Sold 1 Bull Put Credit Spread on Altria Group Stock – 0.99% potential income return in 29 days (12.45% annualized)

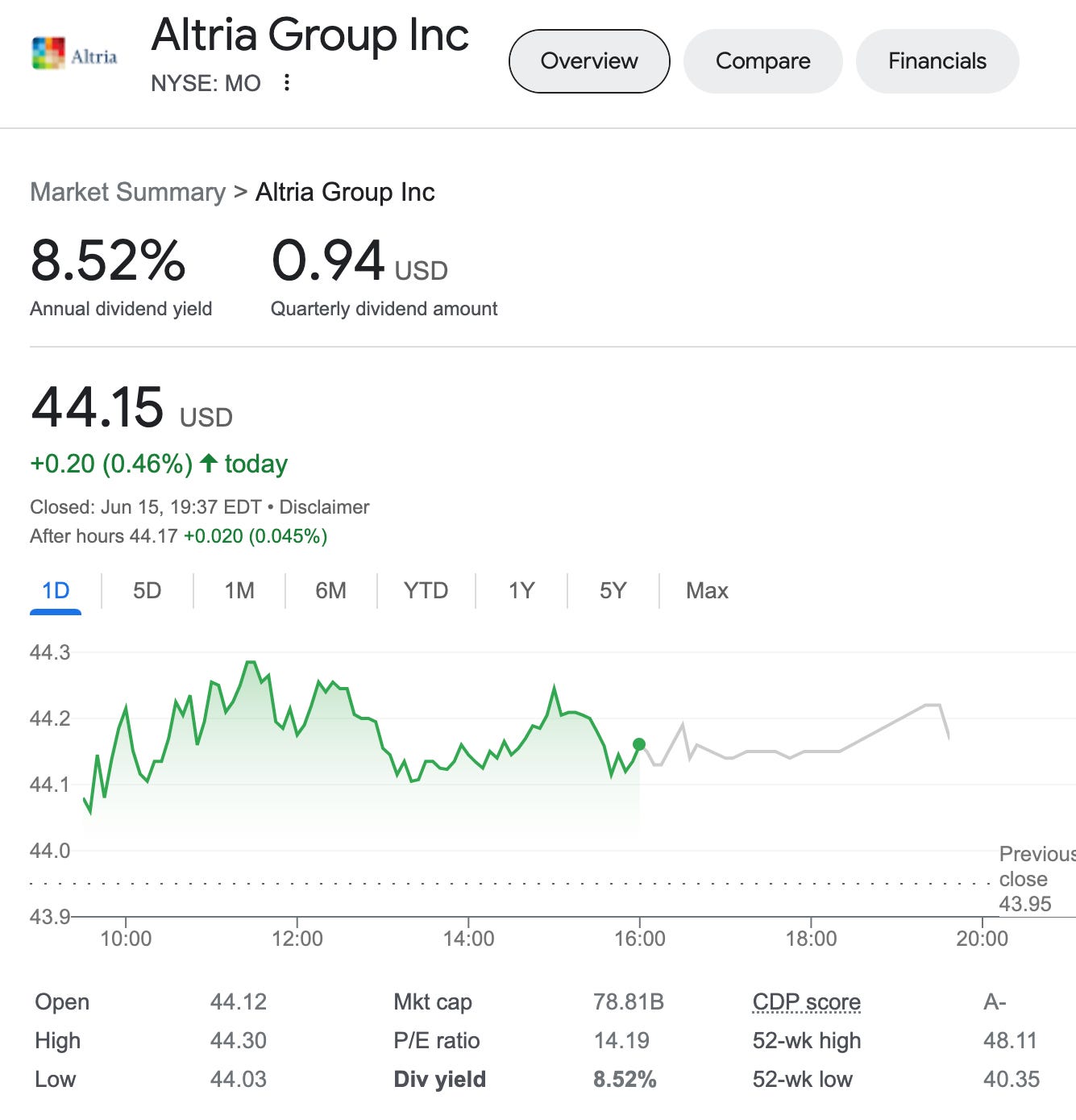

On June 15, 2023, I sold 1 bull put spread on Altria Group stock (NYSE:MO) with strike prices at $44 and $40 with expiry on July 14, 2023. For this trade setup, I was rewarded with $43.6 (after commissions).

Altria Group, Inc. is an American corporation and one of the world's largest producers and marketers of tobacco, cigarettes and related products. It operates worldwide and is headquartered in Henrico County, Virginia, just outside the city of Richmond.

From the premium received, I bought 1 share of MO stock itself. 99 to go, before I will be able to establish covered call options for this position. Additionally, MO is a dividend-paying stock, with a yield above 8%.

One share will boost my dividend stock portfolio by $3.76. Awesome.

When setting up this trade I was looking for more aggressive, near the money, strike prices, as I’m actually ready for the stock assignment at $44.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 MO JULY 14 '23 44 Put Option 0.49 USD

BOT 1 MO JULY 14 '23 40 Put Option 0.05 USD

What happens next?

On the expiry date, July 14, 2023, MO is trading above $44 per share - options expire worthlessly and I keep premium - if MO trades under $40 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $4,400

In case the stock falls under $40, I have protection.

As I already have collected a premium of $0.43 per share, my break-even price for this trade is $44-$0.43 = $43.57

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 3 trades since June 15, 2023

Options premium: $43