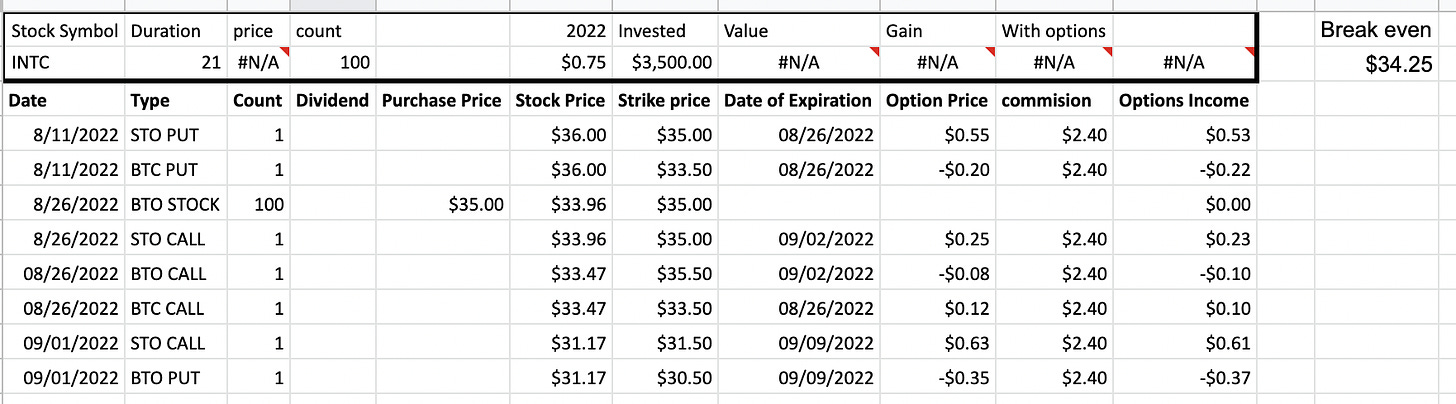

Risk Reversal Covered Call + Protective Put on INTC; Potential loss - 8.02% in 29 days

On September 1, 2022, I rolled forward and down 1 covered call on the INTC stock (NASDAQ: INTC) with a new expiry date set on September 09, 2022.

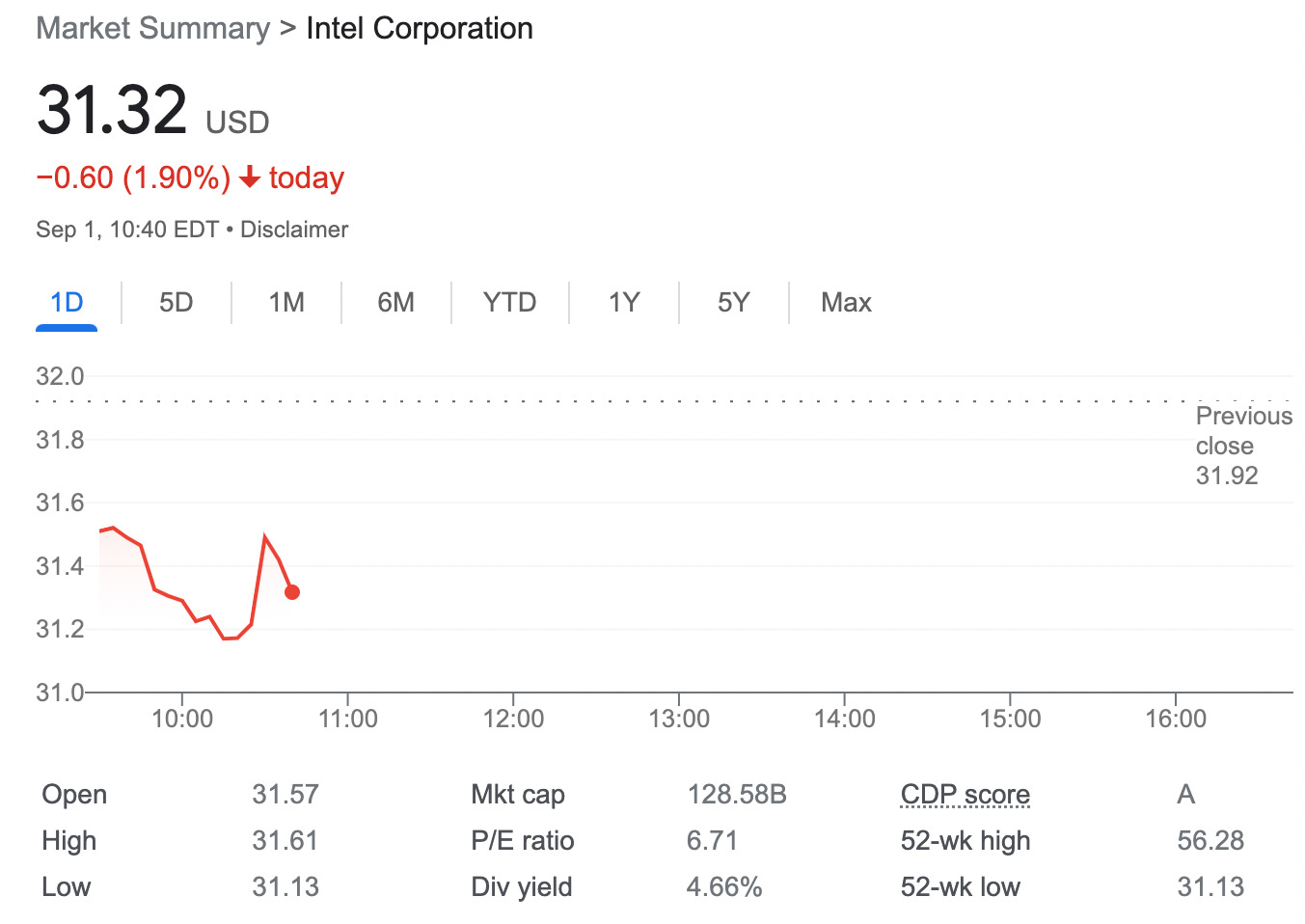

Additionally, I bought a protective put, to stop the bleeding. That’s right, Intel stock has dropped more than $2 since last week, and it seems the bleeding will continue. This morning (Tbilisi time) I was looking through some charts and saw a potential comeback at $36, but I have no idea when it could happen. Next few weeks or months.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 INTC Sep09'22 31.5 CALL 0.63 USD

BOT 1 INTC Sep09'22 30.5 PUT 0.35 USD

For this trade, I got $32.2 (after commissions)

What happens next?

On the expiry date, September 09, 2022, INTC is trading under $31.5 per share - options expire worthlessly and I keep premium and start over - if INTC trades above $31.5 on the expiry date, my 100 shares risk getting called away, in such case, I will realize a loss of $275 (-$350 value gain and +$75 options premium) or potential loss of +8.02% in 29 days.

Of course, I will try to avoid assignments, and if challenged will try to roll up.

Additionally, I bought protection at 30.5, which means if the INTC stock will keep failing under this strike price I will actually gain from that position. Say INTC stock fell another 2 dollars to 29.5, my loss will be just half of that as I can then sell this put and compensate for the loss.

I feel sad I didt’t construct a risk reversal trade already last week.

Break-even price: $35-$0.75= $34.25

Running Total 8 Trades since August 11, 2022

Options income: $75

Value gain: -$368

Total gain: -$293