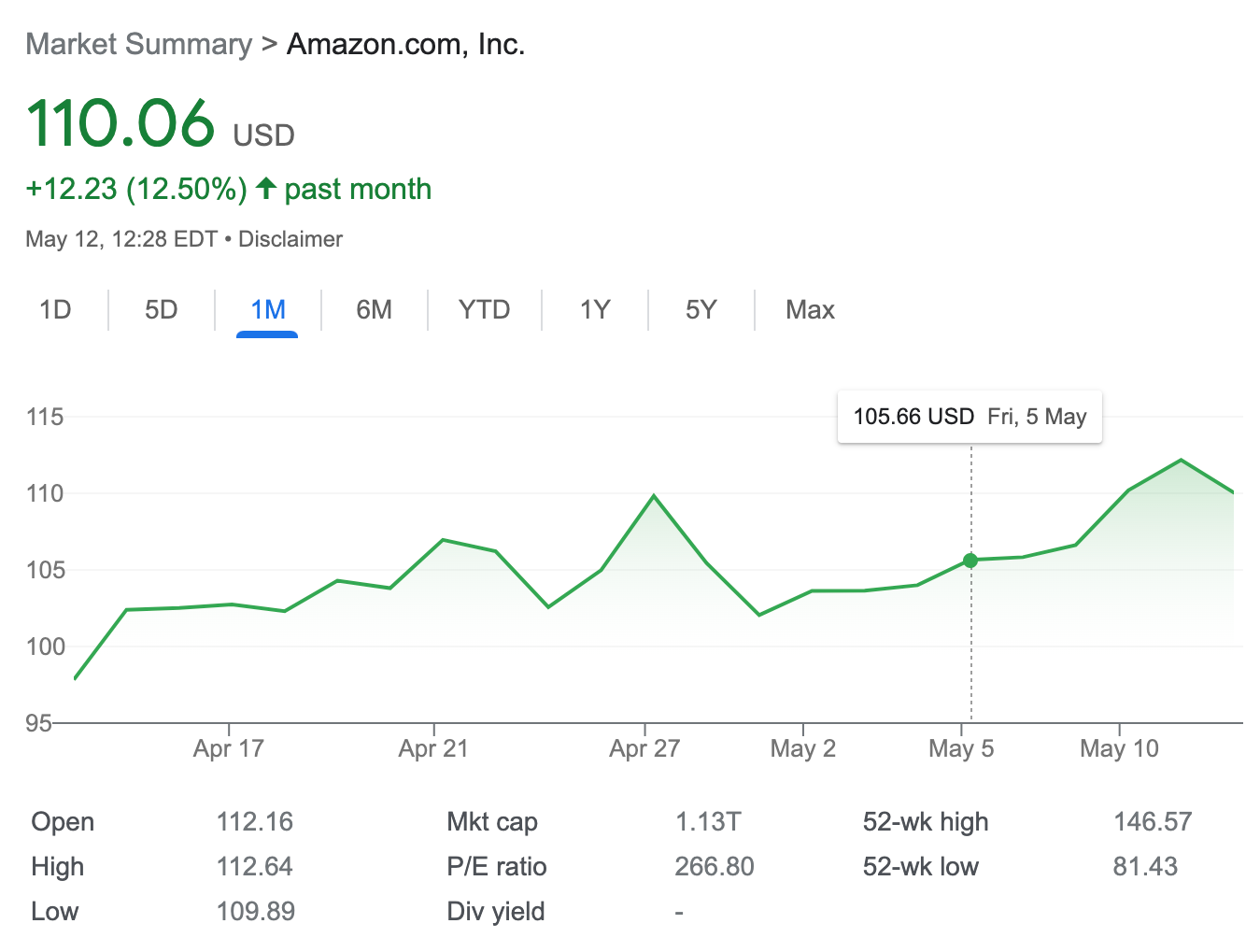

Iron Condor on AMZN stock – 4.6% potential income return in 14 days

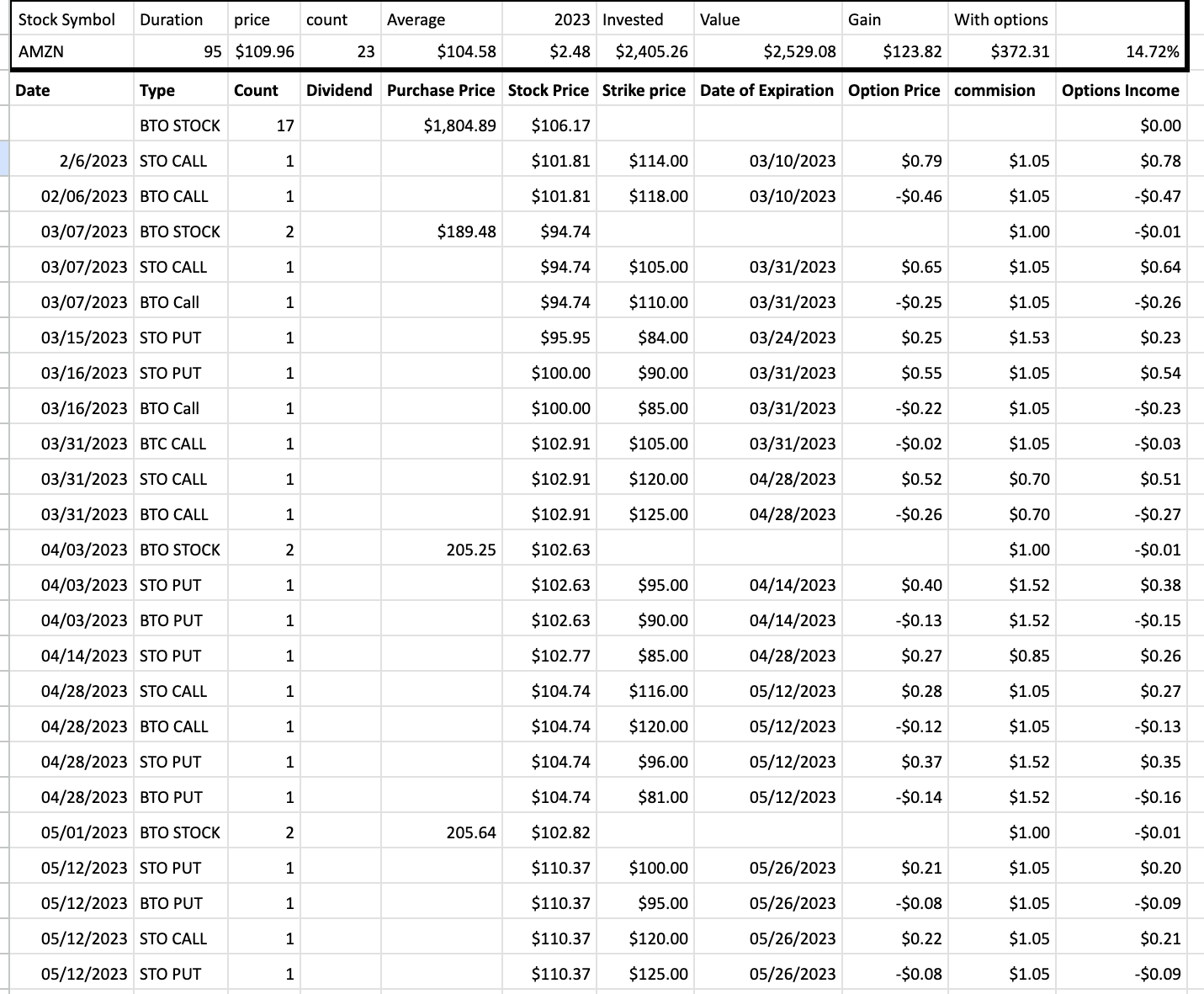

On May 12, 2023, I sold 1 bull put spread and 1 bear call spread (thus forming an iron condor) on Amazon stock with my strike prices set at $100 and $95 for the put spread and $120 and $125 for the call side, with expiry on May 26, 2023). For this trade setup, I was rewarded with $22.80 (after commissions).

When setting up this trade I was looking for a high probability profit trade and chose my strike prices with Delta under 0.1 and -0.1

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 AMZN MAY 26 '23 100 Put Option 0.21 USD

BOT 1 AMZN MAY 26 '23 95 Put Option 0.08 USD

SLD 1 AMZN MAY 26 '23 120 Call Option 0.22 USD

BOT 1 AMZN MAY 26 '23 125 CALL Option 0.08 USD

What happens next?

On the expiry date, May 26, 2023, AMZN is trading in between $100 and $120 - options expire worthlessly and I keep premium - if AMZN trades under $100 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $100

Also if AMZN trades above $120 - I risk selling 100 shares, which I actually don’t have (I have just 23 AMZN shares)

In any case, put or call spread being challenged I will try to roll out, if possible for a credit.

The break-even price for this trade is $99.78 and $120.22

As I’m trading here with $5 dollar wide spreads, my max risk from the trade is $500.

Collecting $22 premium on $500 (if options expire worthless) - equals 4.6% income

In total: 24 trades since February 6, 2023

Options premium: $248