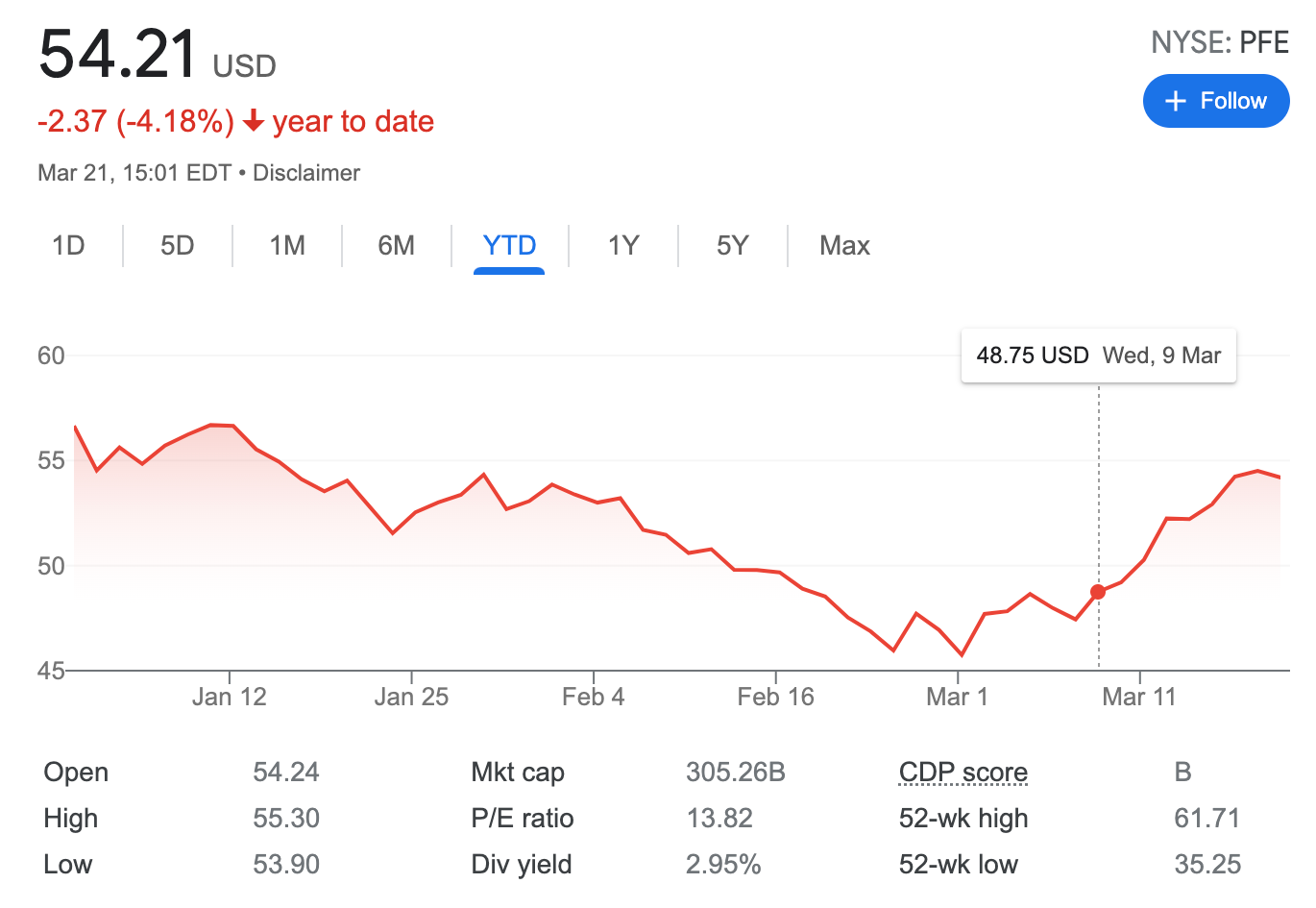

Established New Covered Call on Pfizer NYSE: PFE

On March 21, 2022, I bought 100 shares of NYSE: PFE stock paying $54.25 per share and simultaneously sold 1 covered call on them with a strike price of $54.5 and expiry this Friday. Credit received $62 (before commissions)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German immigrants, Charles Pfizer and his cousin Charles F. Erhart.

I’ve been trading options with PFE stock with various results since 2019. I prefer selling options with PFE stock as this is a decent dividend-paying stock and contributes greatly to my dividend income.

here is the trade setup:

BOT 100 PFE Stock 54.25 USD

SLD 1 PFE MAR 25 '22 54.5 Call Option 0.62 USD

I bought 100 shares at $54.25 apiece, in total paying $5,424 and sold 1 covered call with this Friday’s expiry, for what I received a premium of $62 (before commissions)

What happens next?

On the expiry date, March 25, 2022, NYSE: PFE is trading under $54.5 per share - options expire worthlessly and I keep premium - if PFF trades above $54.5 on the expiry date, my 100 shares will get called away and I realize my max profit $84 ($25+$59) or potential 1.54% income yield in 4 days.

Break-even price: $54.25-$0.59= $53.66

Running Total 2 Trades since March 21, 2022

Options income: $55