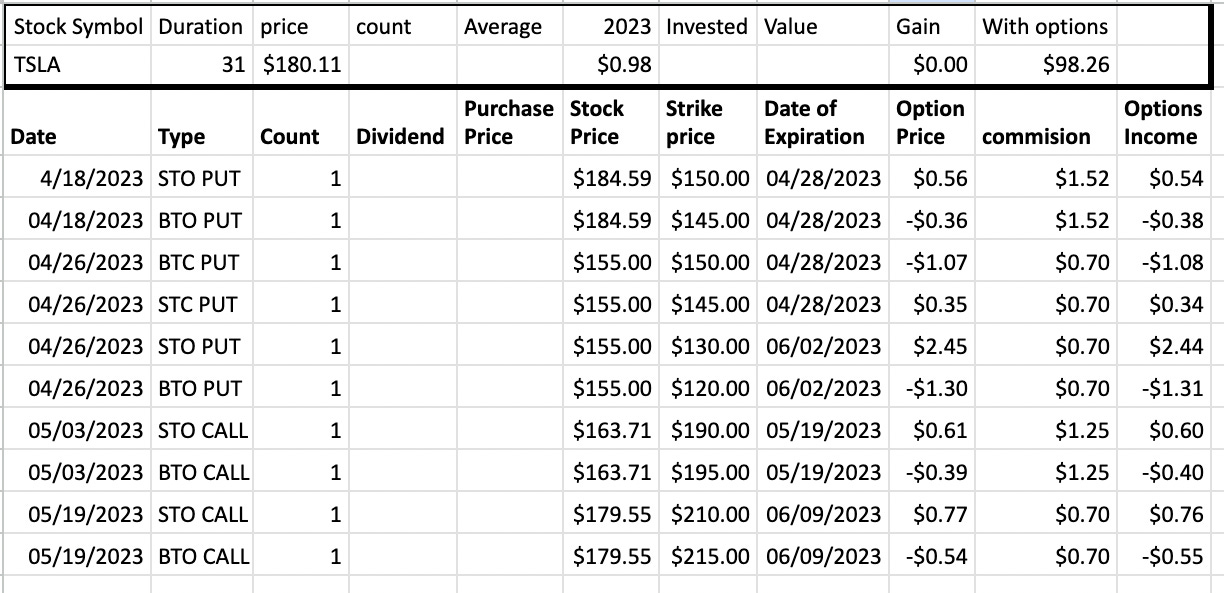

Call Bear Spread on Tesla with Potential 4.32% Return in 21 days

On May 19, 2023, I sold another 1 call bear spread on Tesla stock with strike prices at $210 and $215 with expiry on June 9th, 2023.

For this five-dollar-wide credit spread, I was rewarded with $21.60 (after commissions).

About 4.32% potential return in 21 days, if options expire worthless.

Short delta 0.08, or about 92% probability that the trade will expire worthless.

A call bear spread is an options trading strategy that involves selling a call option with a higher strike price and simultaneously buying a call option with a lower strike price on the same underlying asset. In this case, I sold a call option with a strike price of $210 and bought a call option with a strike price of $215.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset

here is the trade setup:

SLD 1 AMZN JUN 09 '23 210 Call Option 0.77 USD

BOT 1 AMZN JUN 09 '23 215 Call Option 0.54 USD

What happens next?

On the expiry date, June 9, 2023, TSLA is trading under $210 per share - options expire worthless and I keep premium - if TSLA trades above $210 I'm troubled as I need to deliver shares I don’t have. To avoid such a scenario I will try to roll up the strike price.

The Max risk is $500 to earn $21.6

Max loss: $478.4

Break-even price: $210+$0.21= $210.21

In total: 10 trades since April 18, 2023

Options premium: $98