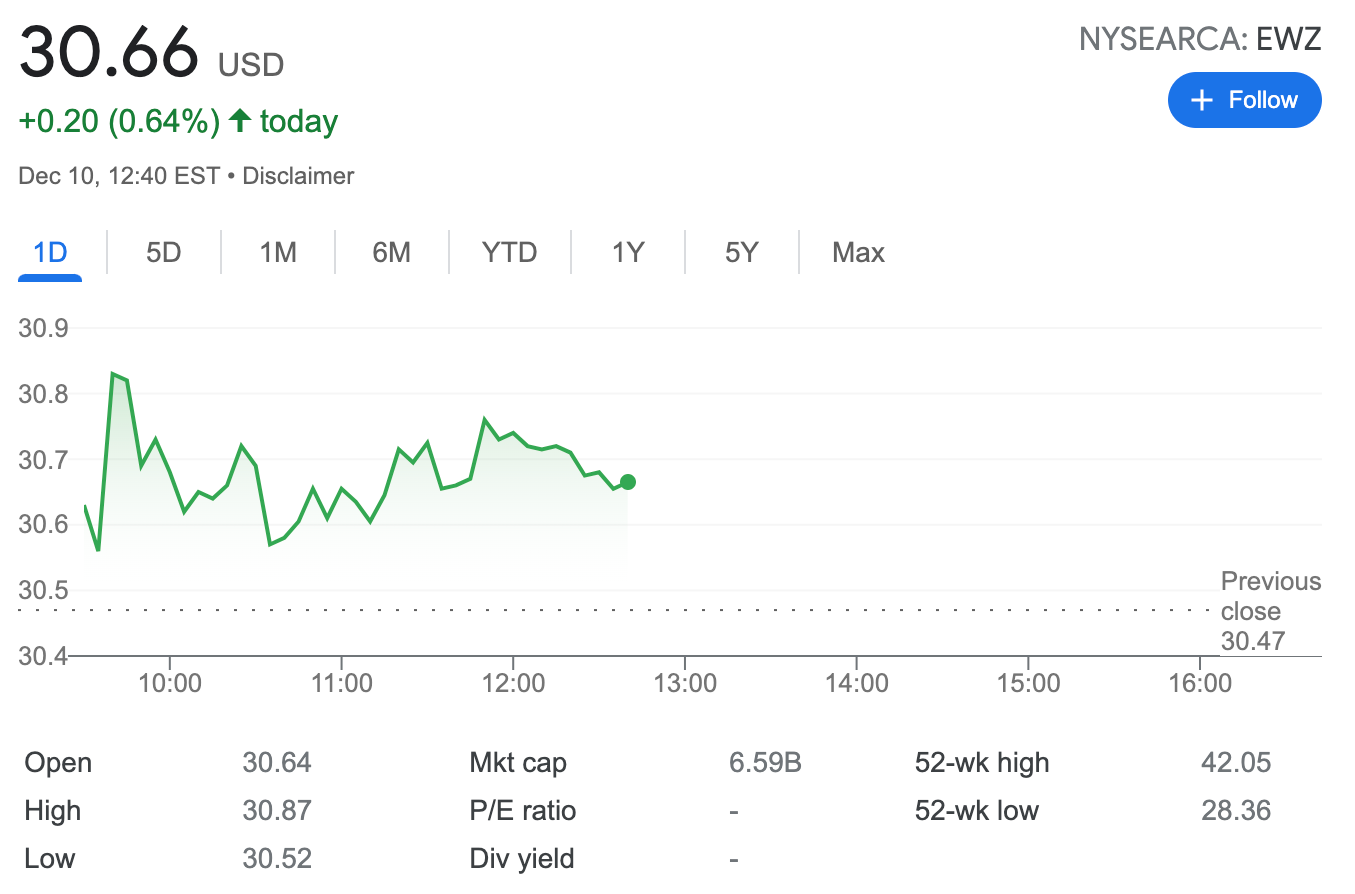

Trade Adjustment: Roll Forward and Down EWZ Put Option +7.17% potential income return in 165 days

On December 10, 2021, I rolled forward and down a put option on the EWZ ETF I originally established at the end of September. This is already the sixth time I'm rolling this trade out.

EWZ ETF is going ex-div on December 13, paying a heft $1.77 per share, to avoid a significant price drop after the ex-div date, I decided to roll out this trade bit early, still some 3 weeks before the options expiry.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Here is the trade setup:

Keep reading with a 7-day free trial

Subscribe to OptionsBrew.com to keep reading this post and get 7 days of free access to the full post archives.