February 2022 Options Trading Income Report -$2,148 (loss)

Hi traders, February is finally over and before stepping in March, let’s have a quick recap of happenings at the stock market and options trading back in February.

Wow, what a month, from the hopes of avoiding war in Ukraine to a full-scale invasion at the end of February. It was clearly visible in the stock market, most of my positions suffered, both options and long-term stock holdings. Yikes.

The last January, we did a total of 34 trades / from which most were covered calls, credit spreads, a few puts, and some straddles (earnings trades)

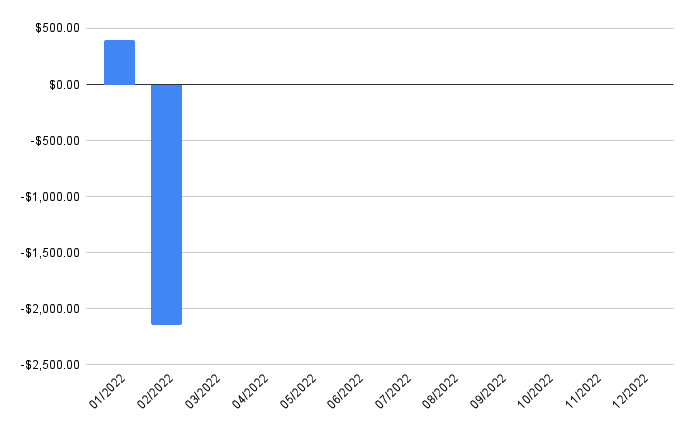

Because of the market selloff and overtrading in the previous month, I took a loss of -$2,148 (not all is pure loss, some money was reinvested in actually buying options/option straddles), but I agree it was one of the biggest losses so far.

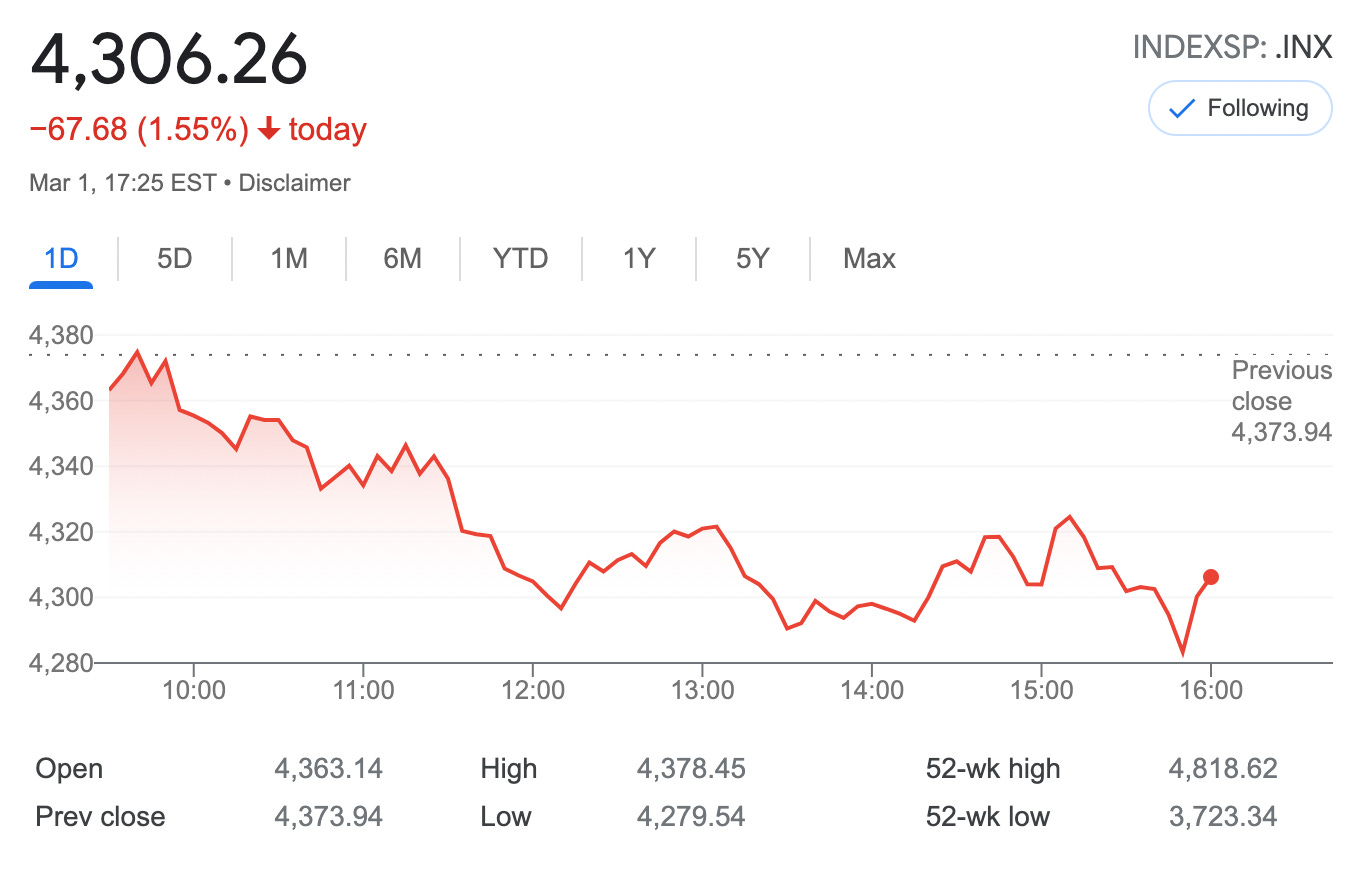

Market Sentiment

Last February SPX500 dropped by another -6.17%, Dow Jones -6.55%, and Nasdaq Index by -6.14%. I was literally squeezed out of the market, but I decided to use this time to get rid of the bad apples in the basket, bought bad some losing trades, and focused on quality-covered calls.

Despite the selloff, I didn’t face any more margin calls or most probably I would face them If I wouldn’t close some of the positions, resulting in a negative 2K

Options Income

Because of the market selloff, I lost -$2,148 in options premium, which is about a negative -9.67% monthly yield, if calculated against the stock portfolio. It will take me a few months (at least) to recover from the loss

My usual goal is at least +1% monthly, now, it didn’t happen this month

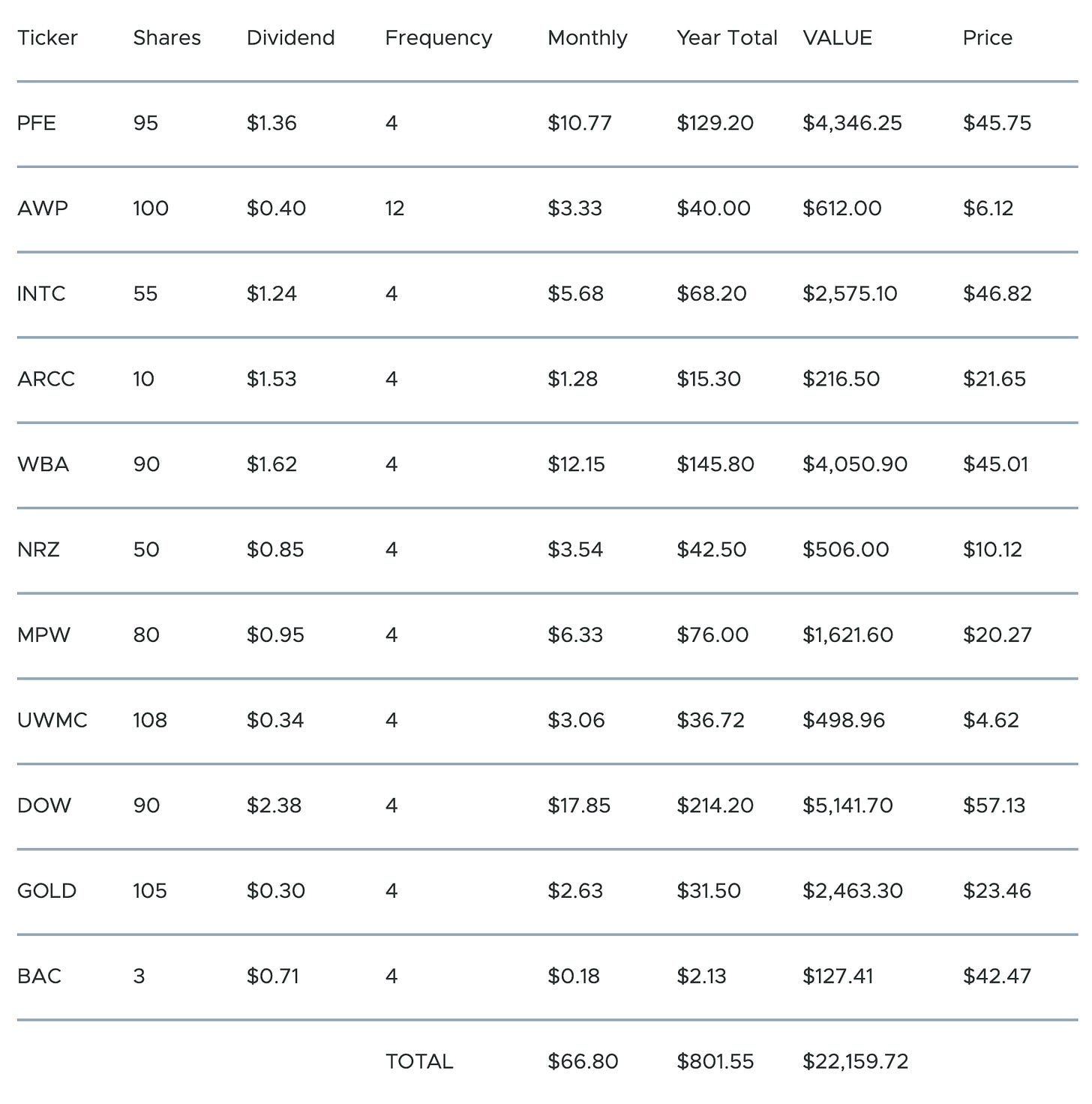

Dividend income

Our dividend income portfolio’s value now is $21,719 (+440), and it generates about $66.8 (+5.04) in monthly dividend income. The current annual yield is about 3.62%

Here are all of our holdings (as of March 02, 2022)

I sold some of the PFE stock but bought more some INTC, ARCC, NRZ, MPW, and BAC

Trading plan for March 2022 (Option trades & Stock Buys)

I will look to buy some more PFE, WBA, DOW, MPW, and BAC stock, to have fully covered positions for covered call selling

From covered calls/credit spreads - I’m looking to take ~ $300 during the month of March.

Subscriptions

At the end of February, we had

121 email subscribers (+6) for Covered Calls with Reinis Fischer newsletter

6 paying subscribers (0) (for as low as $9/mo subscribers get access to extra content 1-2 per week)

65 subscribers (+5) for the YouTube channel.

How was your month? Hit the reply button or leave a comment on the website!