Covered Call Trade idea with Intel stock (NASDAQ:INTC)

I like the idea of selling covered call options on "good" dividend stocks, preferably from the Dow Jones list. Intel stock is a great dividend payer, and also is the cheapest stock from the Dow Jones list.

Unfortunately Intel stock has bad guidance for the next few months/quarters and further drops in the stock price are quite possible.

This is not a trade recommendation, this is a trade idea. I'm not a financial advisor, anything written here should be taken with a grain of salt. I take no responsibility If you will decide to invest

Generate monthly income selling covered calls on Intel stock

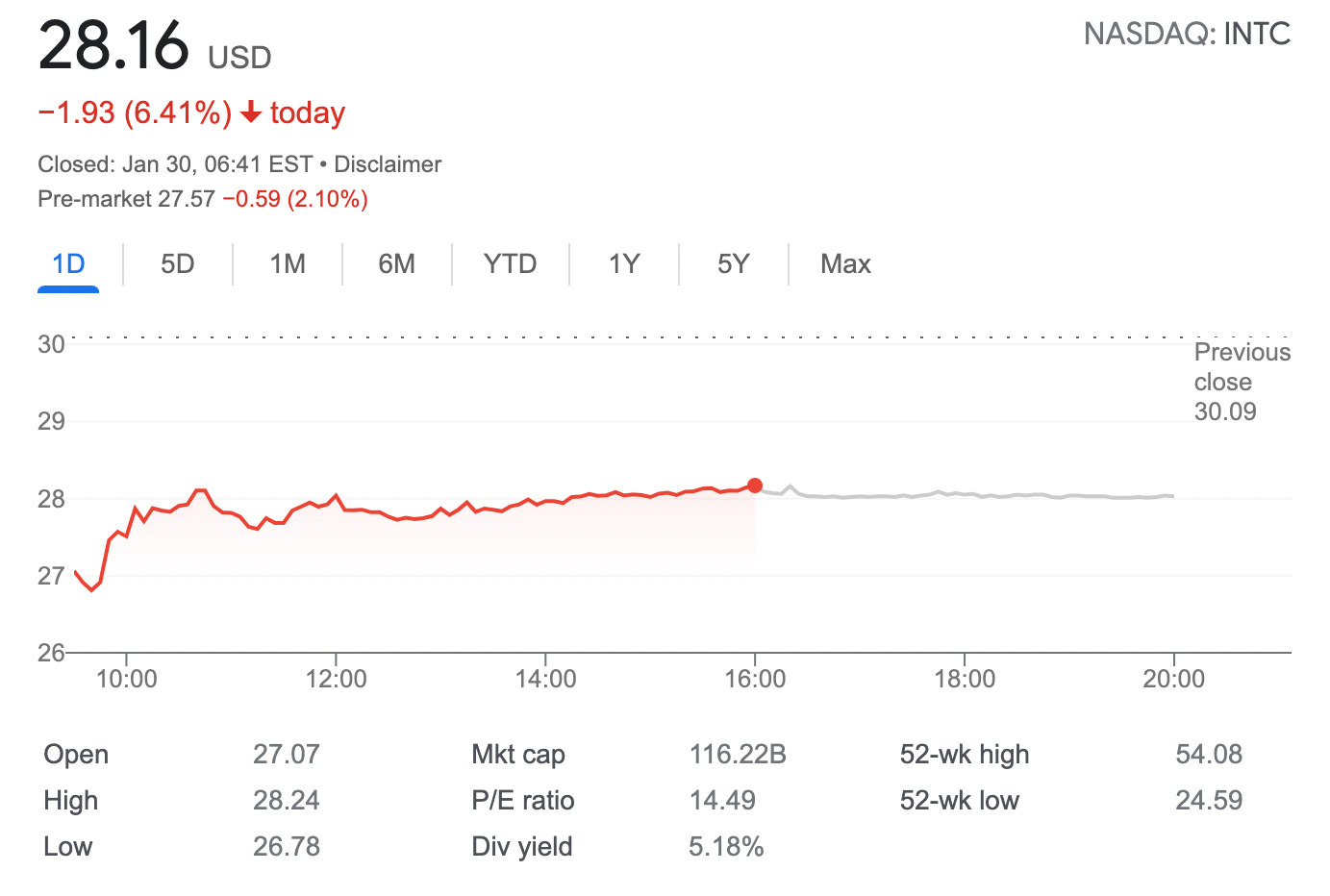

On January 30, 2023, we could buy 100 shares of INTC stock spending $28.16 per share or $2,816, and simultaneously sell out of the money February 24 expiry covered call at the strike price of $29 for about $ 0.49. That gets us $49 and makes about a 1.7% return in 25 days. Break-even: 27.67

If INTC stock closes below $29 on February 24, you keep the premium and start over.

If the stock closes above $29 your stock gets called away, but you keep a premium of $0.49 + realize a value gain of $0.84 (29 - 28.16) from selling stock higher than you bought. Total $133 or about 4,72% potential income return from your initial investment in 25 days

There are several options you could use not to get shares called away, like a roll-up or roll forward. Or you could sell the stock, and start over by writing a cash-secured put to get the stock back.

Remember, you are selling one contract, 100 shares of INTC stock, make sure you have 100 shares to sell if called away.

The biggest risk - involved in a covered call strategy - the stock price could fall below our buy price and stay there for months/years.

As we are selling on a reasonably good dividend stock, with a dividend yield above 5%, you would limit the potential downside with the extra dividend.

At the moment INTC is trading well under both its 50/200-day moving averages. The short-term support is $24.69 / the resistance: is $28.55. As INTC just broke under the 50-day moving average (after the earnings report and bad guidance for the next few quarters). There is a great chance the downward trend will continue. More pressure to come. More pressure could push a dividend cut…

I wouldn't recommend going with call options on INTC stock now, instead waiting for a couple of days/weeks before making a decision

Alternatively, if you enjoy the stock but are concerned with the current stock price, you could enter the trade by selling put options. A put credit spread could be a potential trade setup for a night of better sleep.