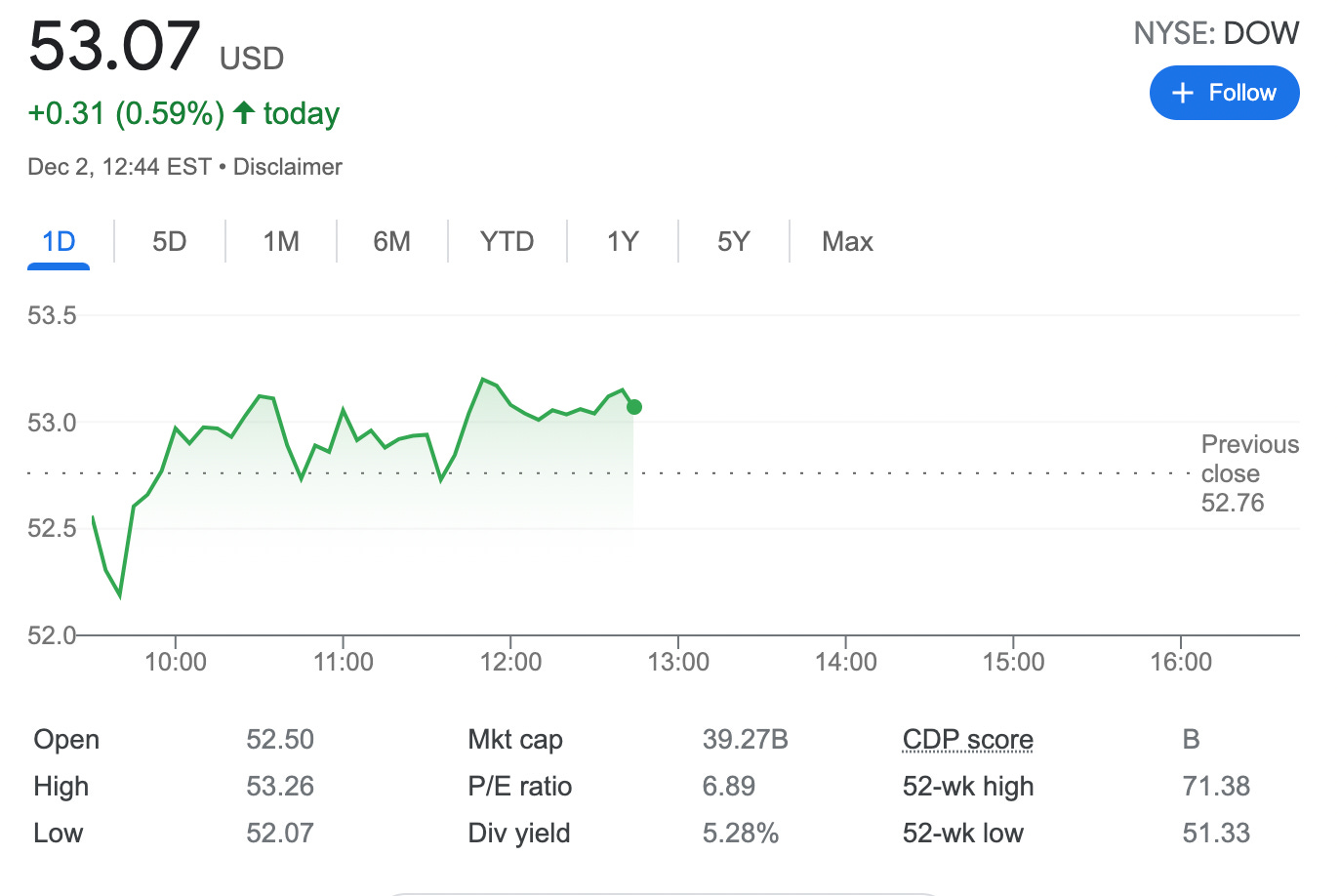

Sold 1 Put Bull Ratio Back Spread on DOW

On December 02, 2021, I sold 1 bull put ratio back spread option on DOW inc stock with an expiry set in the next 36 days on January 07, 2022. For this trade, I paid a debit of $131.2 (after commissions)

As I'm actually holding 100 shares with DOW inc stock - I decided to establish this ratio back spread as protection from further drop and also to free up some margin.

The Put Ratio Back Spread is a 3 leg option strategy as it involves buying two OTM Put options and selling one ITM Put option. This is the classic 2:1 combo.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Here is the trade setup:

SLD 1 DOW JAN 07 '22 52 Put Option 2.12 USD

BOT 2 DOW JAN 07 '22 51 Put Option 1.675

For this trade, I paid a debit of 131.2 USD (after commissions) or a 2.52% premium, if options expire worthlessly

What happens next?

On the expiry date, January 07, 2022, DOW is trading above $52 per share - options expire worthlessly and I lose the premium I paid - if DOW trades under $52 on the expiry date, I risk getting assigned 100 shares and buying them for $5,200

As I already hold 100 shares with Dow and my average buy price is $5,850 in case of assignment I will hold 200 shares with an average buy price of $55.25

In case DOW will drop below our second bought strike prices at $51, we will earn additional income. The more it will drop, the more we will earn.

In case of an assignment, I will turn this trade into a wheel, but prior to the assignment I will try to roll out this trade

Break-Even: $49.68