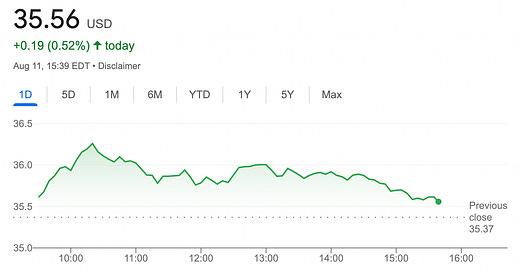

Sold 1 Credit Spread on INTC – 0.86% potential income return in 15 days

On August 11, 2022, I sold 1 bull put credit spread on INTC stock with an expiry set in the next 15 days. For this trade, I got a premium of $30.2 (after commissions)

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, in Silicon Valley

Why did I place this trade?

Intel has been one of my favorite tech stocks for the past few years. I like playing the options wheel and collecting dividend stock from it.

the current stock price seems like a potential buy entry signal, but I also have to admit that Intel might be losing the stem. To play safe I prefer entering trades using credit spreads.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Here is the trade setup:

BOT 1 INTC Aug26'22 33.5 PUT 0.20 USD

SLD 1 INTC Aug26'22 35 PUT 0.55 USD

For this trade, I got a premium of 30.2 USD (after commissions) or a 0.86% potential income return in 15 days, if options expire worthlessly

What happens next?

On the expiry date, August 26, 2022, INTC is trading above $35 per share - options expire worthlessly and I keep a premium - if INTC trades under $35 on the expiry date, I will get assigned 100 shares and will have to buy them for $3,500

But as I already have collected a premium of $0.30 per share, my break-even price for this trade then is $35-$0.3 = $34.7

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.