Roll Forward and Up 1 Covered Call on VXRT stock - Potential income return 33.78% in 91 days

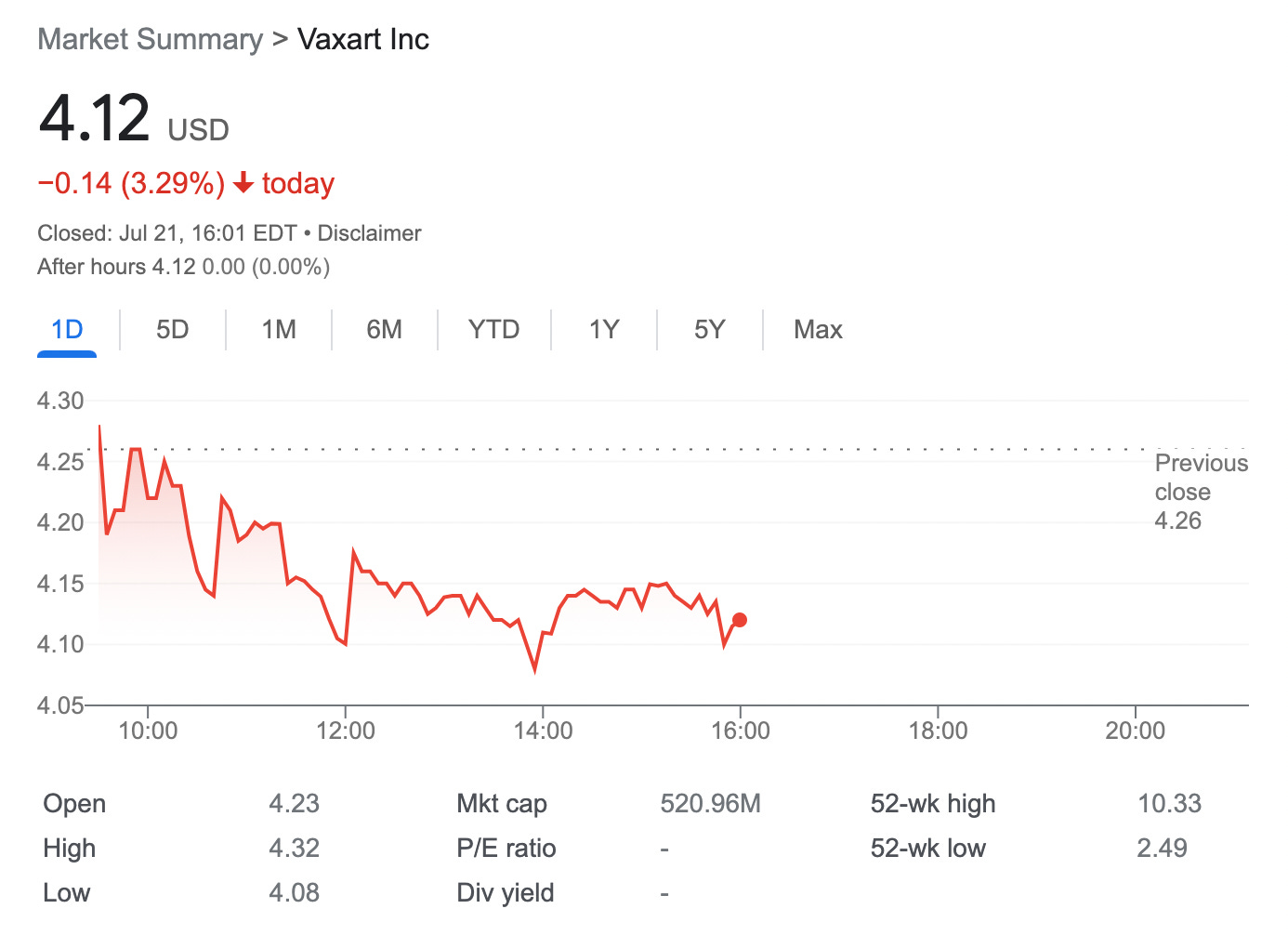

On July 21, 2022, I rolled forward and rolled up 1 covered call on the VXRT stock (NASDAQ: VXRT) with a new expiry date of August 19, 2022.

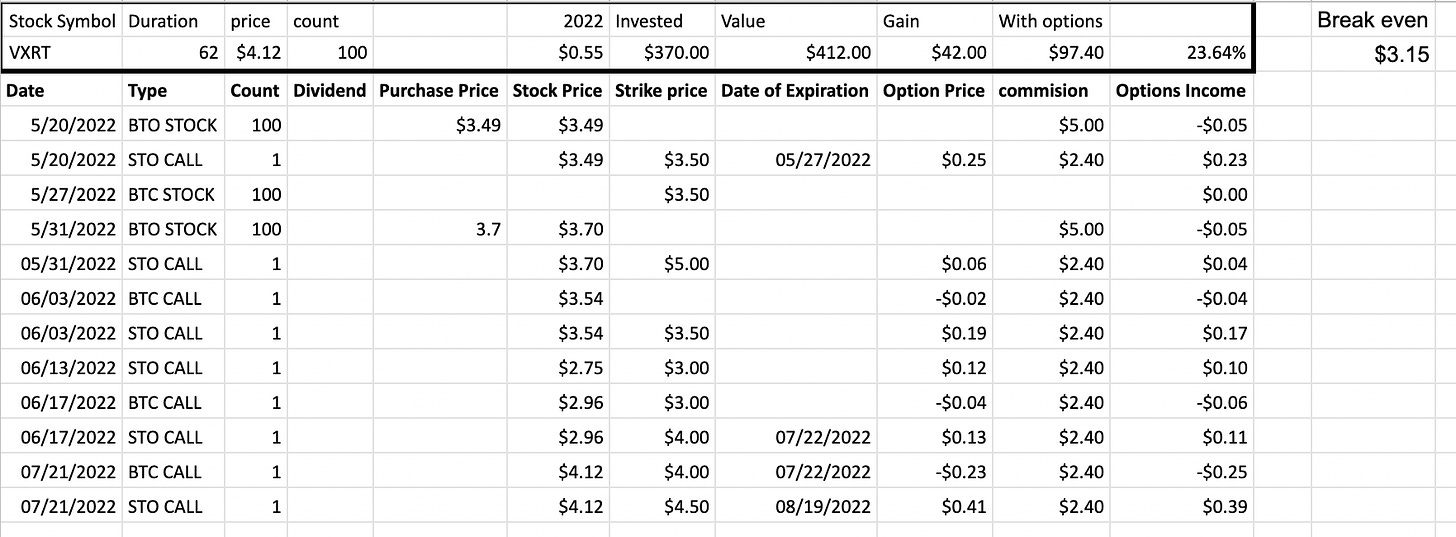

I have been in this trade since May 31, 2022, when bought 100 shares at $3.70

With VXRT trading near my strike price I decided to close the position and roll up for a credit.

here is the trade setup:

BOT 1 VXRT Jul22'22 4 CALL 0.23 USD

SLD 1 VXRT Aug19'22 4.5 CALL 0.41 USD

I bought back the $4 call option paying $23 and sold a new call option with a higher strike price ($4.5) and an expiry set for the end of August. For this trade, I got $41 (before commissions)

What happens next?

On the expiry date, August 19, 2022, VXRT is trading at under $4.5 per share - options expire worthlessly and I keep premium and start over - if VXRT trades above $4.5 on the expiry date, my 100 shares will get called away and I will realize a profit of $125 ($70 value gain and +$55 options premium) or potential income of +33.78% in 91 day

Break-even price: $3.7-$0.55= $3.15

Running Total 12 Trades since May 20, 2022

Options income: $55