Sold 1 Put Option on Amazon stock – 0.27% potential income return in 9 days

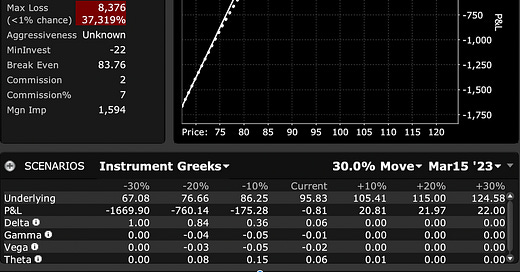

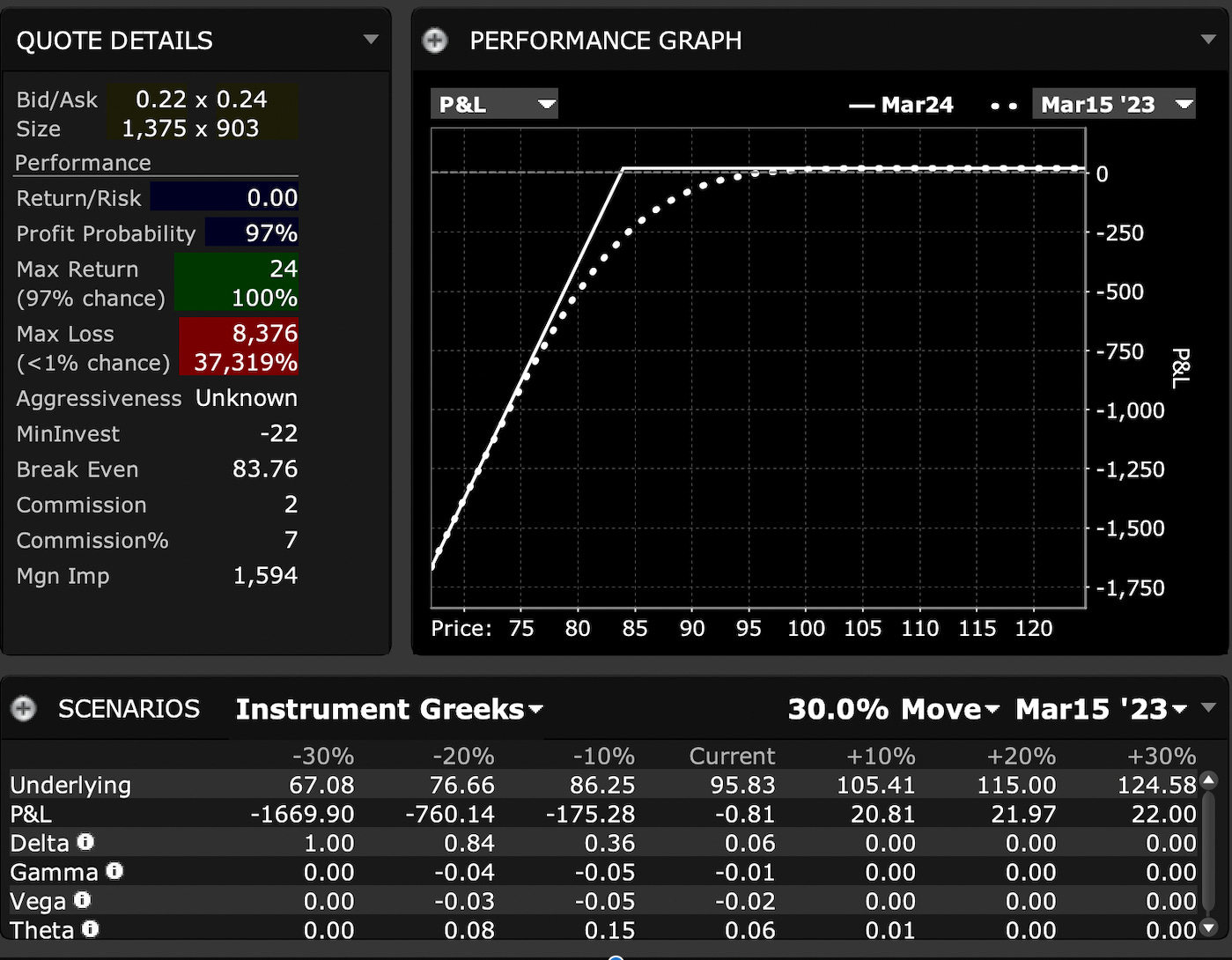

On March 15th, 2023, I sold 1 put option on Amazon stock with a strike price of $84 and expiry on March 24, 2023). For this trade setup, I was rewarded with $23.47 (after commissions), which would yield about 0.27% return in 9 days if the put option will expire worthless.

When choosing the strike price for this trade I was looking for a very high-profit probability trade and chose a strike with Delta 0.03, giving about a 97% profit probability this trade will expire worthless.

Now, there is always a 3% risk that things could go South.

But I'm ready to take the assignment risk and turn this trade into a covered call

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Here is the trade setup:

SLD 1 AMZN MAR 24 '23 84 Put Option 0.24 USD

For this trade, I got a premium of 23.47 USD (after commissions) or about 0.27% potential income return in 9 days, if options expire worthlessly

What happens next?

On the expiry date, March 24, 2023, AMZN is trading above $84 per share - options expire worthlessly and I keep premium - if AMZN trades under $84 on the expiry date, I risk getting assigned 100 shares, and will have to buy them paying $8,400

But as I already have collected a premium of $0.23 per share, my break-even price for this trade is $84-$0.23 = $83.77

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment.

In total: 7 trades since February 6, 2023

Options premium: $91