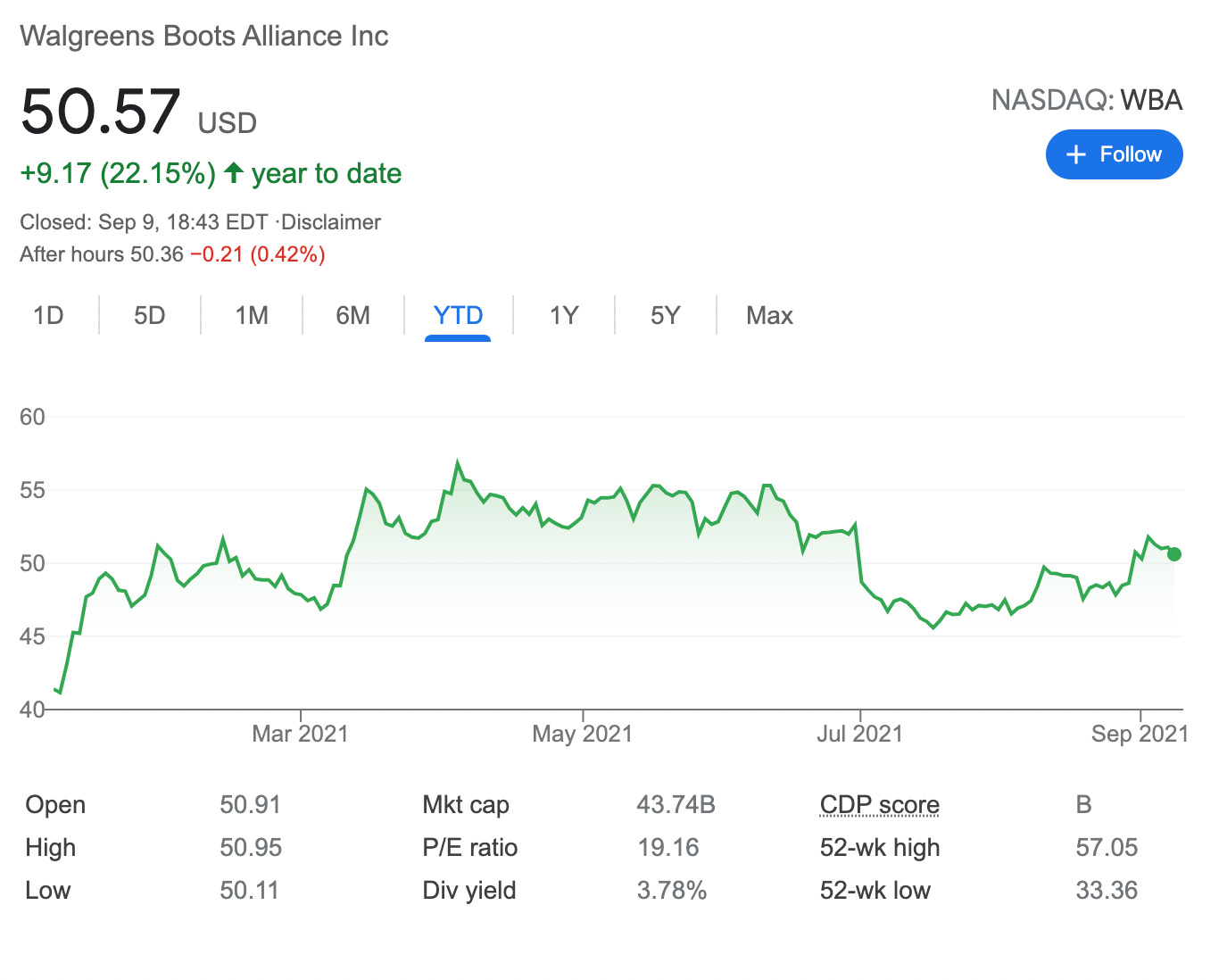

Sold 1 Credit Spread on WBA – 0.92% potential income return in 43 days

On September 09, 2021, I sold 1 bull put credit spread on WBA stock with an expiry set in the next 43 days. For this trade, I got a premium of $45.20 (after commissions)

Walgreens Boots Alliance, Inc. is a holding company headquartered in Deerfield, Illinois that owns the retail pharmacy chains Walgreens and Boots, as well as several pharmaceutical manufacturing, wholesale, and distribution companies

These trades come as the #16 and #17 in the month of September, according to my trading plan for this month, the premium generated from this trade makes me about 4.52% of my $1,000 monthly goal. While in total I have reached already 28.4% so far. Awesome.

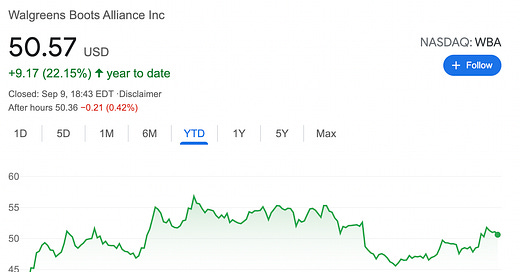

This stock is up by more than 20% YTD, and as WBA is part of my dividend stock portfolio, I actually wouldn't mind adding more shares at a better price to the portfolio

Here is the trade setup:

SLD 1 WBA OCT 22 '21 49 Put Option 1.13 USD

BOT 1 WBA OCT 22 '21 47 Put Option 0.63 USD

For this credit spread, I got a credit of 45.2 USD (after commissions) or a 0.92% potential income return in 43 days, if options expire worthlessly

What happens next?

On the expiry date, October 22, 2021, WBA is trading above $49 per share - options expire worthlessly and I keep premium - if WBA trades under $49 on the expiry date, I will get assigned 100 shares and will have to buy them for $4,900

But as I already have collected a premium of $0.45 per share, my break-even price for this trade then will be $49-$0.45 = $48.55

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls