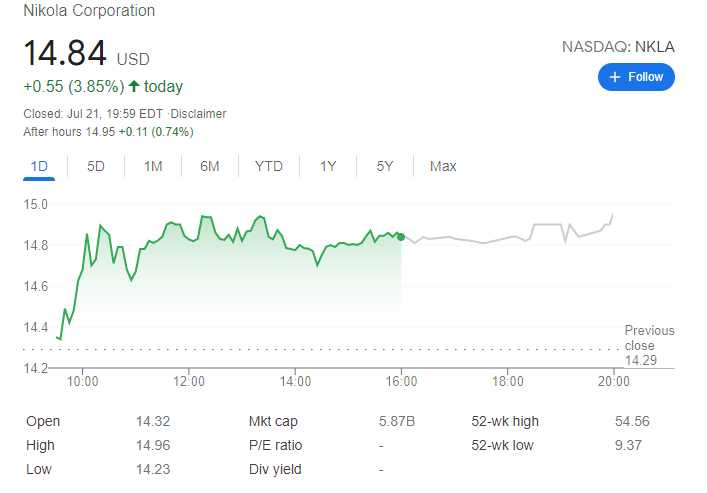

Sold 5 Credit Spreads on NKLA – 3.7% potential income return in 30 days

On July 21, 2021, I sold 5 bull put credit spreads on NKLA stock with an expiry set in the next 30 days. For this trade, I got a premium of $243 (after commissions)

Nikola Corporation is an American company that has presented a number of zero-emission vehicle concepts since 2016. The company has stated on several occasions that it intends to take some of its concept vehicles into production in the future. Nikola Corporation is based in Phoenix, Arizona

These trades come as the #3 and #4 in the month of July, according to my trading plan for this month, the premium generated from this trade makes me about 12.15% from my $2,000 monthly goal. While in total I have reached already 21.1% so far. Awesome.

Here is the trade setup:

BOT 5 NKLA AUG 20 '21 - 13 + 11 Put Bull Spread -0.534 USD

For this trade, I got a premium of 243 USD (after commissions) or a 3.7% potential income return in 30 days, if options expire worthlessly

I entered this less aggressively, constructing strike prices further out of the money

What happens next?

On the expiry date, August 20, 2021, NKLA is trading above $13 per share - options expire worthlessly and I keep premium - if NKLA trades under $13 on the expiry date, I will get assigned 500 shares

But as I already have collected a premium of $0.48 per share, my break-even price for this trade then is $13-$0.48 = $12.52

In case of assignment, will turn this trade into a wheel strategy and will start selling covered calls.

From the premium received I bought 37 shares with AWP stock. This purchase will contribute to my dividend portfolio about $1.23 every month. Awesome