Rolled down and away 1 Bull Put Credit Spread on TSLA – 5.7% potential income return in 45 days

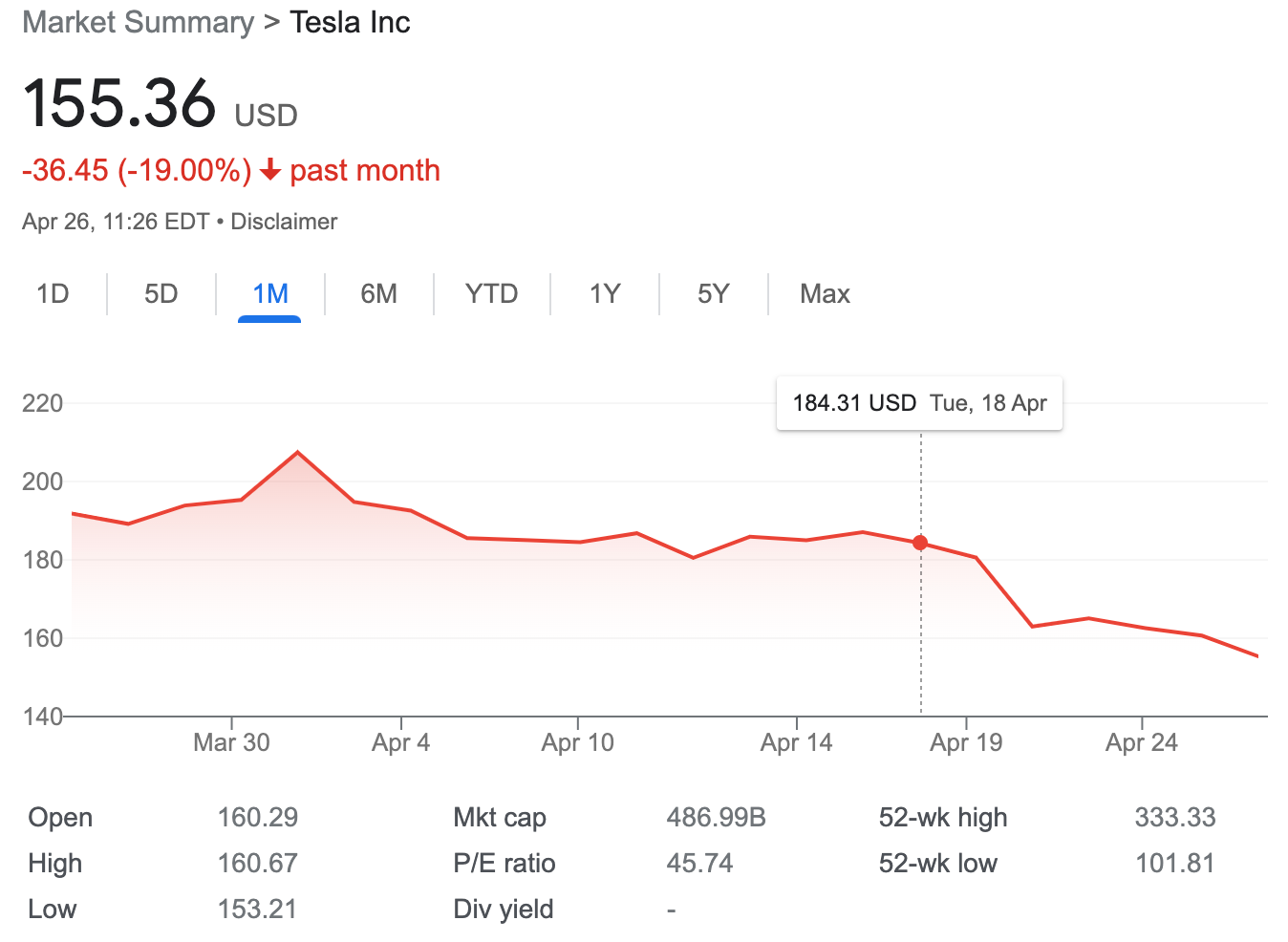

On April 26, 2023, I rolled forward and rolled down a bull put option I established just a week ago on TSLA stock. See: Sold 1 Bull Put Credit Spread on TSLA – 3.4% potential income return in 10 days

Key points:

Saved potential $2,000 in case of assignment

Lowered delta for short put from -0.25 to -0.14

Rolled for a credit

As the stock price for TSLA failed after the earnings report and was barely hovering above my strike price of $150 I decided to roll away despite the current options expiry being just two days away on April 28.

The risk that the current strike could end in money increased too much and I just don't want to take a Tesla stock assignment (at least not yet).

Originally when I opened this position TSLA was trading above $180, now the price has dropped by more than $25 per share.

I can feel only happy not buying 100 shares payinh $18,000. As the stock price keeps falling I don't want to buy them also at $15,000, with the latest roll I rolled down the buying price to $13,000. Thus potentially saving another $2,000 before actually investing in TSLA stock.

Tesla is trading under it’s both 50-day and 200-day moving average, and it seems will keep falling. Touching January lows at $100 doesnt seem something imaginary, before that the other minor price support levels could be touched at $150, $140 and $130.

With the $130 being the price when possible price conssidalation could happen.

Just a guess! Better safe than sorry, I decided to roll down and away the current position, still recieving credit. To recieve credit I had to widen the spred from $5 wide to $10 wide.

Keep reading with a 7-day free trial

Subscribe to OptionsBrew.com to keep reading this post and get 7 days of free access to the full post archives.