Sold 1 Put Option on XOM – 0.96% potential income return in 8 days

On August 12, 2021, I sold 1 put option on XOM stock with an expiry set in the next 8 days. For this trade, I got a premium of $54.6 (after commissions)

Exxon Mobil Corporation, stylized as ExxonMobil, is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil, and was formed on November 30, 1999, by the merger of Exxon and Mobil.

This trade comes as the #6 in the month of August, according to my trading plan for this month, the premium generated from this trade makes me about 3.9% of my $1,400 monthly goal. While in total I have reached already 62.44% so far. Awesome.

Here I made a quick YouTube video, explaining this trade

Here is the trade setup:

SLD 1 XOM AUG 20 '21 56.5 Put Option 0.57 USD

For this trade, I got a premium of 54.6 USD (after commissions) or a 0.96% potential income return in 8 days, if options expire worthlessly

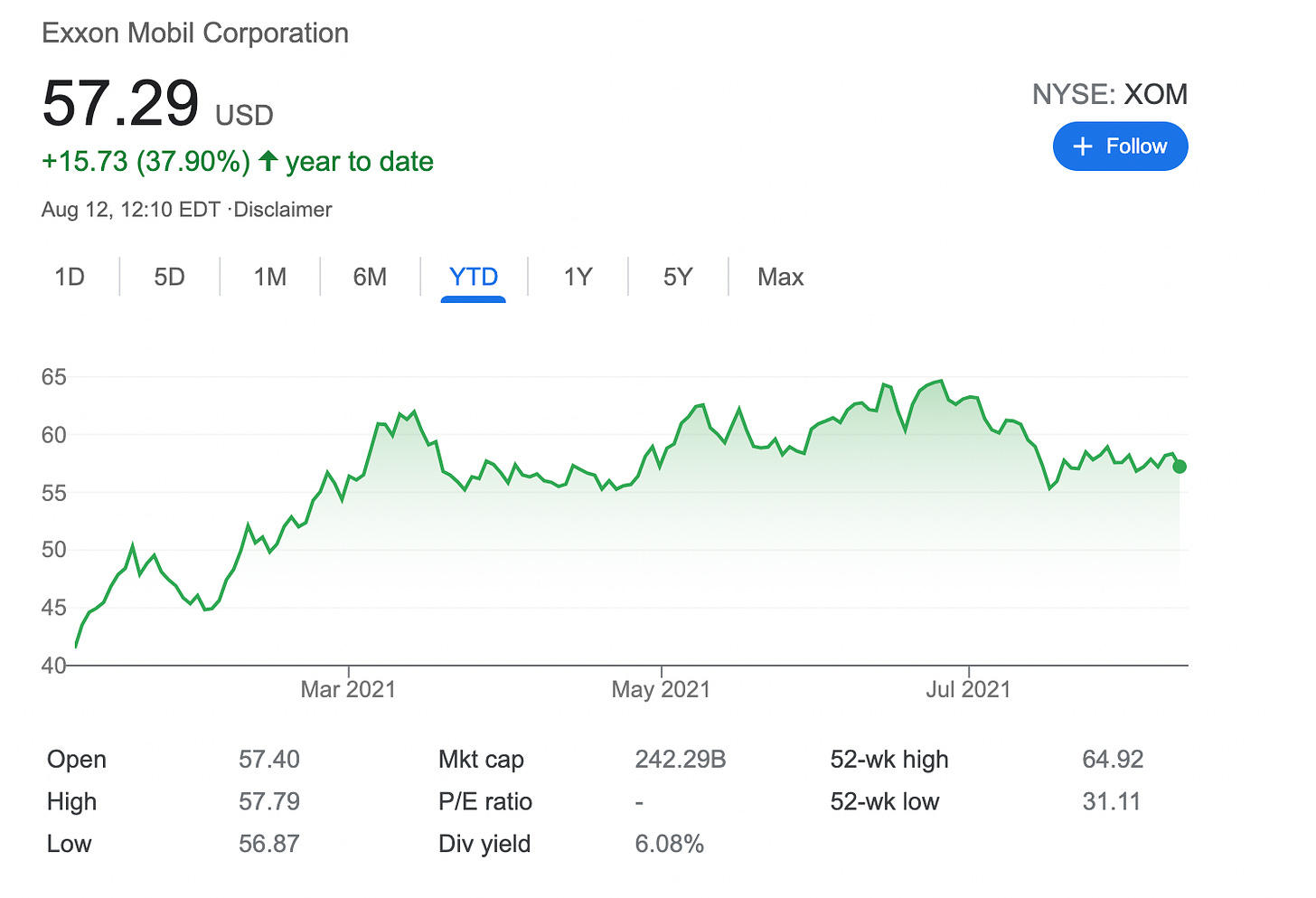

YTD XOM is up by some 37%, the future looks promising.

What happens next?

On the expiry date, August 20, 2021, XOM is trading above $56.5 per share - options expire worthlessly and I keep premium - if XOM trades under $56.5 on the expiry date, I will get assigned 100 shares and will have to buy them for $5,650

But as I already have collected a premium of $0.54 per share, my break-even price for this trade then is $56.5-$0.54 = $55.96

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

From the premium received I bought 6 shares with NRZ stock. This purchase will contribute to my dividend portfolio on average an additional $0.34 every month. Not the biggest addition, but every bit counts.

This is what I plan to do by the end of this year - reinvesting most of the premiums received into dividend-paying stocks, for this year my goal is to reach at least $65 in projected monthly income.