Roll Forward 2 Covered Calls on Corbus Pharmaceuticals (NASDAQ:CRBP) - Potential income return 10.2% in 326 days

On June 17, 2021, we rolled forward 2 covered calls on CRBP stock with an expiry set on July 16, 2021. For this trade, we got a small $41.2 premium (after commissions).

This trade was originally established as a credit spread back on August 27, 2020, and since then we have been selling covered calls.

Our average stock buys price $2.46

Here I made a quick YouTube video about this position and how I entered it about a year ago:

Corbus Pharmaceuticals Holdings, Inc. is a Phase 3 clinical-stage pharmaceutical company focused on the development and commercialization of novel therapeutics to treat inflammatory and fibrotic diseases by leveraging its pipeline of rationally designed, endocannabinoid system-targeting drug candidate.

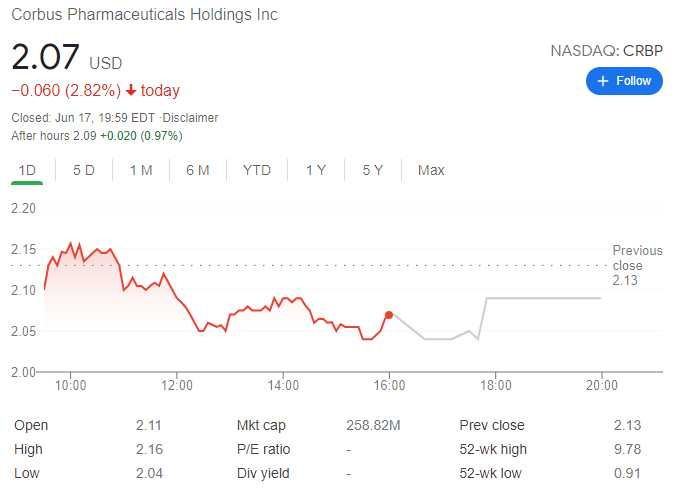

With CRBP stock trading at $2.13 shortly before the expiry date, I decided to roll these contracts for another month

Here is our trade setup:

SLD 2 CRBP JULY 16 '21 2.5 Call Option 0.23 USD

what can happen next:

CRBP is trading below our strike price of $2.5 at the expiry date (July 16, 2021), in such case, we keep the premium and sell more covered calls to lower our cost basis.

In case CRBP is trading above our strike price of $2.5, our 200 shares get called away at the strike price of $2.5 and we realize our max gain of +50.2$ or 10.2% potential income in 326 days

Break-even: $1.72