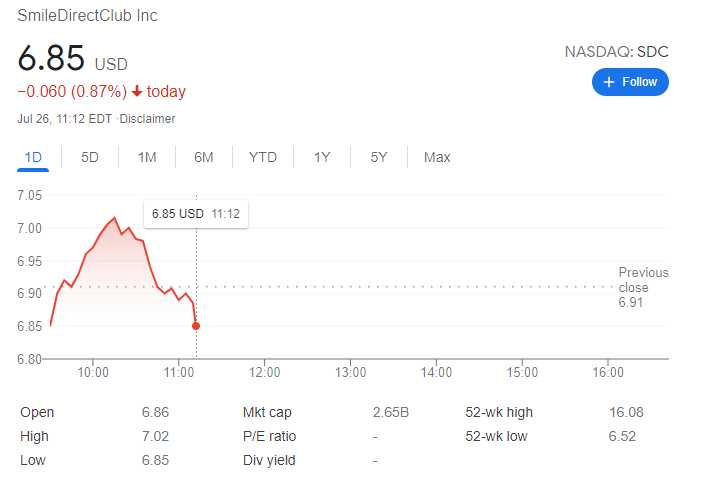

Sold 5 Credit Spreads on SDC – 5.12% potential income return in 39 days

On July 26, 2021, I sold 5 bull put credit spreads on SDC stock with an expiry set in the next 39 days. For this trade, I got a premium of $186 (after commissions)

SmileDirectClub is a teledentistry company. The company was co-founded in 2014 by Jordan Katzman and Alex Fenkell. It is based in Nashville, Tennessee

These trades come as the #7 and #8 in the month of July, according to my trading plan for this month, the premium generated from this trade makes me about 9.3% from my $2,000 monthly goal. While in total I have reached already42.85% so far. Awesome.

Here is the trade setup:

BOT 5 SDC SEP 03 '21 - 6.5 + 5 Put Bull Spread-0.42 USD

For this trade, I got a premium of 186 USD (after commissions) or a 5.12% potential income return in 39 days, if options expire worthlessly

I entered this trade quite aggressively, constructing strike prices near the money, will se was it a smart move.

What happens next?

On the expiry date, September 03, 2021, SDC is trading above $6.5 per share - options expire worthlessly and I keep premium - if SDC trades under $6.5 on the expiry date, I will get assigned 500 shares and will have to buy them for $3,250

But as I already have collected a premium of $0.37 per share, my break-even price for this trade then is $6.5-$0.37 = $6.13

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls.

From the premium received I bought 10 shares with ARCC stock. This purchase will contribute to my dividend portfolio on average $1.13 a month. Awesome