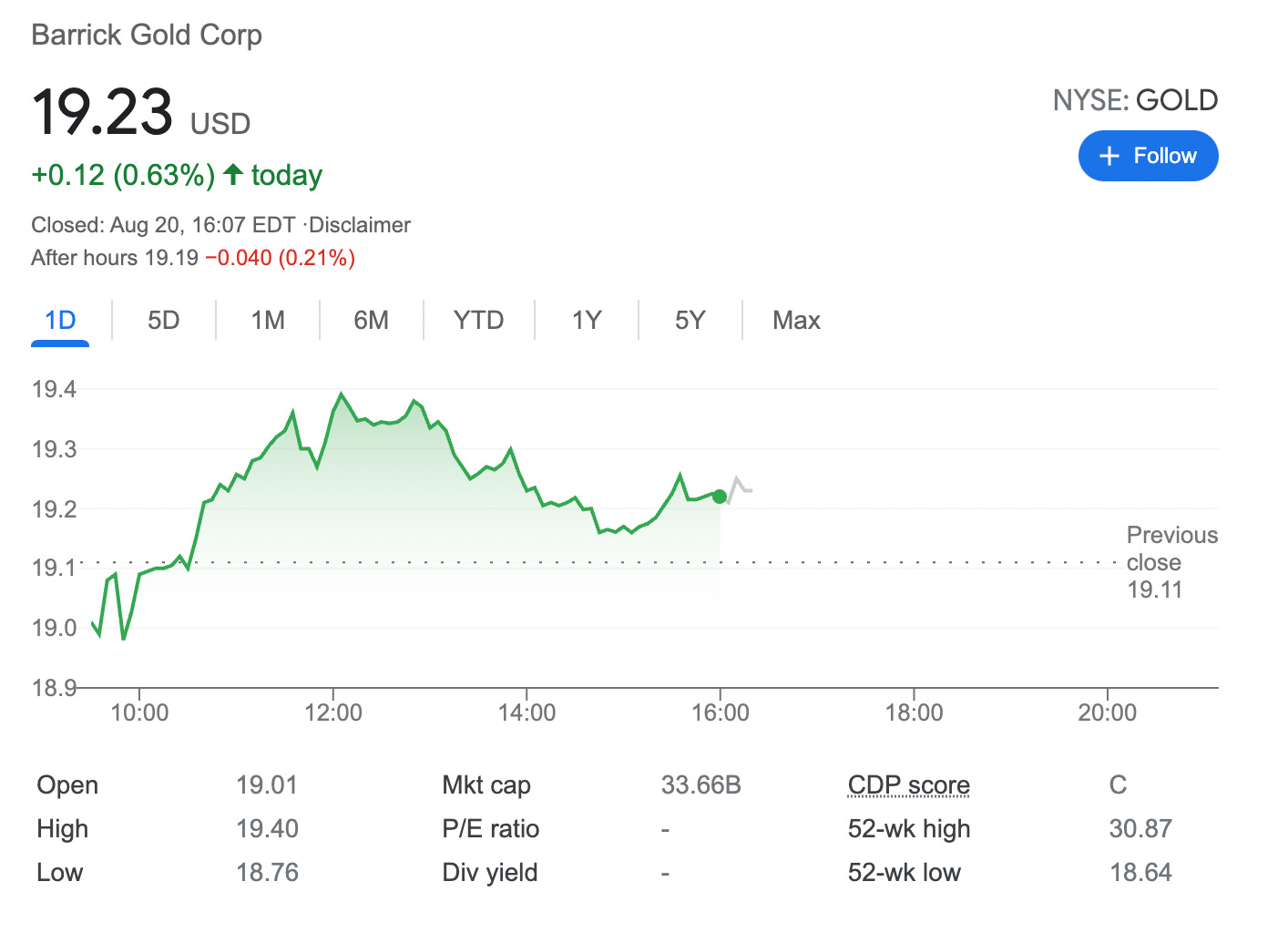

Sold 1 Put Option on NYSE:GOLD – 1.4% potential income return in 7 days

On August 20, 2021, I sold 1 put option on NYSE:GOLD stock with an expiry set in the next 7 days. For this trade, I got a premium of $26.6 (after commissions)

Barrick Gold Corporation is a mining company that produces gold and copper with 16 operating sites in 13 countries. It is headquartered in Toronto, Ontario, Canada.

This trade comes as the #23 in the month of August, according to my trading plan for this month, the premium generated from this trade makes me about 1.9% of my $1,400 monthly goal. While in total I have reached already 95.77% so far. Awesome.

Here is the trade setup:

SLD 1 GOLD AUG 27 '21 19 Put Option 0.29 USD

For this trade, I got a premium of 24.6 USD (after commissions) or a 1.4% potential income return in 7 days, if options expire worthlessly

What happens next?

On the expiry date, August 27, 2021, GOLD is trading above $19 per share - options expire worthlessly and I keep premium - if GOLD trades under $19 on the expiry date, I will get assigned 100 shares and will have to buy them for $1,900

But as I already have collected a premium of $0.26 per share, my break-even price for this trade then is $19-$0.26 = $18.74

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.