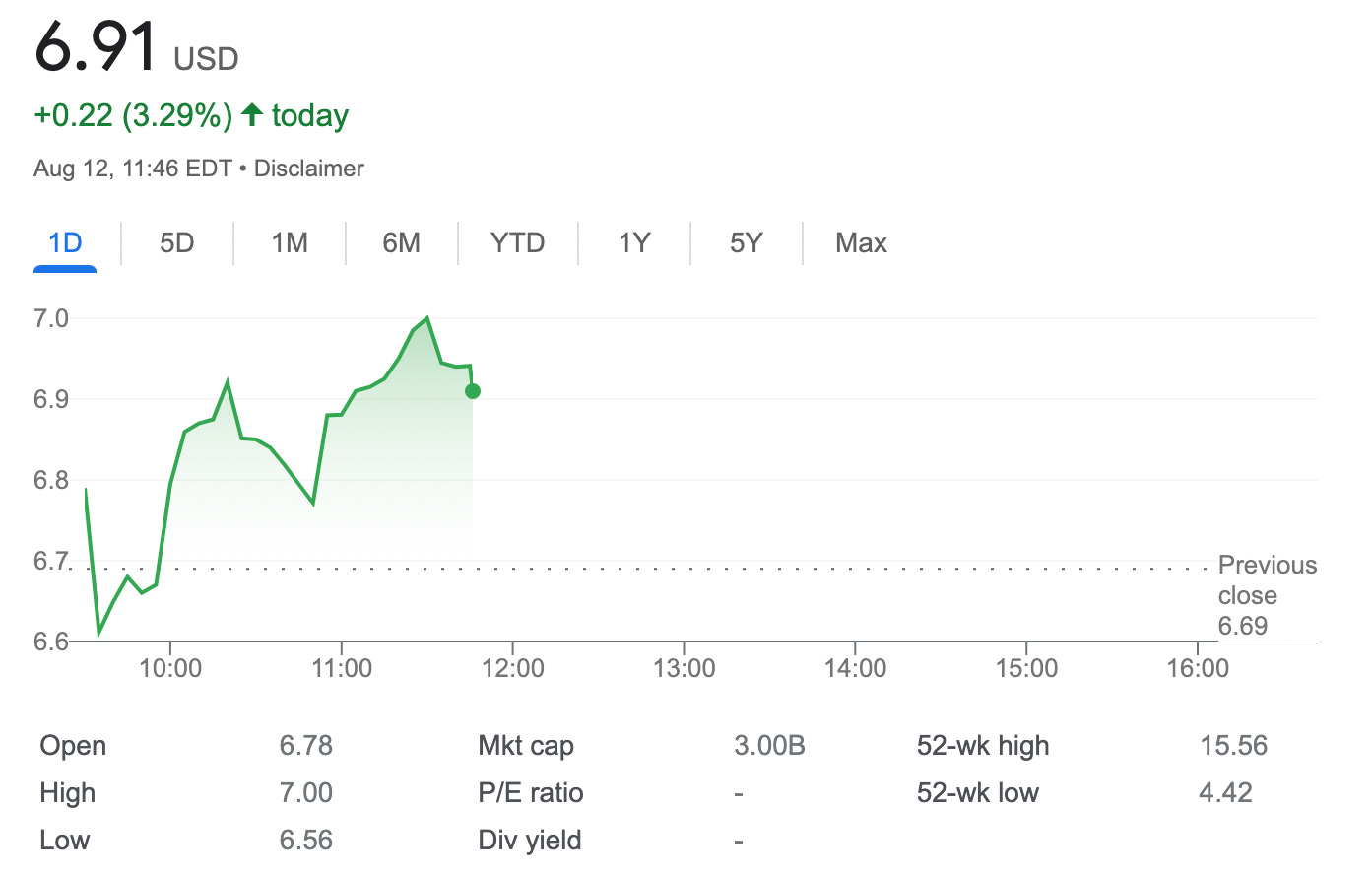

Sold 1 Put Option on NASDAQ:NKLA – 3.01% potential income return in 21 days

On August 12, 2022, I sold 1 put option on NASDAQ: NKLA stock with an expiry set in the next 21 days (September 02). For this trade, I got a premium of $16.6 (after commissions)

Nikola Corporation is an American manufacturer of heavy-duty commercial battery-electric vehicles, fuel-cell electric vehicles, and energy solutions. It presented several vehicle concepts from 2016 to 2020, the first of which was a natural gas fuelled turbine-electric semi-truck.

Why did I place this trade?

Stocks like NKLA are quite volatile and offer juicy premiums.

No earnings report until the expiry

The stock seems to be trading close to its bottom, and in case of an assignment it seems I might get out of the trade

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

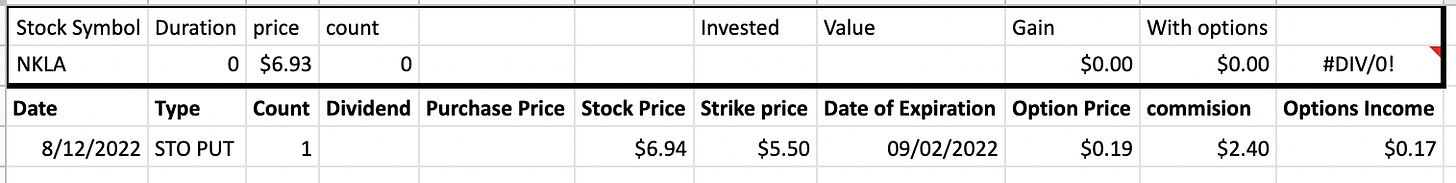

here is the trade setup:

SLD 1 NKLA NASDAQ.NMS Sep02'22 5.5 PUT 0.19 USD

For this put option, I got a credit of 16.6 USD (after commissions) or about 3.01% potential income return in 21 days, if options expire worthlessly

What happens next?

On the expiry date, September 02, 2022, NKLA is trading above $5.5 per share - options expire worthlessly and I keep a premium - if NKLA trades under $5.5 on the expiry date, I will get assigned 100 shares, and will have to buy them paying $550

Break-even price: $5.5-0.16= $5.34

If the options contract is going to expire worthlessly I will proceed with another put option. In case of an assignment, I will happily start selling covered calls on this position.

Running Total 1 Trade since August 12, 2022

Options income: $17