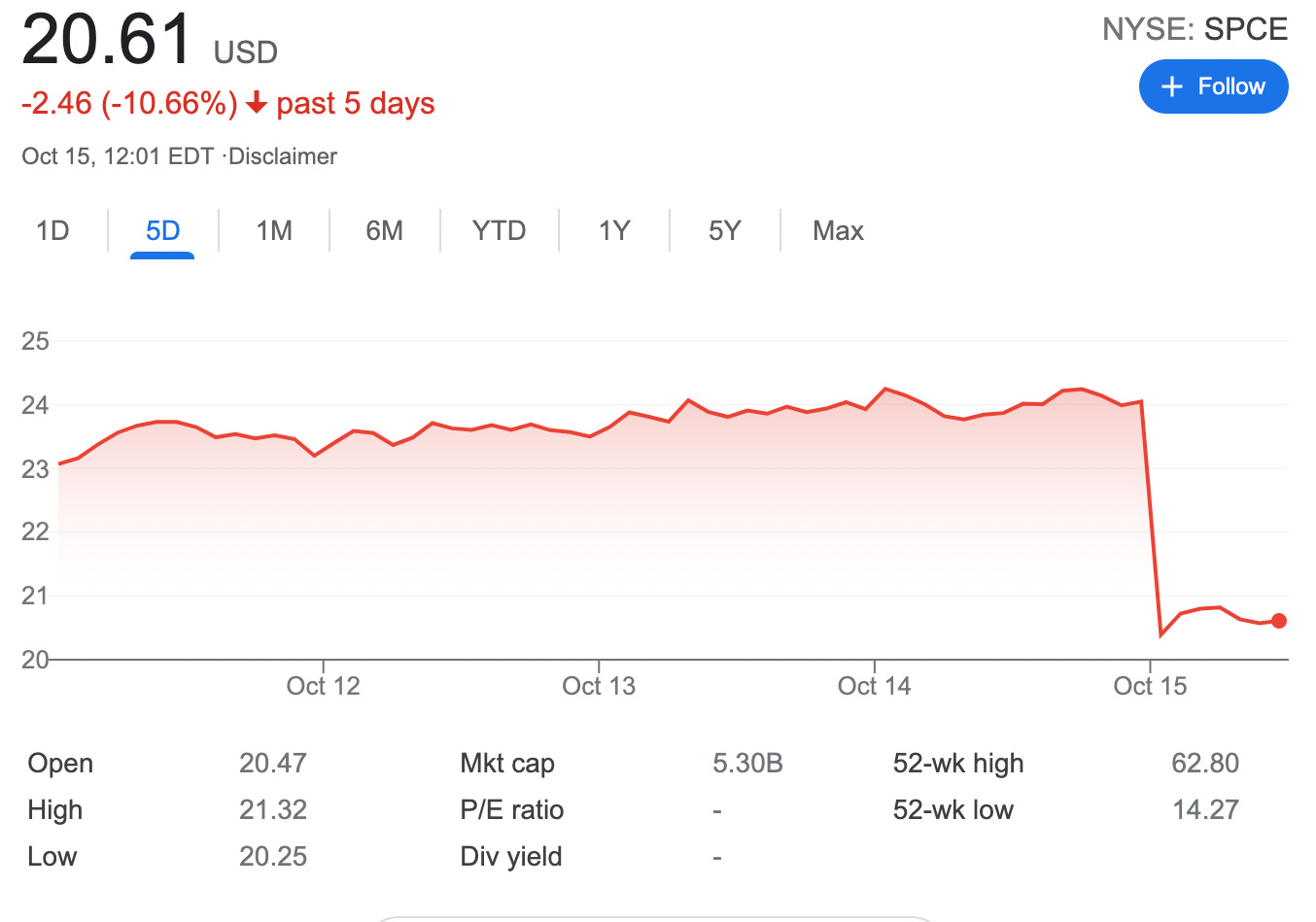

Trade Alert: Rolled SPCE Credit Spread to Put Option - 3.68% potential income in 52 days

On October 15, 2021, I rolled an SPCE credit spread into a put option.

Originally I entered this trade back at the end of August as a credit spread, see: Sold 1 Credit Spread on SPCE – 2.27% potential income return in 45 days

Virgin Galactic is an American spaceflight company founded by Richard Branson and his British Virgin Group retains an 18% stake through Virgin Investments Limited. It is headquartered in California, USA, and operates from New Mexico

The stock price dropped significantly after it was announced that the company will delay spaceflights to 2022.

Virgin Galactic stock plunges after company delays spaceflight tests to 2022

Here is the trade setup:

BOT 1 SPCE OCT 15 '21 22.5 Put Option 1.69 USD

SLD 1 SPCE OCT 22 '21 22.5 Put Option 1.98 USD

SLD 1 SPCE OCT 15 '21 20 Put Option 0.10 USD

Here I bought back the $22.5 put option with today’s expiry paying $169 and sold a new put option with the same strike price but with an expiry next Friday. For this trade, I got $198 (before commissions). As trade was established as a credit spread, I sold the 20 Put Option and got an additional $10.

What happens next?

On the expiry date, October 22, 2021, SPCE is trading above $22.5 per share - options expire worthlessly and I keep premium - if SPCE trades under $22.5 on the expiry date, I risk getting assigned 100 shares. Will try to roll out / roll down. But ready to take an assignment and start selling covered calls.

New break-even price $22.5-$0.83 = $21.67