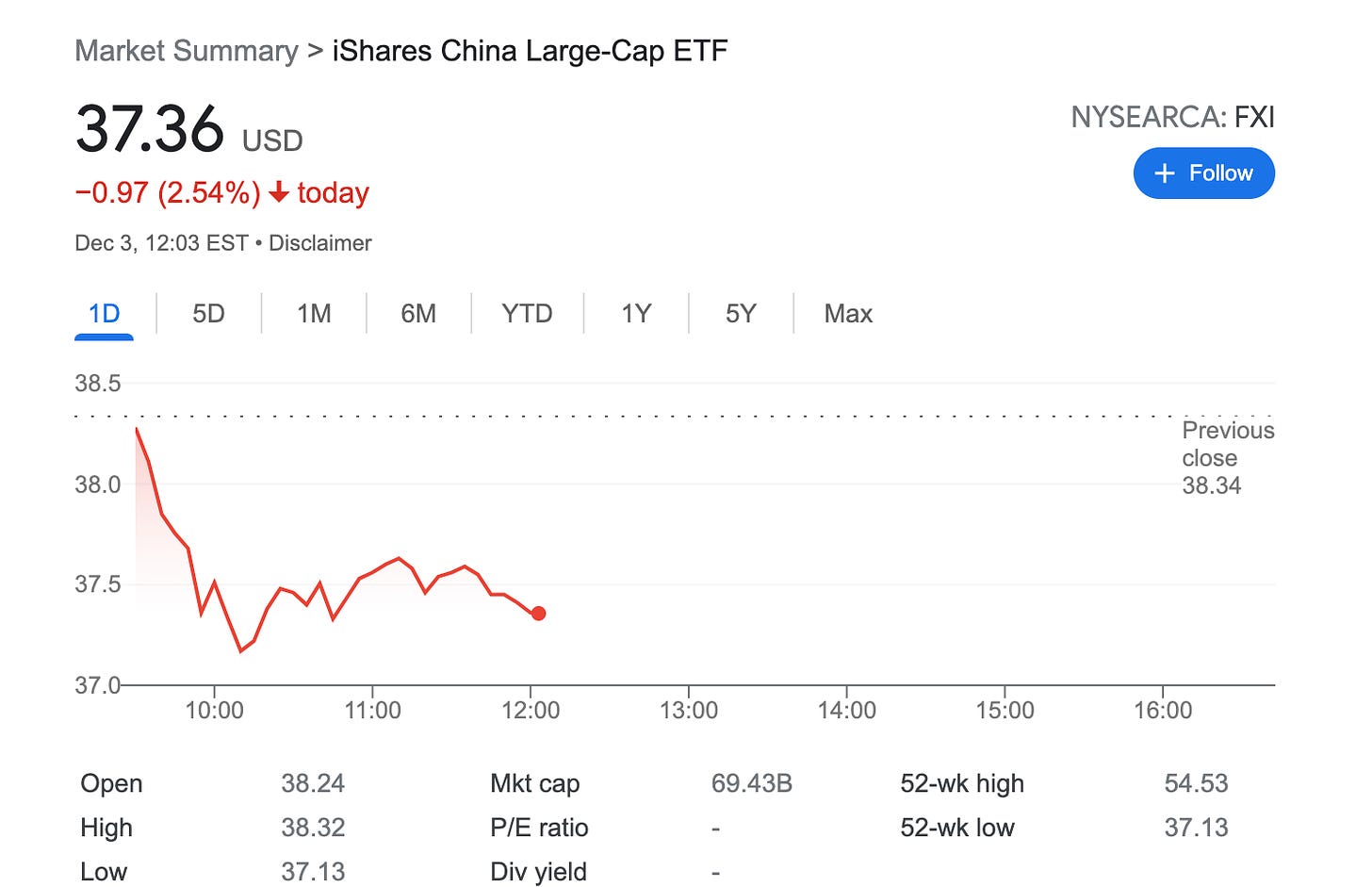

Sold 1 Call Option on FXI ETF – 0.32% potential income return in 7 days

On December 3, 2021, I sold 1 call option on FXI ETF with a strike price of $39 and expiry on December 10. I don't have actually 100 shares to deliver if challenged.

In case of danger, I will roll up and forward this call option.

FXI or the iShares China Large-Cap ETF seeks to track the investment results of an index composed of large-capitalization Chinese equities that trade on the Hong Kong Stock Exchange.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

here is the trade setup:

SLD 1 FXI DEC 10 '21 39 Call Option 0.15 USD

What happens next?

On the expiry date, December 10, 2021, FXI is trading under $39 per share - options expire worthlessly and I keep premium - if FXI trades above $39 I'm troubled as I need to deliver shares I don’t have, to avoid such scenario I will try to roll up strike prices

Break-even price: $39+$0.12= $39.12