Week #20 Ethereum Options Trading Results (-0.1542 ETH)

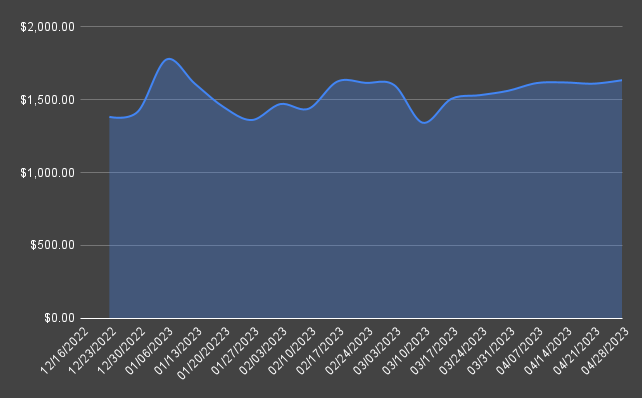

On Friday, April 28, 2023, 1 ETH traded at $1,905 while the total value of our Ethereum / EUR portfolio was worth $1,634.30, which is about 16.34% of my $10,000 goal.

Last week we also booked a -0.1552 ETH loss, which comes from the previously closed and rolled away options trades.

Despite a paper loss, our Ethereum portfolio gained 1.48% last week of its value. In dollar terms +$23.88

One of our short-term goals is to grow the portfolio back to its all-time high of $1,802, which was recorded at the start of January 2023.

Total ETH available: 0.7519 (+0.069)

At the moment, there are 1 put and 1 call options opened with the following strikes and expiry dates:

1700 Put (May 05, expiry)

2000 Call (June 30, expiry)

To keep the max profit, ETH should stay above $1,700 and below $2,000

In case of a challenged trade we will try to adjust the trade by rolling up or down the challenged side)

Additionally, we bought 0.01 ETH on Coinbase.

In total: 59 trades since December 23, 2022

Options premium: -0.3824 ETH