Roll Forward and up 1 Covered Call on VXRT stock - Potential income return 32.16% in 150 days

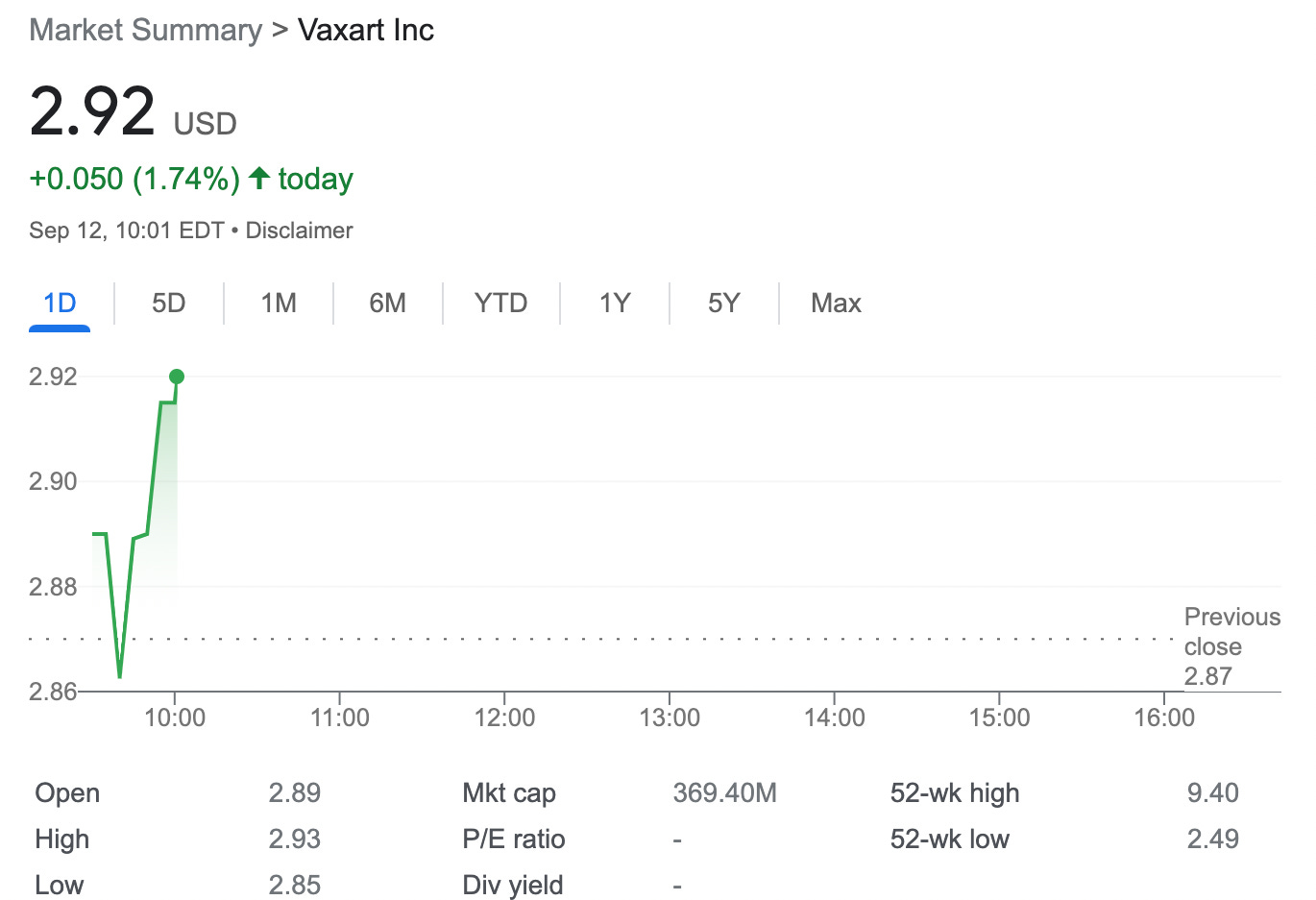

On September 12, 2022, I rolled forward and up 1 covered call on the VXRT stock (NASDAQ: VXRT) with a new expiry date set on October 28, 2022.

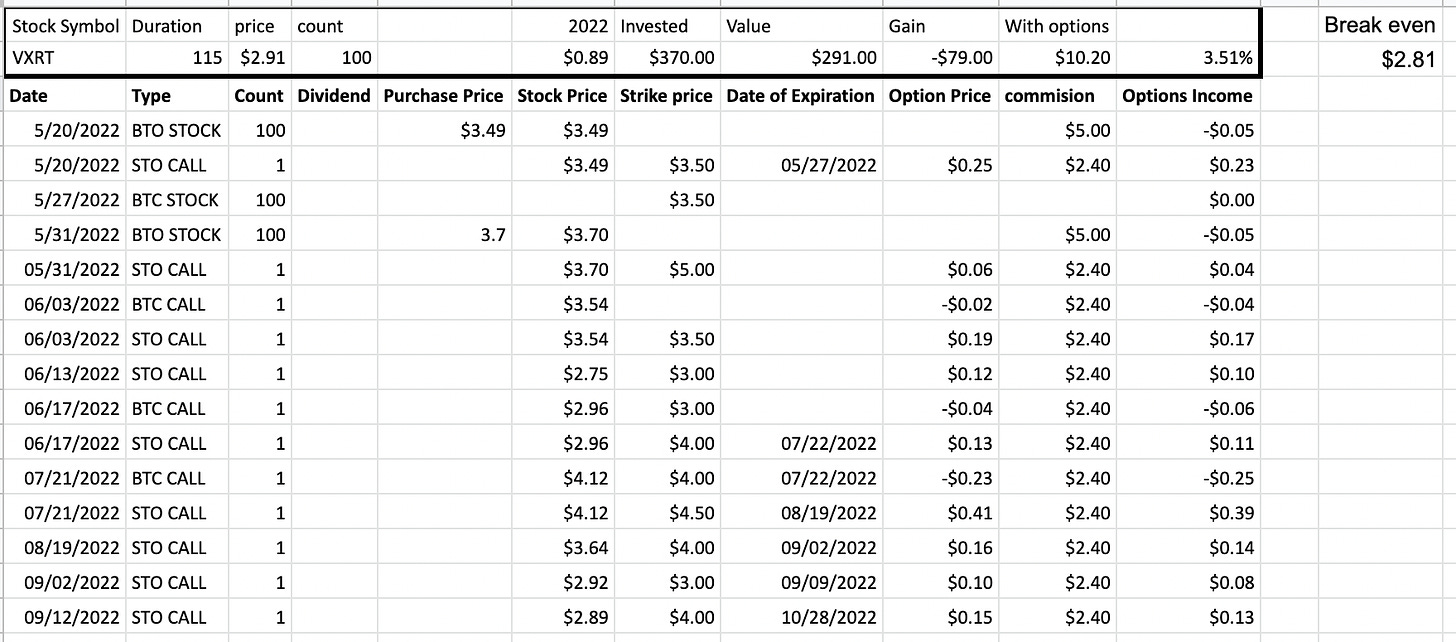

I have been in this trade since May 31, 2022, when bought 100 shares at $3.70

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

With VXRT trading under $3, I decided to roll up and forward this position to the end of October to receive some options premium.

here is the trade setup:

SLD 1 VXRT Oct 28'22 4 CALL 0.15 USD

For this trade, I got $15 (before commissions)

What happens next?

On the expiry date, October 28, 2022, VXRT is trading under $4 per share - options expire worthless and I keep the premium and start over - if VXRT trades above $4 on the expiry date, my 100 shares will get called away and I will realize a profit of $119 ($30 value gain and +$89 options premium) or potential income of +32.16% in 150 days

Break-even price: $3.7-$0.89= $2.81

Running Total 15 Trades since May 20, 2022

Options income: $89