Closed covered calls with SKLZ (+$66.6/1 day) and Barrick Gold (+$72.6/18 days)

On May 07, 2021, two of our call options were called away and we realized some nice gains with NYSE: SKLZ and NYSE: GOLD stocks

Here I made a quick YouTube video

If you enjoy the content, subscribe to my YouTube channel where I talk about options trading, stock investments, and finance in general

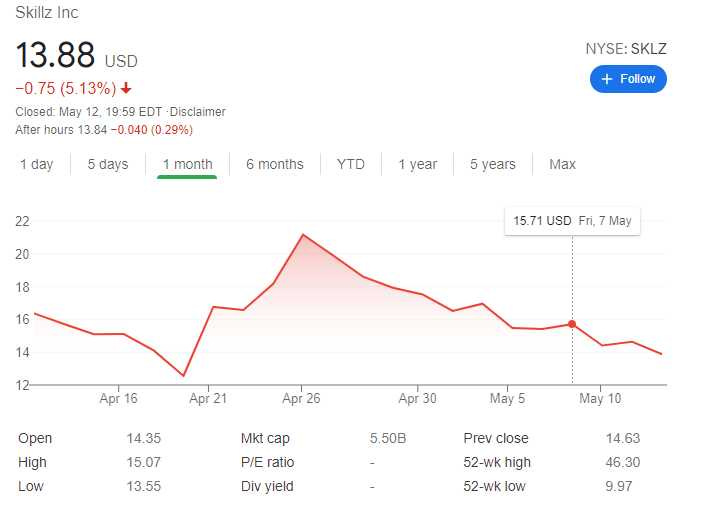

Closed covered call with SKLZ stock

On May 07, 2021, our 100 shares of NYSE: SKLZ got called away at the strike price of $15.5. We were in this trade just for one day.

We have been in this trade just for one day, we bought 100 shares on May 06, paying $15.11 per share, and simultaneously sold the next days expiry covered call with a strike price of $15.5

On the close stock traded above $15.5 and we realized our max gain of $66.6 or about 4.4% yield in just one day. Awesome.

It seems we got just lucky, entering this trade at the right moment. For the future, I won’t risk trading SKLZ

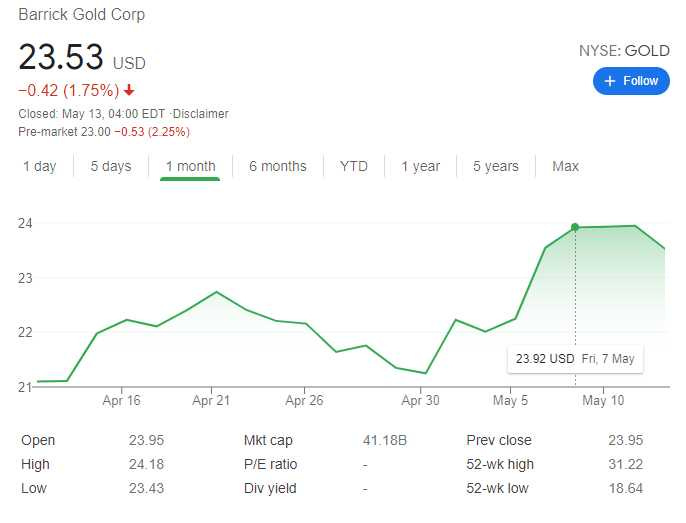

Closed covered calls with NYSE:GOLD

On May 07, 2021, our 100 shares of NYSE: GOLD got called away at the strike price of $22.5. In this trade, we were for 18 days.

We have been in this trade since April 19, when we bought 104 shares with GOLD at $22.2, see: Sold 1 Covered Call on (NYSE:GOLD) - Potential income return 1.8% in 4 days

On the close stock traded above $22.5 and we realized our max gain of $72.6 or about or 3.27% potential return of income in 18 days.

Barrick gold is a stock we see we are going to continue selling calls and puts in the future. Right now waiting for a pullback in this stock before entering a new trade.