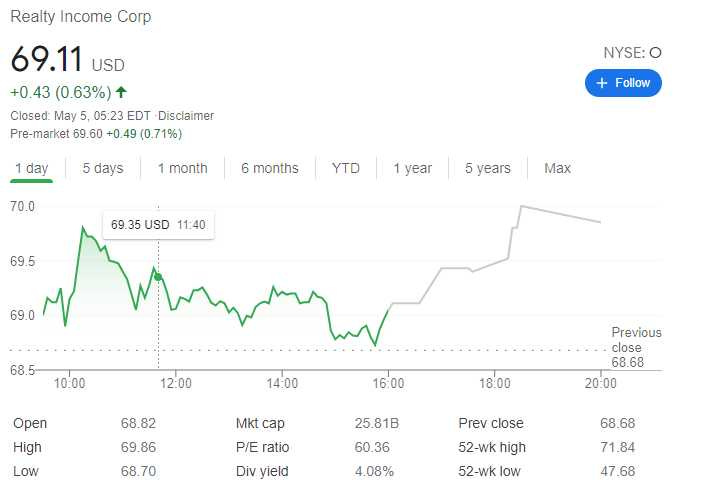

Roll Forward 1 Covered Call on Realty Income stock (NYSE:O) - Potential income return 8.89% in 129 days

On May 3, 2021, we bought back 1 covered call on Realy Income O stock and additionally sold a new covered call with expiry further out on June 18, 2021. The aftermath of this trade +$22 (after commissions)

With O price hovering around $69/$70 per share and not willing to let our $65 strike to get called away and not being able to find a decent higher strike prices for a credit, we decided just to roll this contract into the next month.

As we have been buying O using dollar-cost averaging our average buy price is: $61.16

here is our trade setup:

BOT 1 O MAY 21 '21 65 Call Option 4.21 USD

SLD 1 O JUN 18 '21 65 Call Option 4.49 USD

what can happen next:

O is trading below our strike price of $65 at the expiry date (June 18, 2021), in such case, we keep the premium and sell more covered calls to lower our cost basis.

In case O is trading above our strike price of $65, our 100 shares get called away at the strike price of $65 and we realize our max gain of $524 or 8.89% potential total income return in 129 days

Break-even: $59.76