Rolling Out an NVDA Bull Put Credit Spread

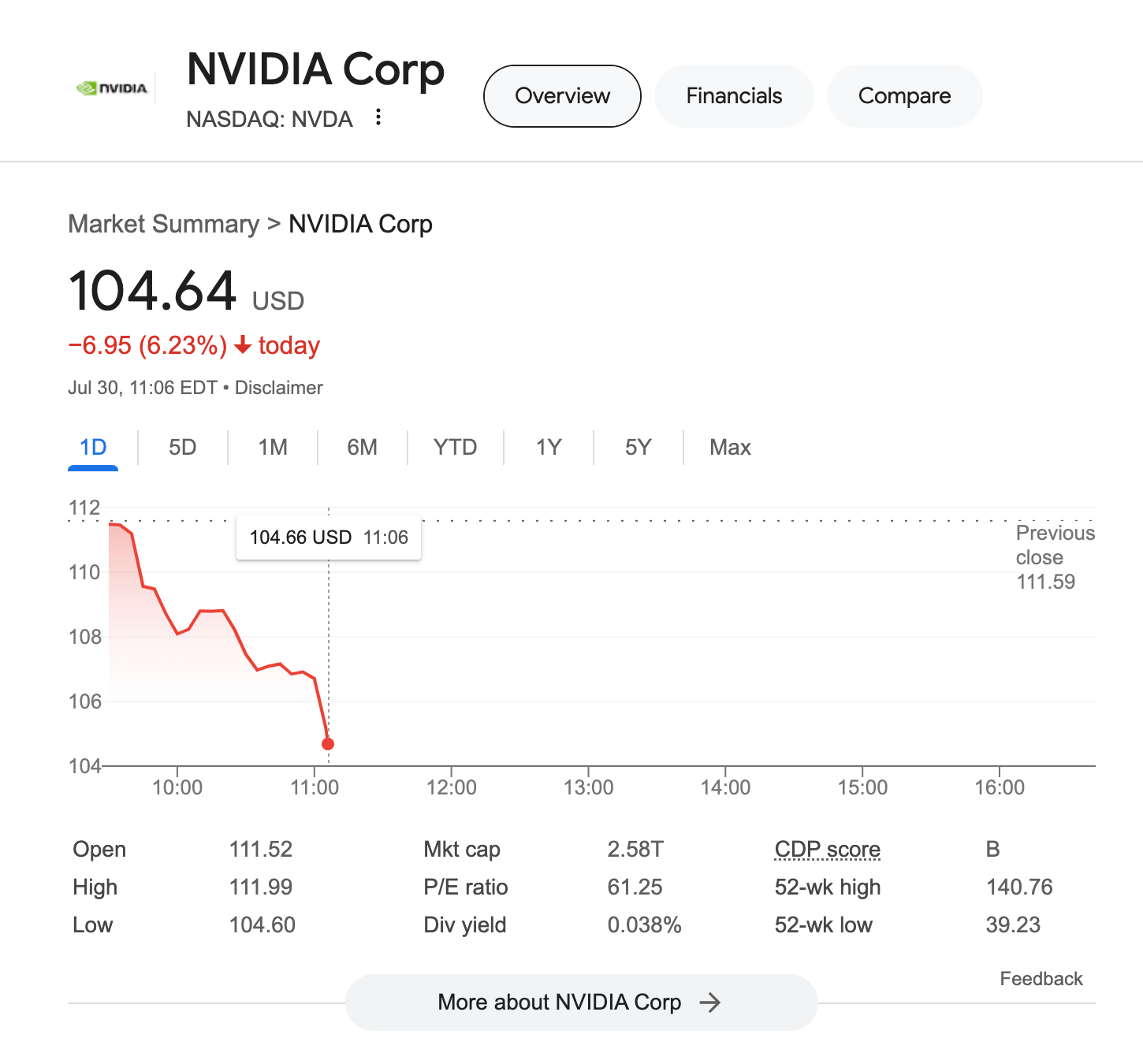

Today, I made a strategic adjustment to my NVDA (NVIDIA Corporation) options trade. Initially, I had a bull put credit spread with a 110/105 strike price expiring on August 2, 2024. Given the recent performance of NVDA and other tech stocks, I decided to roll this spread out to a single put with a strike price of 95, expiring on August 30, 2024.

The Rationale Behind the Adjustment

Tech stocks, including NVDA, have faced significant headwinds recently. Despite my confidence in NVDA as a long-term holding in my portfolio, I am always on the lookout for better entry prices. This means that I am keenly focused on optimizing my trades to reflect current market conditions.

Rolling out my bull put credit spread to a lower strike price allows me to:

Mitigate Risk: By lowering the strike price, I reduce the potential downside risk associated with holding the original spread.

Improve Entry Price: The adjustment positions me better to capitalize on NVDA's potential rebound from a lower price point.

Maintain Portfolio Flexibility: Ensuring my portfolio can withstand any market situation is a key lesson I've learned in my 5+ years of options trading. This adjustment aligns with that principle.

The Aftermath and Future Outlook

The aftermath of this trade adjustment resulted in an additional $70 in premium. I reinvested this amount to purchase an additional 0.65 shares of NVDA stock, bringing my total holdings to 2.4 NVDA shares in our stock portfolio.

This move signifies my confidence in NVDA's long-term potential while also showcasing a cautious approach to navigating the current market volatility. With a 95 strike put in place, I will have fewer options trades over the next 40 days. However, I remain active in the stock market, selectively buying stocks to strengthen my portfolio.

Key Takeaways for Options Traders

Stay Sharp: Constantly monitor market conditions and be ready to adjust your trades accordingly.

Risk Management: Always ensure your portfolio can withstand various market scenarios.

Long-term Perspective: While short-term trades are important, maintaining a long-term perspective on high-quality stocks like NVDA is crucial.

By sharing my experience with this NVDA trade adjustment, I hope to provide valuable insights for fellow options traders. Stay vigilant, and always be prepared to adapt your strategies to the ever-changing market landscape.