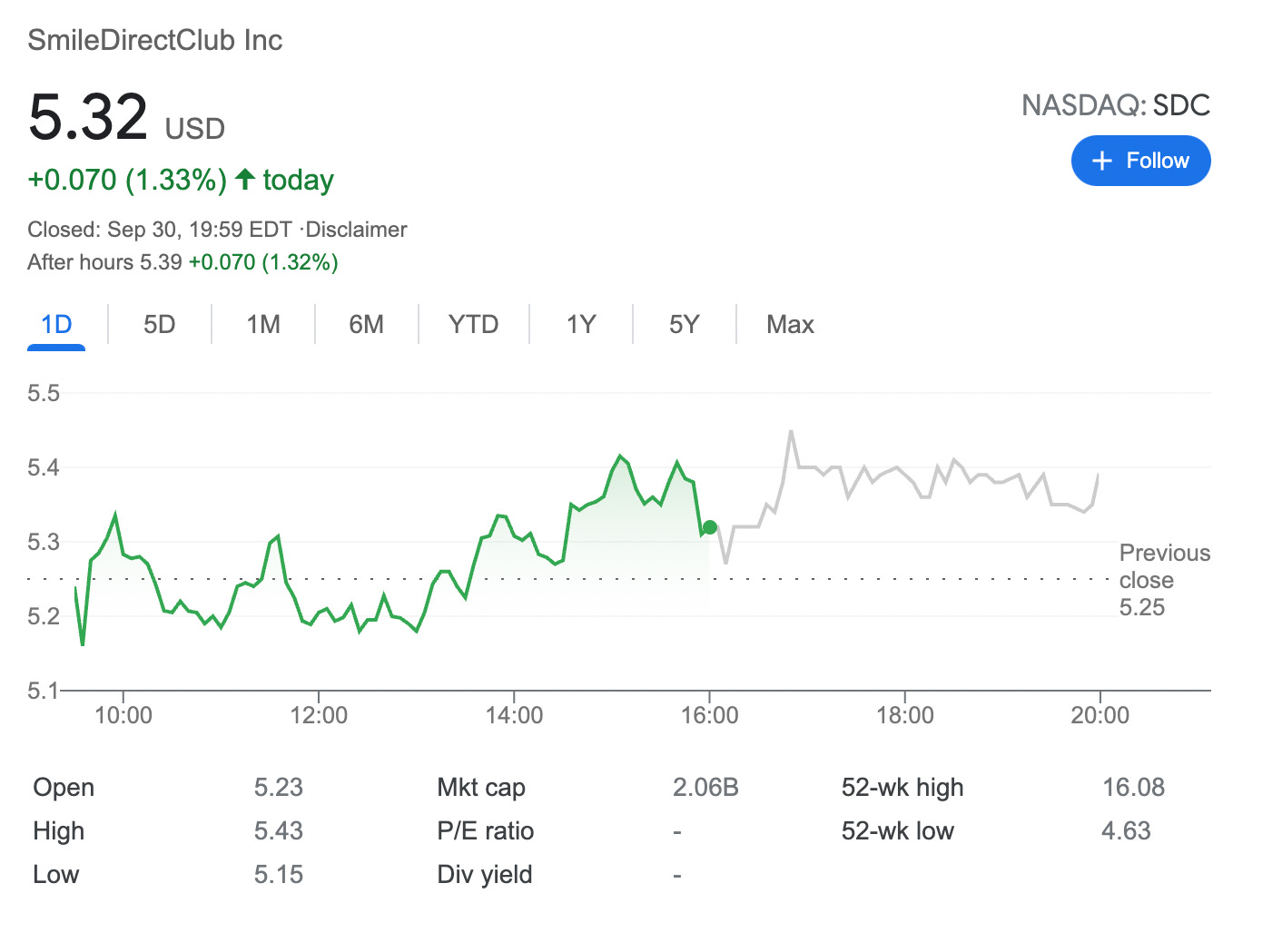

Trade Alert: Roll Forward and Down 2 Credit Spreads on SDC +1.24% potential income return in 64 days

On September 30, 2021, I decided to roll forward, roll down and decrease the contract size for a credit spread I established on SDC stock in the middle of September

Disclosure: This is not trading advice. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

SmileDirectClub is a teledentistry company. The company was co-founded in 2014 by Jordan Katzman and Alex Fenkell. It is based in Nashville, Tennessee

As the expiry date approached and my strike prices on SDC were in the money. Not wanting yet to turn this trade into a covered call, I decided to roll it out and decrease the total contract size from 4 to 2, yet still getting some credit.

I've been trading SDC stock with mixed success since April 2020, have seen both ups and downs. Volatile stock means a juicier premium and also more risk. Credit spreads give protection.

Here is the trade setup:

BOT 4 SDC OCT 01 '21 5.5 Put Option 0.34 USD

SLD 2 SDC NOV 19 '21 5 Put Option 0.69 USD

BOT 2 SDC NOV 19 '21 4 Put Option 0.24 USD

I bought back 4 out options with a strike price of $5.5 and sold 2 new credit spreads with strike prices of $5 and $4.

For this trade setup, I got a credit of 12.4 USD (after commissions) or a 1.24% potential income return in 64 days, if options expire worthlessly.

Not the best trade, but also not the worst-case scenario - turning a losing trade into a profitable one. well time of course will show, will I be able to close this trade with this small but profit.

What happens next?

On the expiry date, November 19, 2021, SDC is trading above $5 per share - options expire worthlessly and I keep premium - if SDC trades under $5 on the expiry date, I will get assigned 200 shares and will have to buy them for $1,000

But as I already have collected a premium of $0.06 per share, my break-even price for this trade then will be $5-$0.06 = $4.96

In case of assignment, I will turn this trade into a wheel strategy and will start selling covered calls