Established New Covered Call on NKLA; Potential Income return 7.05% in 65 days

On August 20, 2021, I got assigned 100 shares with NKLA stock at the price of $13 per share. Luckily this was a part of the credit spread, and I had my protection at $11.

This trade was originally established as a credit spread on July 21, 2021

When the stock market opened Friday, August 20, I sold my protection for $1.35. Thus, making my average buy price $11.17 (including the premium from the original trade setup)

Originally I opened 5 credit spreads on NKLA stock, but after the stock dropped significantly, I decided to roll most of the contracts and lower the strike prices.

Partial Roll Forward and Down 4 Credit Spreads on NKLA – 2.92% potential income return in 86 days (Expires on October 15, 2021)

Another Partial Roll Forward and Down 3 Credit Spreads on NKLA –1.45% potential income return in 121 days (Expires on November 19, 2021)

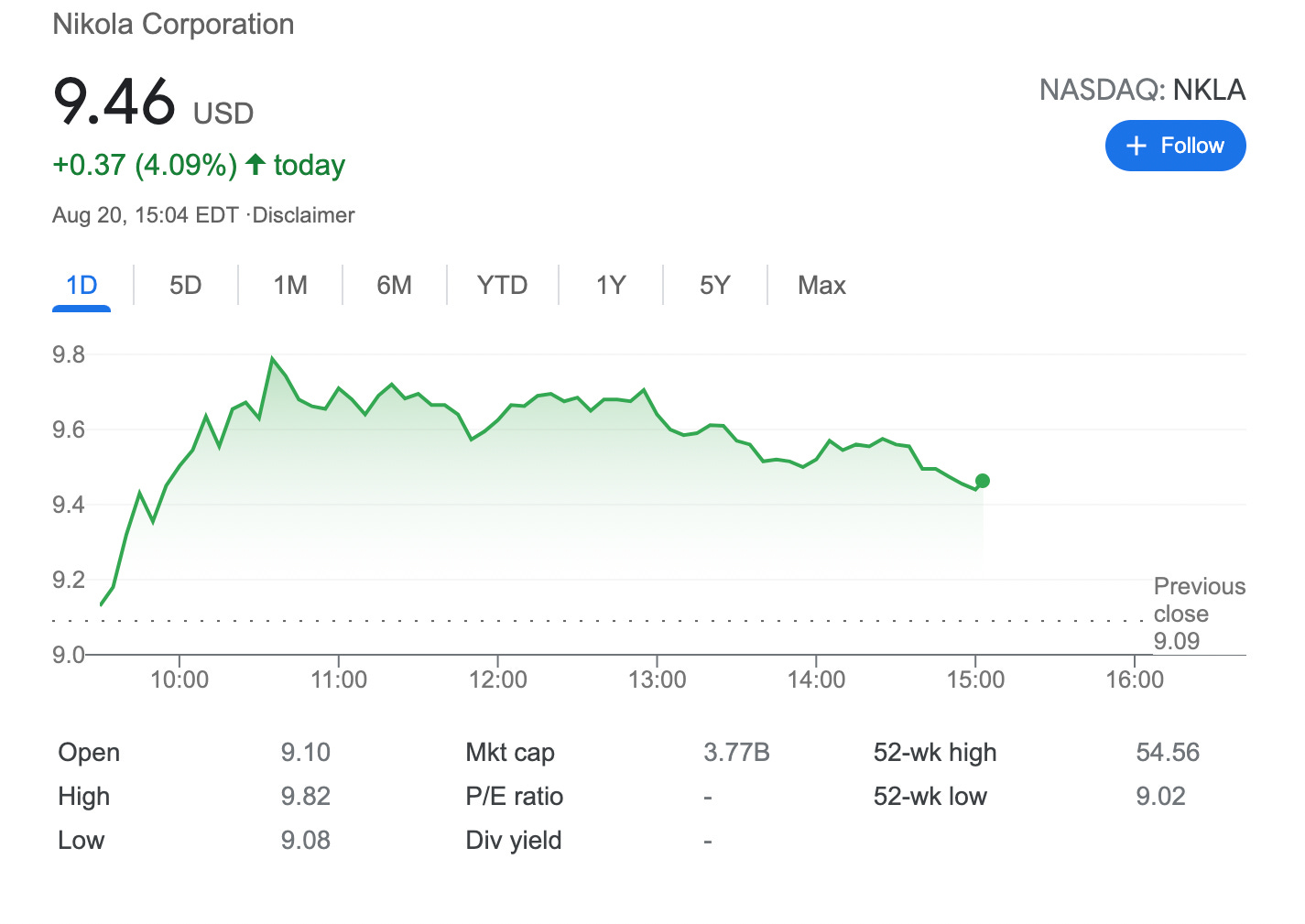

As long as the NKLA stock price stays above $9 per share - I’m safe.

Anyhow here is the trade setup:

BOT 100 NKLA Stock 13.00 USD (assigned)

SLD 1 NKLA AUG 20 '21 11 Put Option 1.35 USD

SLD 1 NKLA SEP 24 '21 11.5 Call Option 0.52 USD

here I bought 100 shares, in total paying $1,300, but as I had protective put, I sold it for $135, and additionally, I sold a covered call with September 24, 2021 expirty for $52.

What happens next?

On the expiry date, September 24, 2021, NKLA is trading under $11.5 per share - options expire worthlessly and I keep premium - if NKLA trades above $11.5 on the expiry date, my 100 shares will get called away.

When originally setting up the credit spread I already got $0.48 per share, my new break-even price for this trade then is $13-$0.48-$1.32-$0.49 = $10.72