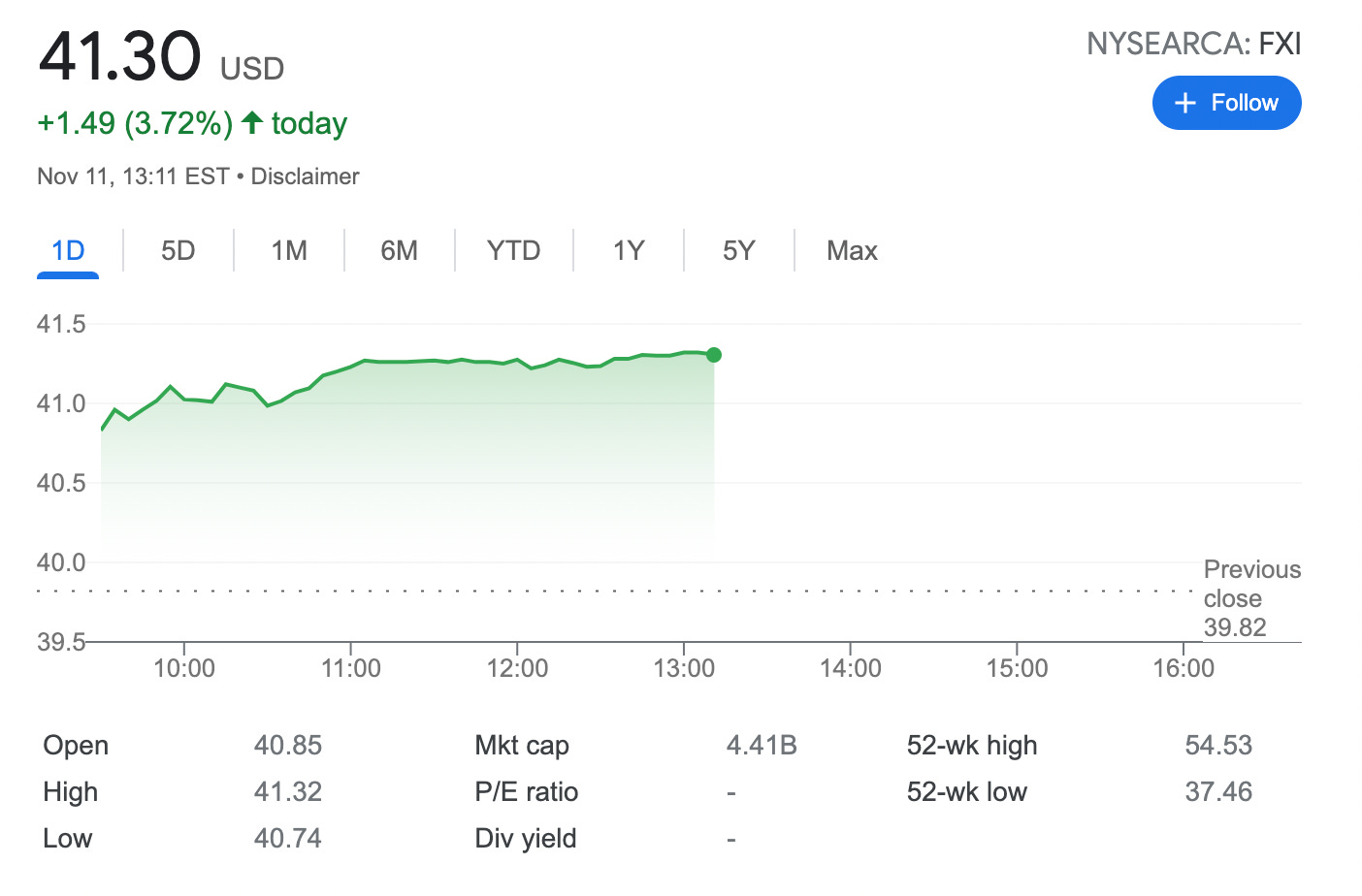

Trade Adjustment: Roll Forward and Down FXI Put Option +1.66% potential income return in 44 days

On November 11, 2021, I rolled forward and down a put option on the FXI ETF I originally established at the end of October, see: Sold 1 Credit Spread on China FXI ETF – 1.21% potential income return in 22 days

As the expiry date approached and FXI was in the money, and not wanting yet to turn this trade into a covered call, I decided to roll it out and avoid the assignment.

Here is the trade setup:

BOT 1 FXI NOV 12 '21 42 Put Option 1.04 USD

SLD 1 FXI DEC 03 '21 41.5 Put Option 1.26 USD

Here I bought back the $42 strike put option paying $104 and sold a new put option with a lower strike price ($41.5) and with an expiry set 22 days later. For this trade, I got $1w6 (before commissions)

I lowered the strike prices from $42 to $41.5

What happens next?

On the expiry date, December 03, 2021, FXI is trading above $41.5 per share - options expire worthlessly and I keep premium - if FXI trades under $41.5 on the expiry date, I will get assigned 100 shares

New break-even price $41.5-$0.69 = $40.81

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls on this CHINA ETF