Trade Adjustment: Rolled Forward and Down 1 Put Option on NASDAQ:NKLA – 5% potential income return in 49 days

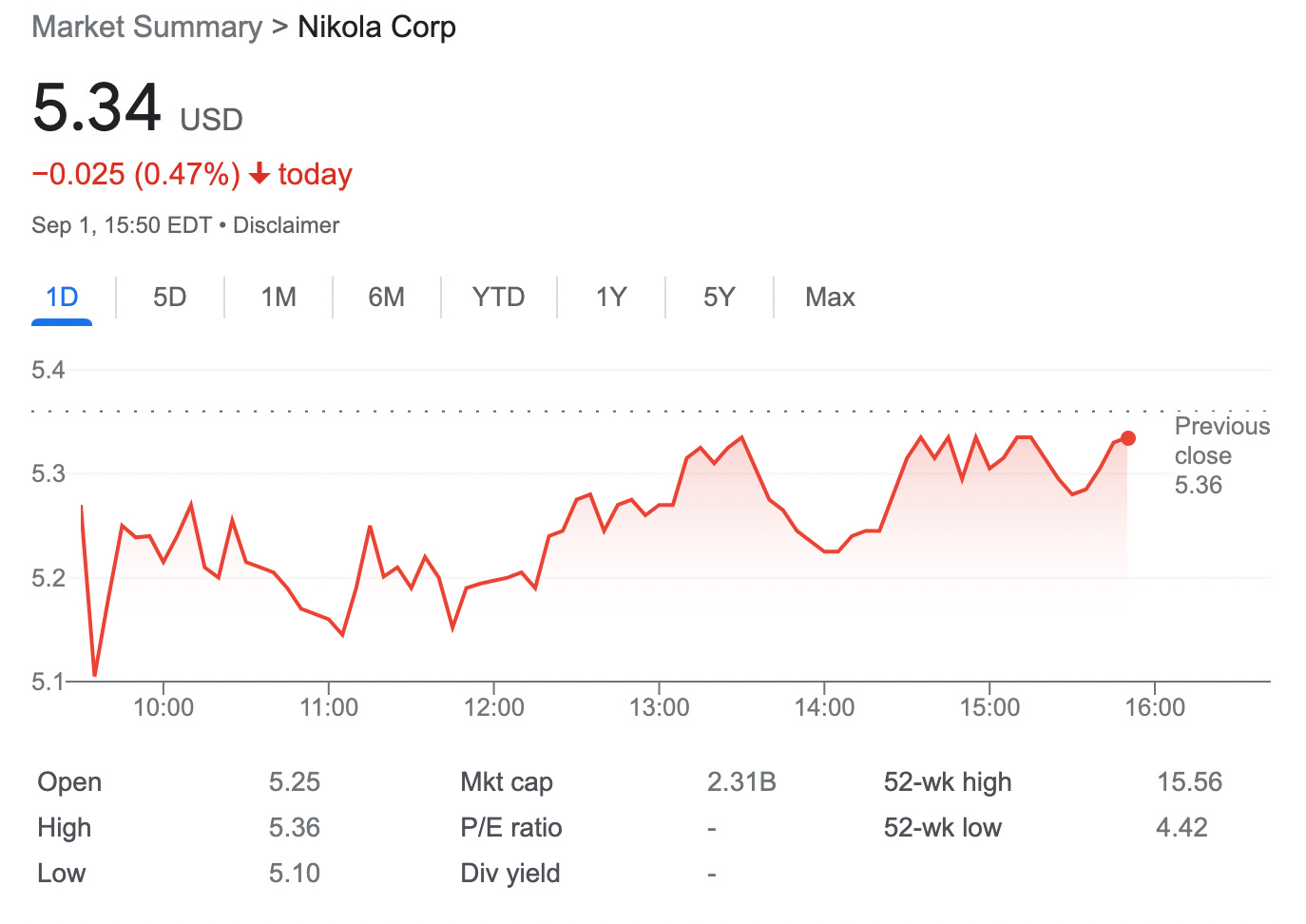

On September 1, 2022, I rolled forward and rolled down 1 put option on NASDAQ: NKLA stock with an expiry set in the next 29 days (September 30). With this trade adjustment, I lowered the strike price from $5.5 to $5 and made a small premium of $8 (after commissions)

I opened this trade back on August 12

With NKLA price falling under my strike price I decided to avoid the assignment and roll for a credit.

This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Nikola Corporation is an American manufacturer of heavy-duty commercial battery-electric vehicles, fuel-cell electric vehicles, and energy solutions. It presented several vehicle concepts from 2016 to 2020, the first of which was a natural gas fuelled turbine-electric semi-truck

here is the trade setup:

BOT 1 NKLA Sep02'22 5.5 PUT 0.35 USD

SLD 1 NKLA Sep30'22 5 PUT 0.48 USD

For this option, I got an additional credit of 8 USD (after commissions) and increased potential income return to 5% in 49 days, if options expire worthlessly

What happens next?

Keep reading with a 7-day free trial

Subscribe to OptionsBrew.com to keep reading this post and get 7 days of free access to the full post archives.