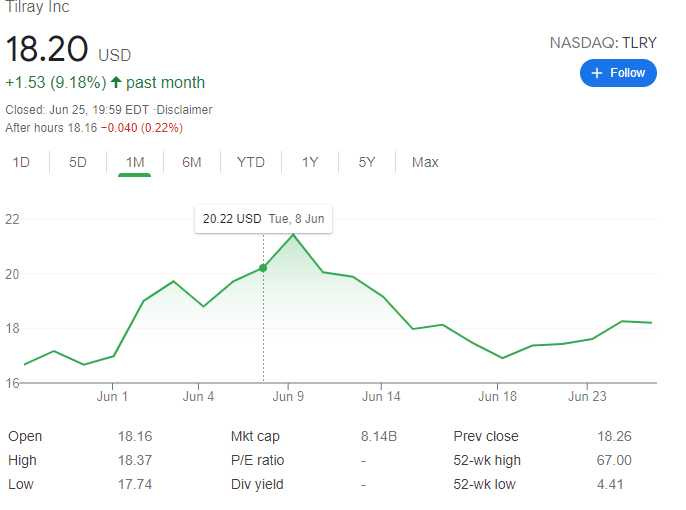

Rolled Forward and Up 1 Covered Call on Tilray stock (NASDAQ:TLRY) - Potential income return +9.54% in 56 days

On June 25, 2021, we rolled forward and up 1 covered call on TLRY stock expiring on July 16, 2021. For this trade, we got a $39 premium (after commissions)

We have been in this trade since May 21

Our average buy price $17.18

here is our trade setup:

BOT 1 TLRY Jun 25 '21 17 Call Option 1.00 USD

SLD 1 TLRY Jul 16 '21 18 Call Option 1.44 USD

As TLRY stock price climbed above our strike price of $17, we decided to roll forward for a credit

what can happen next:

TLRY is trading below our strike price of $18 at the expiry date (July 16, 2021), in this case, we keep the premium and sell more covered calls to lower our cost basis.

In case the TLRY stock is trading above our strike price of $18, our 100 shares get called away at the strike price of $18, and we realize our max gain +$164 or 9.54% potential return of income in 54 days

Break-even: $16.36