Sold 1 Credit Spread on INTC – 0.8% potential income return in 25 days

On January 31, 2022, I sold 1 bull put credit spread on NASDAQ: INTC stock with an expiry set in the next 25 days. For this trade, I got a premium of $36.20 (after commissions)

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Intel supplies microprocessors for computer system manufacturers such as Acer, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors, and other devices related to communications and computing.

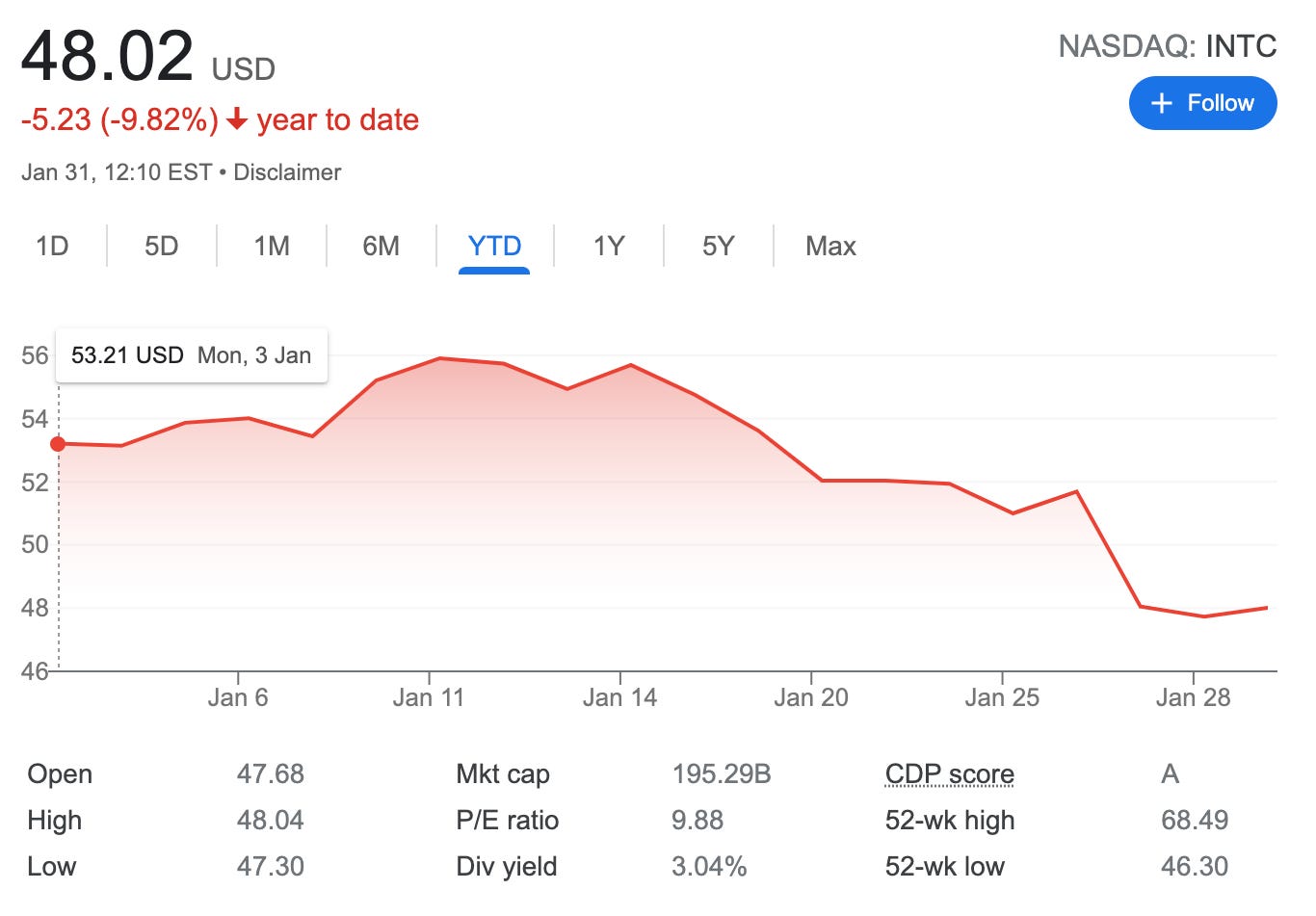

YTD Intel stock is down by almost 10%, which seems like a good entry point, as long it doesn’t keep falling even more.

INTC stock is a stock I’m holding in our dividend income portfolio and is a stock I wouldn’t mind having more.

Here is the trade setup:

SLD 1 INTC Feb25'22 45 PUT 0.92 USD

BOT 1 INTC Feb25'22 43 PUT 0.51 USD

For this credit spread, I got a credit of 36.2 USD (after commissions) or a 0.8% potential income return in 25 days, if options expire worthlessly

What happens next?

On the expiry date, February 25, 2022, INTC is trading above $45 per share - options expire worthlessly and I keep premium - if INTC trades under $45 on the expiry date, I risk getting assigned 100 shares and will have to buy them for $4,500

Before possible assignment, I will try to roll out this trade for credit.

As I already have collected a premium of $0.36 per share, my break-even price for this trade then will be $45-$0.36 = $44.64

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Trade safe!