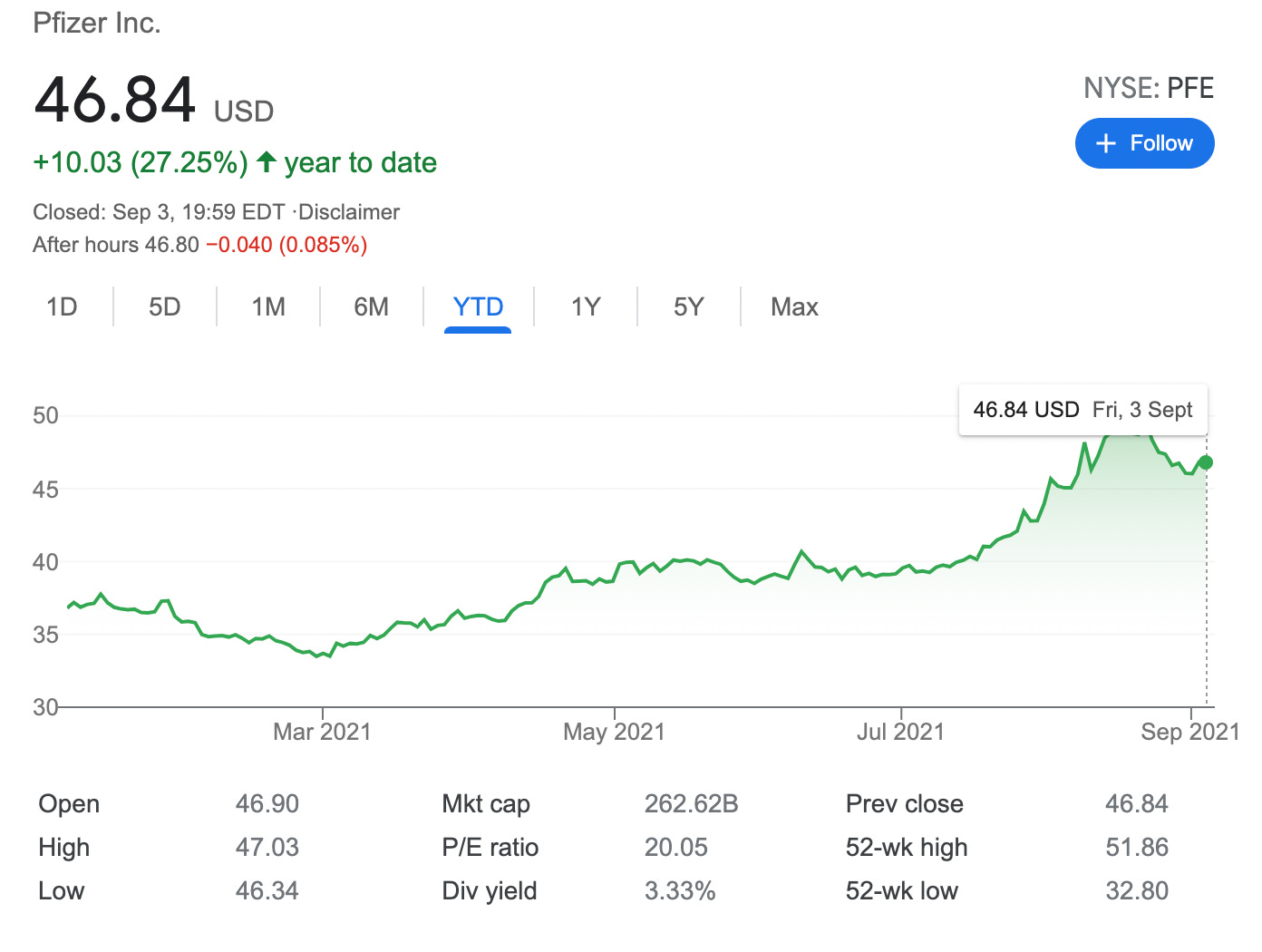

Sold 1 Credit Spread on PFE – 0.65% potential income return in 14 days

On September 03, 2021, I sold 1 bull put credit spread on PFE stock with an expiry set in the next 14 days. For this trade, I got a premium of $30.20 (after commissions)

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German immigrants, Charles Pfizer and his cousin Charles F. Erhart

These trades come as the #7 and #8 in the month of September, according to my trading plan for this month, the premium generated from this trade makes me about 3.02% of my $1,000 monthly goal. While in total I have reached already 18.7% so far. Awesome.

Here is the trade setup:

BOT 1 PFE SEP 17 '21 - 46 + 44 Put Bull Spread -0.35 USD

For this trade, I got a premium of 30.2 USD (after commissions) or a 0.65% potential income return in 14 days, if options expire worthlessly

What happens next?

On the expiry date, September 07, 2021, PFE is trading above $46 per share - options expire worthlessly and I keep premium - if PFE trades under $46 on the expiry date, I will get assigned 100 shares and will have to buy them for $4,600

But as I already have collected a premium of $0.3 per share, my break-even price for this trade then is $46-$0.3 = $45.7

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.