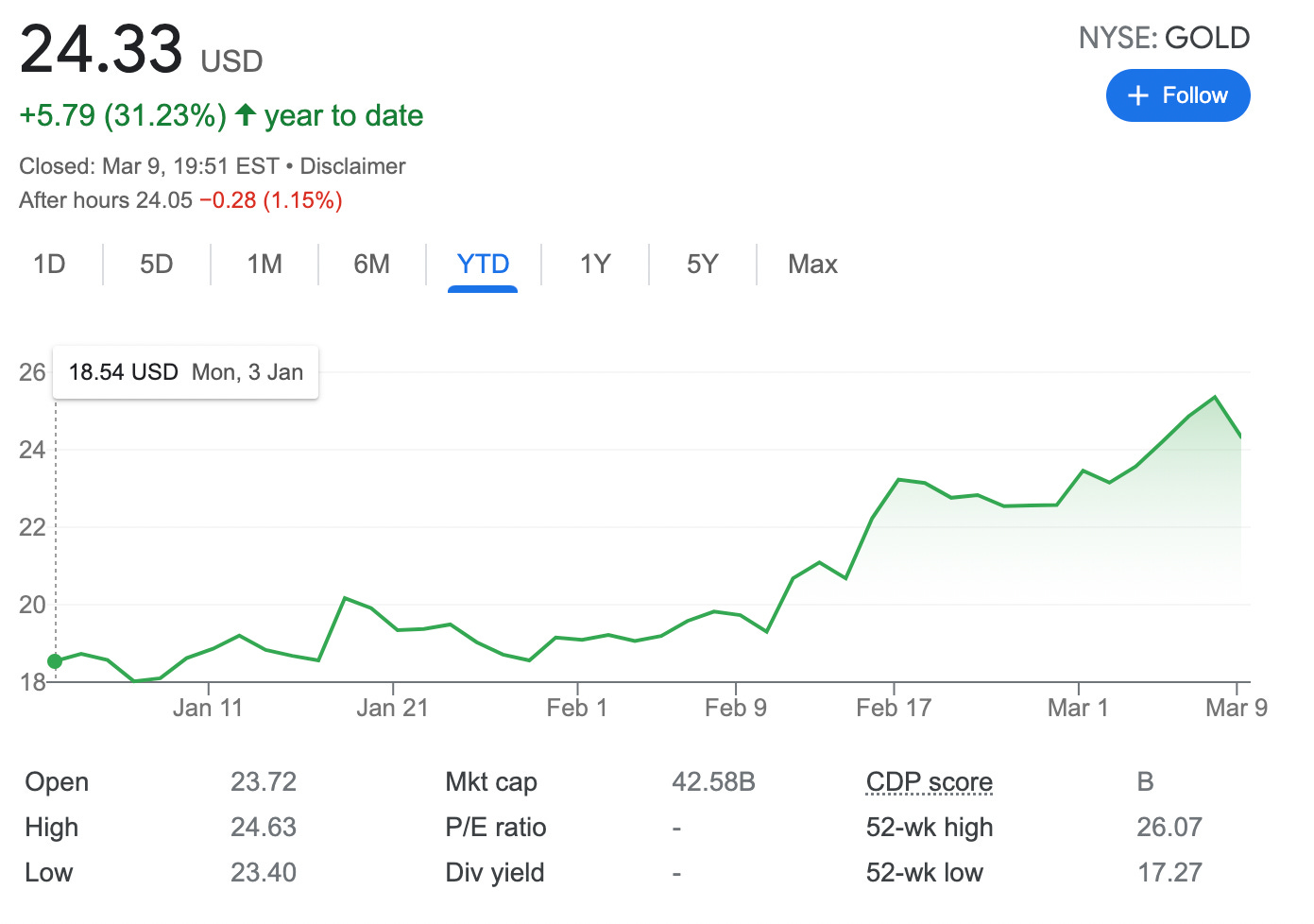

Established New Covered Call on NYSE:GOLD

Hi fellow investors,

On March 09, 2022, I bought 100 shares of NYSE: GOLD stock paying $24.07 per share and simultaneously sold 1 covered call on them with a strike price of $24 and expiry this Friday. Credit received $54 (before commissions)

NYSE:GOLD - Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

I have been trading covered calls with Barrick Gold with quite a huge success in the past. Today the price might seem a bit high and probably a pullback is awaited if some good news comes from Ukraine, but I’m ready to keep this stock for a few more weeks or months in my portfolio while selling covered calls on it.

here is the trade setup:

BOT 100 GOLD Stock 24.07 USD

SLD 1 GOLD MAR 11 '22 24 Call Option 0.54 USD

I bought 100 shares at $24.07 apiece, in total paying $2,407, and sold 1 covered call with this Friday’s expiry, for what I received a premium of $54 (before commissions)

What happens next?

On the expiry date, March 11, 2022, NYSE: GOLD is trading under $24 per share - options expire worthlessly and I keep premium - if GOLD trades above $24 on the expiry date, my 100 shares will get called away and I realize my max profit $44.6 ($51.6+$7) or potential 1.85% income yield in 2 days.

Break-even price: $24.07-0.51= $23.56

If the stock price will fall under $24 I will happily roll this call into next week

Trade safe!